Maybelline, a name synonymous with beauty, style, and global appeal, is a leading cosmetic brand cherished by millions across the globe. Born in the vibrant city of Chicago in 1915 and acquired by French beauty giant L’Oréal in 1996, Maybelline has consistently evolved to match the pulse of modern beauty trends. Its journey from a small family-owned business to the world’s #1 makeup brand is a testament to strategic planning, market adaptability, and a relentless pursuit of innovation.

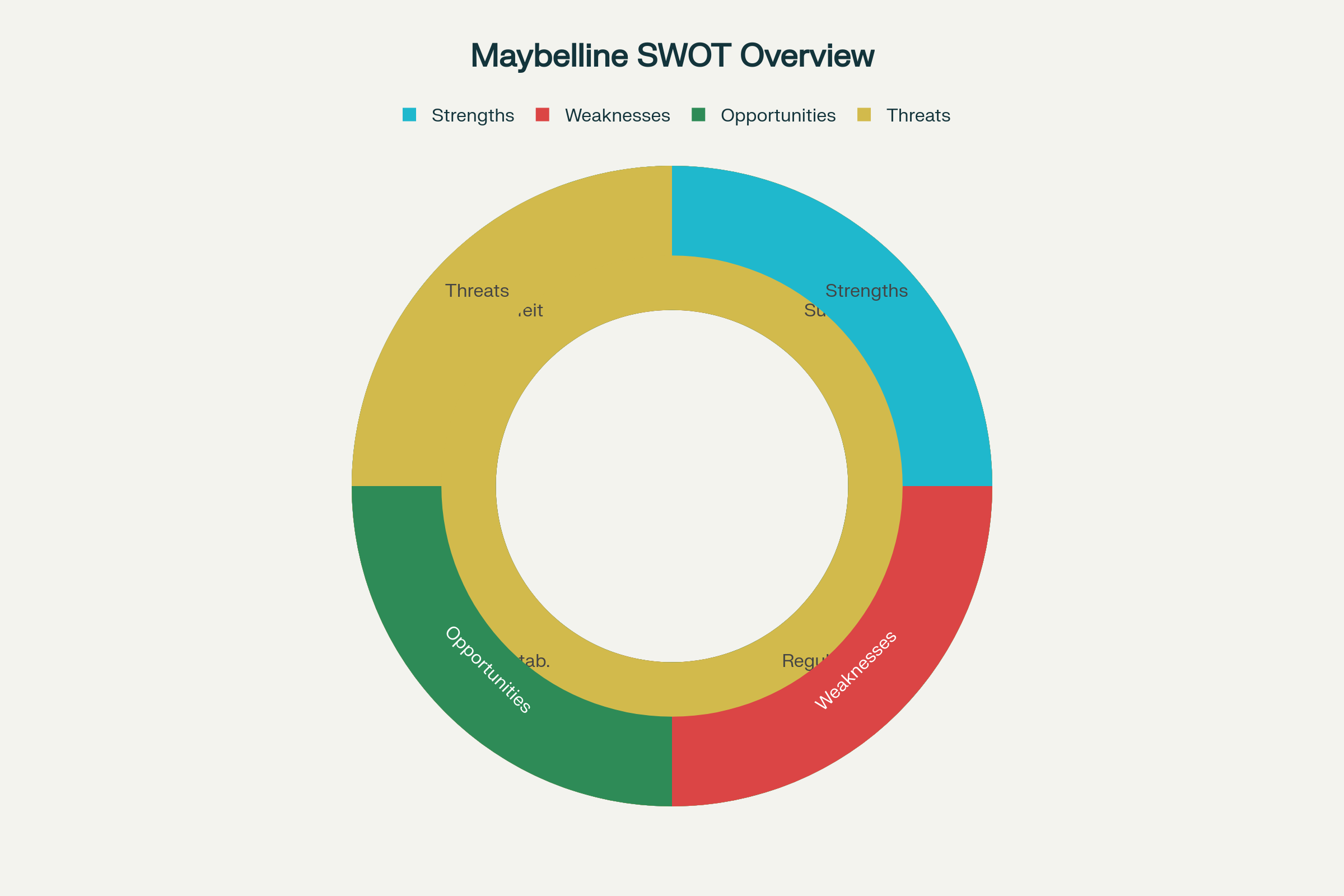

In the fast-moving world of beauty and skincare, where trends shift rapidly and competition intensifies daily, understanding a brand’s internal strengths and weaknesses as well as the external opportunities and threats becomes crucial. This is where SWOT analysis of Maybelline comes into play. It serves as a strategic compass, helping businesses like Maybelline evaluate their position and plan future growth effectively.

