“Progress for Humanity” — more than just a tagline, it’s the fuel powering Hyundai’s global journey.

Founded in 1967 in Seoul, South Korea, Hyundai Motor Company has grown from a small local automaker into the third-largest vehicle manufacturer in the world. With a bold vision and relentless drive for innovation, Hyundai has become a household name in over 180 countries — known not just for its affordability, but for its forward-thinking strides in electric vehicles (EVs), hydrogen fuel cell technology, and smart mobility solutions.

From Humble Beginnings to Global Dominance

What started as a modest automotive venture by visionary founder Chung Ju-yung has now evolved into a global brand that’s redefining the future of mobility. Hyundai’s focus isn’t only on selling cars — it’s about transforming how the world moves. The company’s design philosophy, sustainability goals, and tech-first approach are all anchored in its core purpose: to create meaningful progress for people and the planet.

Live Example: In 2024, Hyundai made waves across global markets with the launch of the IONIQ 6 — a sleek, futuristic electric sedan that set new standards in performance and energy efficiency. The model received global recognition, including top awards in Europe, the United States, and South Korea, for its contribution to redefining the electric vehicle landscape.

“Innovation on Wheels” — Hyundai’s Formula for Success

Hyundai isn’t just keeping pace with industry trends; it’s setting them. The brand has strategically invested in EV platforms, autonomous driving systems, and hydrogen-powered vehicles. Its IONIQ lineup — particularly the IONIQ 5 and 6 — showcases how Hyundai blends cutting-edge design, sustainability, and tech innovation to stay ahead of the curve.

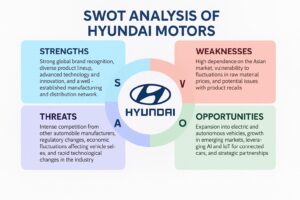

As we head deeper into the future of transportation, it’s crucial to understand Hyundai’s position in the global market. This SWOT Analysis of Hyundai Motors uncovers the company’s key strengths, identifies potential weaknesses, highlights exciting opportunities, and outlines looming threats in the ever-evolving automotive industry.

Let’s dive in.

Company Overview

| Name | Hyundai Motor Company |

| Founded | December 29, 1967 |

| Logo | |

| Founder | Chung Ju-yung |

| Headquarters | Seoul, South Korea |

| Industries served | Automotive (Cars, Commercial Vehicles, Busses) |

| Geographic areas served | Worldwide (186 countries) |

| Key People | Chung Eui-sun – Chairman

Chang Jae-hoon – President and CEO SangYup Lee – Chief Designer |

| Current CEO | Jae Hoon Chang |

| Parent Company | Hyundai Motor Group |

| Employees | 120,000 (2022) |

| Revenue (FY24) | ₩117.61 trillion |

| Net Income (FY24 | ₩5.69 trillion |

| Main Competitors | Bayerische Motoren Werke AG, Chrysler Group LLC, Daimler AG, Ford Motor Company, General Motors Company, Honda Motor Company, Nissan Motor, Tata Motors, Ltd., Toyota Motor Corporation, Volkswagen AG and many other automotive companies. |

This vast footprint has enabled Hyundai to position itself among the top three automobile manufacturers globally, just behind Toyota and Volkswagen.

SWOT Analysis of Hyundai Motors

Strengths of Hyundai Motors

Diverse Product Portfolio That Appeals to All

Hyundai has mastered the art of catering to every kind of customer — from families looking for value to tech-savvy millennials chasing innovation. The lineup includes fuel-efficient hatchbacks, rugged SUVs, sleek sedans, electric vehicles, hybrids, and even commercial trucks.

Live Example:

The Hyundai Grand i10 continues to be a popular choice for Indian city commuters, while the Creta has dominated India’s mid-size SUV segment. In the U.S., Hyundai’s Tucson and Palisade are regularly praised for their features and design.

Truly Global Presence

With operations in over 186 countries and manufacturing facilities spread across India, the U.S., Turkey, China, and the Czech Republic, Hyundai is one of the most internationally rooted automakers today. This global footprint provides both brand resilience and localized product adaptation.

Why it matters:

Economic downturns in one region don’t severely affect Hyundai’s overall performance due to this diversification.

