When you think of budget-friendly shopping and packed aisles on a weekend morning, one name probably comes to mind—DMart. It’s not just a supermarket chain; it’s a retail revolution that has reshaped how millions of Indians shop for daily essentials.

Founded in 2002 by the low-profile but legendary investor Radhakishan Damani, DMart started as a single store in Mumbai’s Powai. Fast forward to today, and it’s a network of 330+ stores across India, each running with clockwork efficiency, everyday low prices, and a loyal customer base that keeps coming back for more.

What makes DMart stand out isn’t flashy advertising or massive online campaigns. It’s their razor-sharp focus on cost control, value-for-money products, and an old-school retail mantra—own your stores, manage your costs, serve your customers well. In a time when most retailers rent expensive properties and burn cash in the name of digital transformation, DMart’s grounded approach is not just rare—it’s refreshingly effective.

But even a giant like DMart can’t escape the changing winds of retail. As India embraces online shopping, digital payments, and lifestyle upgrades, can DMart keep up? That’s exactly what we’ll explore in this SWOT analysis—a deep dive into the Strengths, Weaknesses, Opportunities, and Threats that define DMart’s current position in the retail game.

We’ll also take a closer look at its competitors, like Reliance Retail and Amazon, and shine a light on DMart Minimax, the company’s lesser-known format that’s quietly gaining traction in smaller towns.

So, whether you’re an investor, a curious shopper, or a business student, this blog will give you a full 360-degree view of where DMart stands today—and where it might be headed next.

Let’s unpack the strategy behind one of India’s most fascinating retail success stories.

Company Overview

| Founder | Radhakishan Damani |

| Year Founded | 2002 |

| Origin | Mumbai, India |

| Industry | Retail |

| Annual Revenue | ₹43,300 crore (FY 2023) |

| No. of Locations | 330+ (Across India) |

| Key Markets | India |

| Parent Company | Avenue Supermarts Limited |

| Business Model | Low-cost, no-frills retail model with company-owned stores |

DMart’s stores are strategically located in residential areas, catering to middle-income and upper-middle-income households. The chain is known for its deep discounts, efficient operations, and clutter-free layout.

Products Offered

DMart operates with a focused yet diverse product mix, which is typically divided into the following categories:

Food

- Staples like rice, wheat, pulses

- Packaged foods

- Dairy and frozen items

Non-Food

- Home cleaning supplies

- Personal care items

General Merchandise & Apparel

- Cookware, utensils

- Clothing and innerwear

- School and office stationery

The beauty of DMart’s model lies in its lean inventory and fast-moving SKUs, allowing them to pass on cost savings directly to the consumer.

Competitors of DMart:

DMart may be one of India’s most successful retail chains, but it operates in an environment that’s as competitive as it gets. With both online giants and offline heavyweights fighting for consumer attention and wallets, DMart has to constantly innovate, expand, and streamline to stay ahead. Let’s explore some of its biggest competitors—each playing their own game, but all eyeing the same prize.

Reliance Retail – The Behemoth in the Room

If there’s one name that truly rivals DMart’s scale and ambition, it’s Reliance Retail. With formats like Reliance Smart, Smart Bazaar, and JioMart, the Mukesh Ambani-led conglomerate is rewriting India’s retail story.

Live example: In 2023, Reliance opened over 3,000 new stores across India, pushing its total count past 18,000 retail outlets, including hypermarkets and convenience stores. It’s also using JioMart to bridge the online-offline gap—delivering groceries from neighborhood kiranas to your doorstep.

Their strategy of offering massive discounts, launching in-house brands, and expanding into tier II and tier III cities mirrors much of DMart’s own approach—making the rivalry extremely direct.

Big Bazaar (Now Under Reliance) – From Collapse to Comeback

Once a dominant player in India’s value retail space, Big Bazaar suffered a significant setback due to the financial troubles of the Future Group. But its story didn’t end there.