Background & Brand Snapshot

About Maybelline

Maybelline was started by a young entrepreneur, Thomas Lyle Williams, who noticed his sister using a mixture of Vaseline and coal dust to enhance her lashes. This inspired him to create one of the first commercial mascara products. Over time, Maybelline evolved into a full-fledged cosmetics brand, offering a wide range of makeup products including foundation, lipsticks, eyeshadows, concealers, and more.

Maybelline Parent Company

In 1996, L’Oréal acquired Maybelline, bringing in global resources, extensive R&D capabilities, and an expansive distribution network. L’Oréal’s backing has significantly strengthened Maybelline’s presence across continents.

Maybelline is from Which Country?

Though Maybelline was born in the United States, its current parent company is L’Oréal, based in France. So, Maybelline is a brand that originated in the USA but now operates as a French-owned multinational entity.

Global Reach & Target Market

Today, the brand operates in over 120 to 129 countries worldwide. It is positioned as an urban-chic, mass-market cosmetics brand targeting women between the ages of 16 and 35 who are fashion-conscious, modern, and experimental. It stands out with its mantra: “Maybe she’s born with it, maybe it’s Maybelline.”

Strengths of Maybelline

Strong Brand Recognition

Maybelline enjoys the status of the #1 makeup brand globally. The tagline “Maybe she’s born with it. Maybe it’s Maybelline.” is instantly recognizable. This brand trust plays a vital role in consumer retention.

Live Example: During the 2020 lockdown, Maybelline’s Fit Me Foundation became a bestseller on Amazon in multiple countries. The product’s affordability, reliability, and shade diversity resonated with users shopping online.

Global Distribution & Strong Parent Support

Thanks to L’Oréal’s global infrastructure, Maybelline enjoys widespread availability in physical stores, online platforms, and beauty chains like Sephora, Nykaa, and Ulta.

Moreover, L’Oréal’s investments in R&D ensure continuous innovation in product quality and formulation.

Broad & Localized Product Portfolio

Maybelline tailors its product offerings for regional markets. For instance:

- In India, Maybelline’s Colossal Kajal and Fit Me Foundation are cult favorites.

- In China, they offer skin-whitening products that match local preferences.

Effective Marketing & Celebrity Endorsements

Maybelline has used global celebrities such as Gigi Hadid and local influencers like Alia Bhatt in India to drive brand awareness. Their marketing campaigns are vibrant, inclusive, and very youth-focused.

Example: The Maybelline x Gigi Hadid collection in 2017 sold out within weeks due to the influencer’s star power and targeted social media promotions.

Competitive Pricing Strategy

Maybelline strikes a balance between quality and affordability. Their drugstore pricing strategy opens doors to a wide consumer base.

Weaknesses of Maybelline

Limited Direct-to-Consumer (DTC) E-commerce Focus

While the beauty industry is increasingly shifting towards DTC platforms, Maybelline still relies heavily on third-party platforms like Amazon, Flipkart, and Nykaa. This limits data collection and personalization opportunities.

Potential Skin Sensitivity Concerns

Some products have been reported to cause reactions in users with sensitive skin. This can affect consumer trust and brand credibility in skincare.

Real Incident: In 2019, a batch of Fit Me foundation reportedly caused mild breakouts among users with sensitive skin, leading to negative reviews on platforms like MakeupAlley.

Weak E-commerce User Experience

The official Maybelline website has usability issues in some regions. Navigation problems, stock inconsistencies, and slow customer service responses have been cited in consumer reviews.

Intense Competition in the Cosmetics Market

Maybelline faces fierce competition from both drugstore and luxury brands like Revlon, Lakmé, Fenty Beauty, and e.l.f Cosmetics. This affects market share and pricing strategies.

Opportunities for Maybelline

Rise of Clean Beauty

Consumers are increasingly shifting towards natural, vegan, and chemical-free beauty products. Maybelline has begun to explore this with its Green Edition range, which is vegan and made with sustainable packaging.

Digital Innovation

Maybelline has an opportunity to lead in tech-based beauty. Features like virtual try-ons, AI skin analyzers, and CGI avatars in ads (as used by brands like L’Oréal and Sephora) can enhance digital engagement.