Rising Brand Value

In Interbrand’s 2023 Best Global Brands Report, Hyundai’s brand value rose by 18%, reaching $20.4 billion. This growth places Hyundai among the top 35 most valuable brands worldwide, ahead of many legacy automakers.

What this shows:

The world increasingly sees Hyundai not just as a carmaker, but as a future-ready mobility brand.

Innovation in Clean Energy & Tech

Hyundai isn’t just following trends — it’s setting them. The company is investing aggressively in electric vehicles (EVs), hydrogen fuel cell technology, autonomous driving, and connected cars.

Live Example:

The Hyundai NEXO, a hydrogen fuel cell SUV, is one of the only commercially available models of its kind. The IONIQ 5 and IONIQ 6 have won awards across Europe and North America for their design, range, and tech innovation.

Strong Tech Partnerships

Hyundai’s forward march is powered by meaningful collaborations:

- Amazon – to launch online car sales in the U.S.

- KT Corporation – for autonomous driving and 6G integration

- Infineon – for in-house semiconductor advancements

- Arrival – to build electric commercial vans in Europe

These partnerships allow Hyundai to fast-track future mobility innovation.

Vertical Integration for Better Control

Unlike many automakers who rely heavily on third parties, Hyundai manufactures key components like engines, gearboxes, and EV batteries in-house. This control improves production efficiency, cost savings, and quality assurance.

Exceptional After-Sales Support

Hyundai’s global service network includes over 6,000 dealerships and service points. Their 5-year unlimited mileage warranty in markets like the U.S. sets a new industry benchmark for customer trust and peace of mind.

Example:

This warranty has been a key differentiator, especially for first-time buyers in Europe and Australia.

Rapid Expansion in Electric Vehicles

Hyundai plans to launch 17 new battery electric vehicles (BEVs) by 2030, reinforcing its position as a serious EV player. The IONIQ lineup is designed not just to compete, but to lead in range, design, and affordability.

Live Example:

The IONIQ 5 recently outsold Volkswagen’s ID.4 in several European markets, reflecting strong consumer preference.

Competitive Pricing & Government Incentives

In the U.S., Hyundai EVs qualify for the $7,500 federal tax credit, making them significantly more affordable. Combine that with smart pricing strategies in emerging markets, and Hyundai becomes a value powerhouse.

Balanced Global Revenue Streams

Hyundai’s revenue isn’t overly dependent on a single market:

- North America: 40%

- Korea: 32%

- Europe: 15%

- Asia (excluding Korea): 11%

- Others: 2%

This balance helps it hedge against localized slowdowns and policy shifts.

Weaknesses of Hyundai Motors

Over-Reliance on the Automotive Business

More than 70% of Hyundai’s revenue comes from selling cars. Compared to competitors like Toyota (with diversified streams including financial services and robotics), Hyundai remains heavily tied to automotive.

Why it’s risky:

Any slowdown in the auto industry—like during a chip shortage or EV transition—can severely impact earnings.

Underwhelming Presence in Luxury Segment

Hyundai’s luxury arm Genesis has made strides but still lags behind BMW, Mercedes-Benz, and Lexus in global brand perception and sales.

Challenge:

Convincing high-end buyers to choose Genesis over traditional luxury titans.

Budget Brand Perception in Key Markets

Despite innovation and design leaps, many consumers in Europe and Asia still associate Hyundai with affordable or entry-level vehicles. This affects Hyundai’s ability to charge premium prices or compete in the aspirational car segment.

Quality Recalls Impacting Trust

While Hyundai is known for quality, several product recalls in recent years have raised concerns.

Live Example:

In 2024, Hyundai recalled nearly 7,700 units of the Creta and Verna in India due to faulty electronic oil pump controllers — a major talking point among car reviewers.

Lower Resale Value Compared to Rivals

Hyundai vehicles generally depreciate faster than competitors like Toyota or Honda. This affects customer buying decisions, especially in lease-heavy or resale-driven markets.

Disruptions in the Global Supply Chain

Like most automakers, Hyundai faced semiconductor shortages during the COVID-19 aftermath, affecting production timelines and delivery rates globally.

Ongoing challenge:

Ensuring supply resilience amid geopolitical tensions and raw material shortages.