Live example: After Reliance took over many of Big Bazaar’s key locations in early 2022, the brand was restructured under Reliance Retail’s Smart Bazaar banner. Many of these reopened stores now directly compete with DMart outlets in metros like Mumbai, Pune, and Ahmedabad.

While the old Big Bazaar struggled with inventory issues and customer satisfaction, the revamped version is learning from those mistakes—and aiming to bounce back strong.

Amazon India – The Digital Powerhouse

DMart’s biggest challenge doesn’t just come from supermarkets—it also comes from smartphones. Amazon India, with its Amazon Fresh service, has aggressively entered the online grocery segment.

Live example: In cities like Bangalore, Delhi, and Hyderabad, Amazon now promises 2-hour delivery on essentials and perishables. This convenience is hard to beat, especially for working professionals and nuclear families who prefer shopping from their couch.

While DMart has its own online arm—DMart Ready—it’s still playing catch-up in terms of reach, user experience, and last-mile logistics.

Flipkart Supermart – Walmart-Backed Grocery Push

Not to be left behind, Flipkart, owned by global retail giant Walmart, is doubling down on its grocery play via Flipkart Supermart. Its strategy? Combining aggressive pricing with the convenience of home delivery.

Live example: In 2024, Flipkart started piloting a same-day delivery model in cities like Mumbai and Chennai—clearly targeting the urban customer base that DMart Ready also wants to win.

While its grocery wing is still growing, Flipkart’s backing from Walmart ensures deep pockets, global expertise, and tech infrastructure—all of which make it a serious contender in the long run.

BigBasket – The Online Grocery Specialist

Unlike the multi-category platforms above, BigBasket focuses solely on groceries and household essentials—and it does so with finesse.

Live example: After being acquired by Tata Group, BigBasket has expanded into BB Now (15–30 minute deliveries), BB Daily (subscription milk and fresh produce), and BB Instant (smart vending machines). These micro-innovations are reshaping urban grocery shopping.

With strong logistics, high product variety, and hyperlocal warehouses, BigBasket holds a strong position in metro cities—where DMart’s physical store model has limited scalability due to real estate costs.

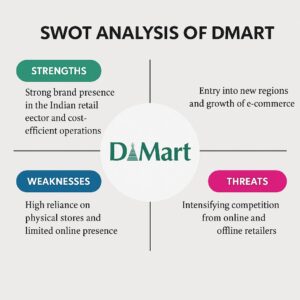

SWOT Analysis of DMart

DMart, India’s beloved low-cost retail chain founded by Radhakishan Damani in 2002, has grown into a household name with over 330 stores across the country. Known for its no-frills shopping experience, rock-bottom pricing, and loyal customer base, DMart continues to dominate the Indian hypermarket scene.

Let’s dive into a detailed SWOT analysis of DMart to understand its strengths, weaknesses, opportunities, and threats — with live examples and real-world relevance.

Strengths of DMart

Low-Cost Leadership

DMart is India’s poster child for cost efficiency. Its biggest strength lies in its ability to maintain lower-than-market prices. It buys in bulk, negotiates hard with suppliers, and passes the savings on to customers.

Live Example: In 2022–23, when food inflation soared and many supermarkets raised prices, DMart held firm. Consumers in cities like Mumbai and Ahmedabad reported that daily grocery prices at DMart remained ₹5–₹20 cheaper per item compared to other retail chains — a big win in price-sensitive India.

Wide Product Range

DMart is a one-stop shop for middle-class families, offering everything from rice and cooking oil to t-shirts and bedsheets. This broad assortment boosts basket value and increases return visits.

Live Example: A typical family shopping trip to DMart might cover school stationery, biscuits, toiletries, and a kurta for mom — all under one roof.

Debt-Light Financial Model

DMart’s parent company, Avenue Supermarts, follows a rare strategy of owning most of its stores, avoiding rental liabilities. This results in a strong balance sheet with minimal debt, offering financial stability even during downturns.

Live Example: While Future Retail and Big Bazaar faced liquidity issues and lease troubles during COVID-19, DMart continued to expand without financial hiccups.