Example: Maybelline India launched a virtual try-on feature for lipsticks on their website during the pandemic, leading to a spike in online purchases.

Local Market Penetration

Expanding into smaller towns with tailored pricing, influencer marketing, and region-specific products can increase market share in emerging economies.

Live Case: In Tier-2 and Tier-3 cities of India, Maybelline’s mini version of popular products has performed well due to affordability and portability.

Threats Facing Maybelline

Risk from Counterfeit Products

Fake Maybelline products are rampant in offline and online markets. These not only damage brand image but also pose health risks.

Example: In 2021, Delhi Police seized a batch of counterfeit Maybelline lipsticks being sold through local markets.

Substitute Products

Consumers have access to DIY beauty, organic alternatives, and niche indie brands that offer similar products, often with a “clean” or “ethical” promise.

Regulatory Changes & Economic Instability

Cosmetic regulations vary across countries and continue to evolve. Trade restrictions, tariffs, and economic slowdowns can affect production and sales.

Recent Example: The EU tightening guidelines on ingredients like parabens and sulfates has prompted reformulation across global brands, including Maybelline.

Strategic Takeaways for Maybelline

Expand Clean Beauty Offerings with Transparency at the Core

Consumers today are increasingly conscious of what goes into their skincare and cosmetics. Maybelline should expand its “Green Edition” line by introducing more vegan, cruelty-free, and eco-friendly products.

Highlighting clean ingredients, sourcing transparency, and biodegradable packaging can help the brand build trust.

For instance, The Body Shop and Youth to the People have successfully built brand loyalty by staying transparent and clean. Maybelline can take a similar route—publishing ingredient sourcing data and sustainability efforts on product pages.

Strengthen Direct-to-Consumer (DTC) Presence

Maybelline must invest in a seamless and engaging DTC experience. This includes redesigning its official website for better mobile UX, offering virtual try-ons, integrating loyalty programs, and enabling exclusive early access to new launches.

Glossier sets a great example here, creating a community-driven experience with personalized content, rewards, and slick UI.

Maybelline can build a similar ecosystem to reduce dependence on third-party platforms.

Supercharge Digital Campaigns Across Platforms

In an age dominated by short-form video, Maybelline should prioritize TikTok challenges, Instagram Reels, and YouTube Shorts by collaborating with rising and mid-tier influencers across markets.

Tools like AR filters (like L’Oréal’s Modiface technology) allow users to try products virtually, increasing conversion.

Brands like Fenty Beauty and e.l.f. Cosmetics have gone viral on TikTok by combining relatable content with trending audio and AR tools—Maybelline should follow suit.

Step Up Anti-Counterfeit Efforts

With counterfeit cosmetics becoming a major issue, Maybelline needs to take visible steps to protect its consumers.

This could include embedding QR codes or holographic seals on packaging for instant authenticity verification, and investing in blockchain-powered supply chain tracking.

Luxury brands like Chanel and Estée Lauder have introduced product scanning and digital ID tags—Maybelline could implement similar features, especially for bestselling products.

Localize and Personalize at Scale

To truly connect with global consumers, Maybelline should focus on market-specific product development—such as climate-specific foundations or culturally preferred shades.

In India, for example, tailor-made foundation tones and long-wear kajals could be prioritized. AI-driven personalization, like customized product suggestions based on skin type, tone, and preferences, will further enhance engagement.

Brands like Sephora and Nykaa are already doing this effectively with quizzes and personalized dashboards.

Competitors of Maybelline

Maybelline, being a global mass-market cosmetics brand, faces stiff competition from both international giants and rising local players. Its rivals span across budget, mid-range, and premium segments, each offering unique value propositions.

Revlon

Segment: Mid-range mass-market

Why it’s a competitor:

Revlon and Maybelline often battle for the same shelf space in drugstores and e-commerce platforms. Both are known for their accessible pricing, wide makeup range (lipsticks, mascaras, foundations), and classic brand reputation.

Real-life example:

In Indian retail chains like Shoppers Stop or Nykaa, you’ll often find Revlon Super Lustrous Lipstick placed right next to Maybelline Sensational Matte, appealing to the same buyer.

Lakmé

Segment: Mid-range, dominant in India

Why it’s a competitor:

Lakmé, owned by Hindustan Unilever, is a homegrown favorite in India. It offers both affordable and premium lines and is well-known for its seasonal fashion week partnerships, giving it an aspirational edge.