Weak Market Share in Japan and U.S. Pickup Market

Hyundai still struggles in Japan, a country loyal to domestic brands like Toyota and Honda. Similarly, it lacks competitive models in the U.S. pickup truck segment, which is a massive revenue generator for rivals like Ford.

Mixed Messaging on Fuel & Green Strategy

While Hyundai champions EVs, its continued promotion of internal combustion engines (ICE) has confused eco-conscious buyers. The brand must fine-tune its messaging to reflect a clear sustainability roadmap.

Opportunities for Hyundai Motors

Hyundai Motors stands at the edge of transformation — and it’s not by accident. The company has invested time, money, and talent in shaping the future of mobility. Let’s explore the key opportunities driving Hyundai’s growth in 2026 and beyond.

EV Expansion – Accelerating Into the Electric Future

The electric vehicle (EV) revolution is no longer coming — it’s already here. Hyundai is doubling down with a $80 billion investment to expand its EV portfolio, with plans to launch 17 new electric models by 2030.

Live Example: The IONIQ 6, launched in 2024, won global acclaim for its aerodynamic design and high efficiency — even beating some Tesla models in specific range and performance tests.

In addition, Hyundai’s $5.5 billion EV plant in Georgia, USA, set to begin production in 2026, is a strategic move to dominate the North American EV market.

Autonomous Driving Development – Pioneering Smart Mobility

Hyundai is not just thinking about the next car; it’s thinking about the next commute. By investing in Motional, a joint venture with Aptiv, and partnering with KT Corporation in South Korea, the brand is fast-tracking its self-driving capabilities.

Real Scenario: Motional’s autonomous vehicles are already being tested in cities like Las Vegas and Los Angeles as part of ride-hailing platforms like Lyft.

Growth in Emerging Markets – Local Strategy, Global Vision

Markets like India, Vietnam, Indonesia, and Brazil are growing rapidly. Hyundai has already made strong inroads by localizing production, adapting to consumer needs, and offering competitive pricing.

Live Example: In India, Hyundai is the second-largest carmaker, with over 15% market share, thanks to its crowd-favorites like the Creta and Venue.

Expansion in the Luxury Segment – Genesis Gaining Ground

Hyundai’s luxury division, Genesis, has proven it can compete with the likes of Mercedes and BMW.

Real Example: The Genesis GV80 SUV was among the top-rated luxury SUVs in the U.S. in 2024, praised for its tech, style, and comfort.

Hyundai’s plan to expand Genesis showrooms in Europe and Asia reflects its ambition to become a dominant player in the premium space.

Shared & Connected Mobility – Riding the MaaS Wave

With car ownership trends shifting, Hyundai is wisely investing in Mobility-as-a-Service (MaaS) platforms — including Ola (India), Grab (Southeast Asia), and MoceanLab (U.S.).

This opens up new revenue streams through ride-sharing, fleet services, and car subscriptions.

Strategic Acquisitions & Collaborations – Innovation via Synergy

Hyundai is actively scouting for partnerships in AI, EV batteries, software, and robotics to future-proof its ecosystem.

Recent collaboration: Hyundai’s acquisition of Boston Dynamics gave it an edge in robotics integration for logistics and future mobility.

Sustainability Push – Driving Towards Carbon Neutrality

Hyundai has committed to becoming carbon neutral by 2045. It’s not just a statement — it’s a strategy.

They’re scaling up hydrogen-powered vehicles, eco-friendly manufacturing, and solar-powered production facilities.

For example, Hyundai’s plant in Ulsan (South Korea) has begun integrating solar panels to reduce grid dependency and carbon emissions.

Threats to Hyundai Motors

As much as Hyundai is racing ahead, it faces an uphill track filled with global and industry-specific threats. Here’s a breakdown of the key challenges that could impact its momentum.

Intense Global Competition – Battling Industry Giants

Hyundai operates in one of the most competitive industries on the planet.

It goes head-to-head with:

- Toyota & Honda (reliable hybrids)

- Volkswagen & Ford (strong presence in Europe & trucks)

- Tesla & BYD (aggressive EV dominance)

Staying ahead means constant innovation, pricing strategy, and faster go-to-market cycles.

Supply Chain Volatility – The Hidden Disruptor

Whether it’s semiconductor shortages, geopolitical tensions like the Russia-Ukraine war, or natural disasters, Hyundai’s supply chain remains vulnerable.