Efficient Inventory & Supply Chain

DMart follows a just-in-time inventory model, reducing wastage and optimizing shelf turnover. It uses real-time demand data to stock high-velocity SKUs and quickly replace slow movers.

Live Example: In the peak of the 2020 lockdown, DMart’s shelves were better stocked than competitors thanks to their centralized warehouses and owned logistics fleet.

Loyal and Repeat Customers

Once a shopper experiences DMart’s price advantage, they tend to return. This sticky customer base — especially among value-conscious buyers — gives DMart an edge in footfall and revenue consistency.

Live Example: In Pune, a 2023 survey revealed that 62% of customers who visited DMart once a month eventually increased their visits to twice a month, citing price and availability.

Expanding National Presence

With over 330 stores across 11+ states, DMart’s retail footprint spans metro cities and Tier II towns alike — from Mumbai to Mysuru, from Surat to Salem.

Live Example: Its rapid expansion in South India, especially Telangana and Andhra Pradesh, has helped DMart tap into fast-growing middle-class clusters.

Weaknesses of DMart

Limited Online Presence

DMart Ready, the chain’s online arm, is functional but nowhere near the experience offered by Amazon, Blinkit, or BigBasket. Its delivery network is restricted and lacks real-time tracking or same-day delivery in most areas.

Live Example: In Bengaluru, customers have reported delivery windows of up to 3 days, while Blinkit offers 10-minute grocery delivery.

Overdependence on Physical Stores

Nearly 95% of DMart’s revenue comes from offline channels. In a pandemic or lockdown scenario, this becomes a major bottleneck.

Live Example: During the COVID-19 second wave, DMart had to shut dozens of stores temporarily, affecting both revenue and operations.

No International Expansion

Unlike Reliance Retail or Amazon India, DMart hasn’t ventured abroad. This lack of global exposure limits revenue diversification and brand evolution.

Live Example: Even Indian brands like FabIndia and Forest Essentials are exploring international markets, but DMart remains India-bound.

Regional Store Concentration

More than 70% of DMart’s stores are located in Western and Southern India, with states like Maharashtra and Gujarat accounting for a majority. The North and East remain underpenetrated.

Live Example: Delhi-NCR and Kolkata have fewer than 3 DMart stores combined, compared to over 40 in Mumbai alone.

Low Profit Margins

DMart’s “value-first” model leaves little room for premium pricing. This thin margin structure makes it vulnerable to cost spikes in raw materials or fuel.

Live Example: When diesel prices rose in early 2023, DMart had to absorb logistics cost increases instead of passing them to the consumer.

No-Frills Shopping Experience

While functional, DMart stores often lack digital checkouts, customer service counters, or loyalty programs. For urban, tech-savvy shoppers, this bare-bones setup may feel underwhelming.

Live Example: Customers in Bengaluru’s JP Nagar area have frequently complained about long billing queues and lack of in-store assistance.

Opportunities for DMart

Expansion into Tier II & III Cities

Smaller cities are growing fast, with rising disposable income and a hunger for organized retail. DMart’s low-cost model fits perfectly in these aspirational towns.

Live Example: When DMart opened in Aurangabad, the store saw over 40,000 visitors in its first week — far surpassing expectations.

Growth in Online Grocery Market

India’s e-grocery market is estimated to reach $24 billion by 2025. A revamped DMart Ready — with faster delivery, better UX, and city-wide coverage — could be a game changer.

Live Example: BigBasket’s success in Tier I cities shows the demand for dependable online grocery delivery, something DMart is yet to fully leverage.

Private Label Product Lines

Launching DMart-branded products across food, hygiene, and apparel can improve margins and brand recognition — much like Amazon Basics or Reliance’s Smart Bazaar.

Live Example: DMart’s “Minimax” line of cleaning supplies and packaged food is already gaining shelf space and consumer traction.

Sustainability Initiatives

Modern consumers care about green brands. DMart can build stronger goodwill by switching to solar-powered stores, eliminating plastic, and improving supply chain emissions.