Live example:

Lakmé 9 to 5 Primer + Matte Lipstick and Maybelline Fit Me Lipstick compete directly during festive season sales on Amazon India, with similar pricing and shade options.

MAC Cosmetics

Segment: Premium/luxury

Why it’s a competitor:

Though positioned higher, MAC attracts loyalists for professional-grade makeup. It competes with Maybelline when consumers ‘trade up’ for special occasions, especially for long-wear or pigmented formulas.

Real-life case:

A consumer who regularly uses Maybelline Fit Me Foundation might opt for MAC Studio Fix Fluid for weddings or photo shoots — showing cross-brand competition.

e.l.f. Cosmetics (Eyes Lips Face)

Segment: Budget-friendly + clean beauty

Why it’s a competitor:

e.l.f. has gained attention globally for vegan, cruelty-free, and dermatologist-tested products at incredibly low prices. It challenges Maybelline’s appeal to Gen Z and conscious buyers.

Example:

The e.l.f. Power Grip Primer became a viral TikTok hit, stealing attention from Maybelline’s Baby Skin Primer in the under-₹1000 range.

Fenty Beauty

Segment: Premium + Inclusive

Why it’s a competitor:

Founded by Rihanna, Fenty disrupted the market with 50+ foundation shades. Its inclusivity model put pressure on brands like Maybelline to expand shade ranges and be more inclusive.

Live context:

Fenty’s Pro Filt’r Soft Matte Foundation forced brands across the board to address diversity. In response, Maybelline India expanded Fit Me to 18 shades, citing demand from deeper-skin-toned users.

Sugar Cosmetics

Segment: Mid-range + Youth-centric

Why it’s a competitor:

An Indian startup brand, Sugar grew rapidly via Instagram, YouTube, and influencer-led campaigns. Known for edgy branding and matte products, it appeals to the same younger urban crowd as Maybelline.

Example:

Sugar’s Matte Attack Transferproof Lipstick is often seen alongside Maybelline’s Super Stay Matte Ink in influencer comparison videos.

Colorbar

Segment: Affordable-premium hybrid

Why it’s a competitor:

Colorbar is known for its cruelty-free stance, broad product portfolio, and in-store experience. It appeals to makeup lovers who seek quality without the premium price of MAC or Fenty.

Live scene:

Walk into Lifestyle or Pantaloons, and you’ll see Colorbar USA’s nail paints and Maybelline Color Show placed adjacent, fighting for impulse purchases.

Nykaa Cosmetics

Segment: D2C Local Disruptor

Why it’s a competitor:

Backed by the giant Nykaa e-commerce platform, this in-house brand has massive visibility. With trend-based launches, it mimics Maybelline’s fast-fashion style but appeals to the “Made for India” pride.

Real-world case:

During Nykaa’s annual Pink Friday Sale, the Nykaa All Day Matte Foundation and Maybelline Fit Me often run head-to-head with bundled offers and influencer reviews.

Conclusion

To sum it up, the SWOT analysis of Maybelline reveals a strong brand backed by a powerful parent company and an extensive product portfolio. However, like all global players, it faces challenges that need constant adaptation. By tapping into clean beauty trends, strengthening its digital infrastructure, and investing in DTC strategies, Maybelline can maintain its crown in the competitive world of cosmetics.

In an age where customers demand quality, transparency, and innovation, Maybelline must not only meet but exceed expectations.

FAQs

What is the SWOT analysis of Maybelline?

The SWOT analysis of Maybelline explores its strengths like global reach and affordability, weaknesses like e-commerce gaps, opportunities in clean beauty, and threats from counterfeit goods.

Where is Maybelline from?

Maybelline was founded in the USA but is now owned by L’Oréal, a French multinational. So, it is a French-owned brand with American origins.

Who are Maybelline’s main competitors?

Revlon, Lakmé, MAC, Sugar, e.l.f., and Fenty Beauty.

What is Maybelline’s target market?

Urban women aged 18-35 looking for trendy and affordable makeup.

How is Maybelline adapting to current beauty trends?

Through clean beauty products, virtual try-ons, influencer campaigns, and localized products.

What are Maybelline’s key strengths?

Strong brand image, global reach, innovation, competitive pricing, and celebrity endorsements.

What challenges does Maybelline face?

Rising competition, counterfeit risks, limited DTC focus, and sensitive skin concerns in some formulations.

How is Maybelline adapting to digital trends?

By integrating AI try-ons, launching CGI campaigns, and using influencer-based marketing.

A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.