The Suez Canal blockage in 2021 delayed shipments worldwide — a reminder of how external events can ripple through production lines.

Shifting Consumer Preferences – New Habits, New Demands

Today’s buyers want connected, clean, and convenient mobility. Car ownership is declining in urban areas, while ride-hailing, EVs, and subscriptions are gaining favor.

Hyundai must continually adapt to meet these lifestyle shifts or risk losing relevance.

Economic Instability – Profits on a Tightrope

Global inflation, rising interest rates, and currency fluctuations can squeeze margins and dampen vehicle demand.

A slowdown in China or a recession in Europe could drastically reduce Hyundai’s global sales outlook.

Stringent Government Policies – Compliance is Costly

Automakers must meet evolving emission norms, safety mandates, and recycling laws — especially in Europe and North America.

Each regulatory change means added costs in R&D, redesign, or retrofitting vehicles.

Technological Disruptions – Race Against Time

In today’s landscape, even a 6-month delay in launching new tech can be costly. Hyundai must stay on its toes with:

- AI-based in-car experiences

- Advanced driver assistance systems (ADAS)

- Next-gen battery innovations

Missing the tech bus could mean losing market share.

Cybersecurity Risks – The Digital Achilles’ Heel

With cars turning into smart devices on wheels, cyber threats are real. Data breaches, remote hacking, and software malfunctions pose severe risks to user safety and brand trust.

Hyundai has to ramp up cybersecurity measures as vehicles become increasingly connected.

Rising Operational Costs – Pressure on Affordability

From raw material spikes to labor shortages and increased energy bills, the cost to produce and deliver a vehicle is rising globally.

For Hyundai, balancing affordability and profitability will be a tightrope walk — especially in budget-sensitive markets like India and Southeast Asia.

Top Competitors of Hyundai Motors

Hyundai Motors may be one of the biggest automotive names globally, but it operates in a highly competitive industry where innovation, sustainability, and customer trust are crucial. Here’s a detailed look at its top competitors, each bringing unique strengths to the race:

Toyota Motor Corporation

Why it’s a top competitor: Toyota is the gold standard when it comes to hybrid technology and long-term reliability. Its Prius model was one of the pioneers of hybrid cars, and the company continues to dominate this segment with new releases like the 2024 Toyota Corolla Hybrid.

Live Example: In 2024, Toyota sold over 2.3 million hybrid and electric vehicles, reinforcing its leadership in sustainable mobility.

Honda Motors

Why it’s a top competitor: Known for producing reliable sedans, hatchbacks, and motorcycles, Honda has built a legacy of trust. Its models like the Honda Civic, Accord, and CR-V are best-sellers globally.

Live Example: The Honda Civic was among the top 10 most sold sedans in North America in 2024.

Volkswagen Group

Why it’s a top competitor: Volkswagen is leading the EV revolution in Europe and owns premium brands like Audi, Porsche, and Skoda.

Live Example: In 2024, Volkswagen launched the ID.7, a fully electric sedan that directly competes with Hyundai’s IONIQ series.

Ford Motors

Why it’s a top competitor: Ford continues to dominate in the pickup truck and SUV market, especially in North America.

Live Example: The Ford F-150 Lightning, an electric version of its iconic truck, saw a 25% increase in sales in 2024, challenging Hyundai’s EV offerings.

Tesla Inc.

Why it’s a top competitor: Tesla is the face of electric mobility with its high-performance vehicles, over-the-air software updates, and growing global presence.

Live Example: In 2024, Tesla delivered over 1.9 million units, with the Model Y becoming the world’s best-selling car, overtaking many traditional gasoline vehicles.

Nissan Motors

Why it’s a top competitor: Nissan continues to be a strong player in the EV and compact SUV segments.

Live Example: The Nissan Leaf remains one of the most affordable EVs globally, appealing to environmentally-conscious budget buyers, while the Rogue SUV competes head-to-head with Hyundai’s Tucson.

Tata Motors & Mahindra (India)

Why they’re competitors: These two Indian giants dominate their local market and are now pushing into the global stage with affordable EVs and SUVs.