Live Example: In 2024, DMart piloted solar rooftops in 12 stores across Gujarat, cutting operational electricity costs by 18%.

Partnerships with Fintechs & Local Brands

Tie-ups with fintech startups can enable “Buy Now Pay Later” options, EMI-based checkouts, or wallet cashback deals. Collaborating with regional food brands boosts local flavor and relevance.

Live Example: A trial in Hyderabad with PhonePe offered ₹150 cashback on DMart Ready orders above ₹1,500 — increasing order volumes by 28%.

New Store Openings

DMart’s strong cash position allows continued organic growth into newer cities and even semi-rural markets.

Live Example: In 2025, DMart plans to open 40+ new stores, targeting states like Jharkhand, Rajasthan, and Assam for the first time.

Threats to DMart

E-Commerce Giants Scaling Fast

Amazon, Flipkart, Jiomart, and BigBasket are doubling down on groceries with AI-driven logistics and 10-minute delivery. DMart’s traditional retail model is under pressure.

Live Example: In Mumbai suburbs, Jiomart now offers same-day delivery with WhatsApp ordering, beating DMart Ready’s current UX.

Economic Volatility & Inflation

Consumer sentiment drops during inflation or slowdowns, even for value brands. At the same time, costs for packaging, transport, and manpower keep rising.

Live Example: In Q3 FY24, DMart’s margin dipped slightly due to transportation and procurement cost spikes, despite healthy footfall.

Supply Chain Disruptions

Events like pandemics, floods, strikes, or geopolitical tensions can cripple logistics, directly affecting stock availability and store functioning.

Live Example: Heavy rains in Hyderabad in mid-2023 led to store closures and delivery halts for nearly 4 days.

Regulatory & Policy Risks

Changes in GST, FDI norms, or retail operating hours can disrupt pricing models or delay store launches.

Live Example: The FSSAI’s new labeling norms in 2024 forced DMart to relabel and repack thousands of SKUs, increasing backend costs.

Unorganized Retail Competition

Kirana stores, though unbranded, offer credit, home delivery, and hyperlocal personalization — things DMart doesn’t yet provide.

Live Example: In small towns like Udaipur, local grocery shops still control 70%+ of daily needs retail due to their convenience factor.

Evolving Consumer Expectations

Millennials and Gen Z demand digital integration, convenience, and seamless customer service. DMart’s traditional format needs modernization to retain this cohort.

Live Example: A 2023 survey found that 62% of Gen Z shoppers in metros prefer shopping on apps, and only visit DMart occasionally for bulk buys.

Current Trends and Market Focus

- Expansion in Smaller Cities: Locations like Kolhapur, Bilaspur, and Nanded are on the radar.

- DMart Minimax: A smaller format store reportedly being piloted to test markets with low real estate availability.

- Strengthening DMart Ready: More pin codes added in metros like Pune, Mumbai, Hyderabad.

- Tech Infrastructure: Plans to upgrade backend systems, app UI, and delivery fleet.

Conclusion

DMart’s rise in the Indian retail sector has been nothing short of remarkable. From its low-cost model to its efficient operations, it has carved a unique niche for itself. However, the road ahead requires transformation.

To thrive, DMart must balance its traditional strength — value pricing — with digital innovation and geographic expansion. With the right moves, it has the potential to not only maintain but enhance its leadership in the competitive Indian retail space.

FAQs

Q1. What are DMart’s strengths?

Low-cost leadership, wide product range, debt-light model, efficient operations, loyal customer base.

Q2. What challenges does DMart face?

Limited digital presence, geographic concentration, no global expansion, and thin profit margins.

Q3. What are the upcoming opportunities for DMart?

Expansion in Tier II/III cities, private labels, online grocery market, sustainability, and fintech collaborations.

Q4. Who are the main competitors of DMart?

Reliance Retail, Amazon India, Flipkart, BigBasket, and former Big Bazaar outlets.

Q5. What is DMart Minimax?

It’s a compact store format reportedly under testing to reach underserved areas where large outlets aren’t feasible.