Live Example: Tata’s Nexon EV became India’s best-selling electric vehicle in 2024, while Mahindra’s XUV700 is gaining attention internationally for its performance and tech integration.

8. Suzuki Motor Corporation

Why it’s a top competitor: Suzuki is strong in compact and affordable vehicles, especially across Asia and emerging markets.

Live Example: In countries like India, the Maruti Suzuki Swift continues to outperform rivals with over 1.3 lakh units sold in 2024 alone.

Google (Waymo)

Why it’s a competitor: While not a traditional automaker, Waymo is pioneering autonomous vehicle technology, potentially disrupting the entire automotive landscape.

Live Example: Waymo’s self-driving taxis are already operational in Phoenix, Arizona, and are slowly expanding to other cities — a sign of what the future may hold.

Conclusion

Hyundai Motors has made exceptional progress, carving a niche in the fiercely competitive global automotive industry. With a focus on technology, customer satisfaction, and sustainability, the brand has evolved into a future-forward automaker.

Its wide-ranging product portfolio, EV investments, strategic alliances, and expanding presence in emerging markets offer strong grounds for growth. However, challenges like supply chain issues, branding limitations, and shifting market trends require constant innovation and strategic evolution.

If Hyundai maintains its pace in electrification, tech innovation, and global outreach, it will re

Frequently Asked Questions (FAQs)

Q1: What is the SWOT analysis of Hyundai?

Answer: Hyundai’s SWOT analysis explores its global dominance, investment in electric and hydrogen vehicles, and innovation in smart mobility. While its strengths include advanced R&D and global outreach, the brand faces weaknesses like occasional quality recalls and limited luxury brand recognition. Opportunities lie in EV adoption and emerging markets, whereas threats include intense global competition and regulatory constraints.

Q2: What makes Hyundai stand out in the global automobile market?

Answer: Hyundai stands out due to its blend of affordability and advanced technology. It offers cutting-edge electric vehicles like the IONIQ 5 and 6, is a pioneer in hydrogen fuel cell tech, and has a strong presence in both developed and developing markets.

Q3: How is Hyundai addressing the electric vehicle (EV) revolution?

Answer: Hyundai is leading the EV race by committing over $80 billion by 2030, introducing the dedicated IONIQ brand, expanding charging infrastructure, and building exclusive EV production lines. It also collaborates with tech firms for smart mobility and autonomous driving innovations.

Q4: Who are Hyundai’s main competitors?

Answer: Hyundai competes with a mix of traditional and electric-first brands, including Toyota, Honda, Volkswagen, Tesla, Ford, Nissan, Tata Motors, and Mahindra. Each brings a different edge—luxury, reliability, or tech-first appeal—while Hyundai competes via smart pricing, innovation, and wide model variety.

Q5: How does Hyundai differ from Honda?

Answer: While Honda is known for long-term reliability, efficient hybrids, and two-wheelers, Hyundai focuses more on innovation in electric and hydrogen-powered vehicles. Hyundai is bolder in design and tech adoption, whereas Honda maintains a steady, trusted approach with hybrid leadership.

Q6: How does Hyundai compare to Volkswagen?

Answer: Volkswagen has a legacy of luxury engineering and premium EV offerings (like the ID series), whereas Hyundai leverages affordability, faster EV rollout, and strong appeal in emerging markets. Both brands are highly innovative but differ in brand positioning and price accessibility.

Q7: What are Hyundai’s key strengths according to SWOT analysis?

Answer: Hyundai’s key strengths include:

- A diverse global product lineup (from hatchbacks to luxury SUVs)

- Advanced R&D and early adoption of green technologies

- Strong presence in emerging markets

- Vertical integration for better cost control

- Growing brand equity in the EV segment

Q8: What markets are most important for Hyundai’s growth?

Answer: Hyundai’s core markets are:

- South Korea (home base and brand loyalty)

- United States (SUVs, EVs)

- India (compact cars, mass-market success)

- Europe (emerging EV market)

- China (facing tough local competition but still strategic)

Q9: What challenges does Hyundai face in the future?

Answer: Hyundai’s key challenges include:

- Navigating strict global emission and safety regulations

- Managing supply chain disruptions (e.g., chip shortages)

- Strengthening its position in the premium and luxury car market

- Maintaining consistent quality across global operations