Mahindra & Mahindra (M&M), a core part of the Mahindra Group, is one of India’s largest multinational conglomerates. Known for its stronghold in the automotive and agricultural machinery industries, M&M has built a reputation for ruggedness, affordability, and innovation. Headquartered in Mumbai, India, Mahindra has grown from a small steel trading firm in 1945 to a globally recognized brand.

Over the decades, M&M has successfully diversified its operations across multiple sectors such as IT, aerospace, defense, finance, and real estate, making it a powerhouse in the Indian industrial landscape. As the industry adapts to rapid technological changes, the relevance of a detailed SWOT analysis of Mahindra and Mahindra becomes even more crucial. It allows the company and stakeholders to understand strategic positions, identify challenges, and align growth opportunities effectively.

Company Overview

| Founder | J.C. Mahindra & K.C. Mahindra |

| Year Founded | 1945 |

| Origin | Ludhiana, India |

| Industry | Automotive, Agriculture, Technology |

| Annual Revenue | $19 Billion (FY 2023) |

| Employees | 250,000+ |

Founding and History: Founded in 1945 as Mahindra & Mohammed in Ludhiana, the company was later renamed Mahindra & Mahindra after the departure of its co-founder Ghulam Muhammad. Initially a steel trading business, it pivoted to vehicle manufacturing with the iconic Willys Jeep in India. This laid the foundation for its automotive legacy.

Key Sectors: Today, Mahindra operates in an impressive array of sectors:

- Automotive: SUVs, LCVs, MUVs, commercial vehicles, and electric vehicles

- Agriculture: World’s largest tractor manufacturer by volume

- Finance: Mahindra Finance, offering vehicle loans and rural financing

- IT: Tech Mahindra, a leading IT services provider

- Aerospace & Defense: Armored vehicles, aircraft components, and drones

- Real Estate: Mahindra Lifespace, focusing on sustainable urban development

- Hospitality: Club Mahindra Holidays and Resorts

- Healthcare, Retail, and Energy: Including solar energy and e-commerce initiatives

Financial Performance (FY23):

- Consolidated Revenue: INR 1,21,269 crore (up 34%)

- Consolidated PAT after EI: INR 10,282 crore (up 56%)

- SUV Revenue Market Share: #1 with 19.1% share

- LCV Market Share (<3.5T): #1 with 45.5%

- Farm Equipment Market Share: #1 with 41.2%

- Electric 3-Wheelers: #1 with 67.6% market share

Workforce and Global Presence: With over 2,50,000 employees and assembly units in India, the UK, China, and Brazil, Mahindra’s global operations span across over 100 countries.

Current Highlights (2024–2025)

Electric Vehicles (EVs) Expansion

Mahindra has made significant progress in its EV journey. The company plans to launch the all-electric version of the XUV700 and has introduced the XUV400 to compete with Tata Nexon EV. It aims to invest $1.2 billion in electric mobility by 2027. In a live example, Mahindra collaborated with Volkswagen for platform sharing of EV components.

Strategic Partnerships

Strategic alliances have been key to Mahindra’s growth. Notable collaborations include:

- Volkswagen: For MEB electric platform.

- Qualcomm: For advanced driver assistance systems (ADAS).

- British International Investment: Joint venture in electric mobility segment.

Agricultural Sector Leadership

Mahindra is the world’s largest tractor manufacturer by volume. The company’s Yuvo and Jivo series have been widely adopted in India and Africa. Mahindra USA has also strengthened its position with increasing market share in North America.

Sustainability Goals

Mahindra aims to become carbon neutral by 2040. It has implemented green manufacturing processes, waste recycling, and energy efficiency projects in plants like Igatpuri and Chakan.

Strong FY23 Performance

FY23 was a record year across multiple verticals. SUV and LCV sales hit new highs, and Mahindra Finance registered strong growth due to rural demand for vehicle financing.

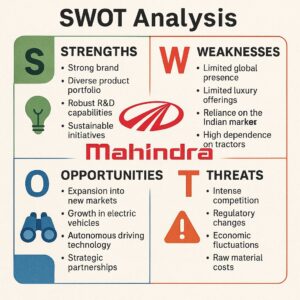

SWOT Analysis of Mahindra & Mahindra

Mahindra & Mahindra (M&M) stands tall as one of India’s most respected business conglomerates. Known for its rugged SUVs, dominance in tractors, and a footprint in sectors ranging from finance to IT, M&M has created a multi-vertical legacy. This SWOT analysis presents a detailed and insightful look into M&M’s strategic position in 2025, enriched with real-world examples to add depth and relevance.

Strengths

Diverse Business Portfolio

Mahindra’s operations span across automotive, agriculture, aerospace, IT, real estate, and finance. This diversified structure protects the company from over-reliance on one segment.

For example, during the COVID-19 lockdown in 2020, when automotive sales declined, Mahindra’s tractor sales rose by 18% due to strong rural demand and favorable monsoons.

Global Leadership in Tractors

M&M is the world’s largest tractor manufacturer by volume, with a 41.2% market share in India. Its tractors are highly preferred in both emerging and developed markets.

Mahindra USA is a top player in North America’s utility tractor segment, while the acquisition of Mitsubishi Agricultural Machinery expanded its footprint in Japan.

Robust R&D and Product Innovation

Mahindra continues to invest in innovation through R&D centers in Chennai and Detroit, focusing on both IC engines and electric vehicles.

The XUV700 became India’s first SUV to offer Level-2 ADAS features, while the newly launched INGLO platform powers their upcoming EV lineup.

Trusted Brand in Rural India

Mahindra vehicles are seen as rugged and reliable, especially in semi-urban and rural markets.

Vehicles like the Bolero and Scorpio are frequently used in rescue missions during floods in states like Bihar and Assam, due to their strong off-road performance.

Commitment to Sustainability

Mahindra is among India’s most sustainability-focused manufacturers.

Under its ‘Hariyali’ initiative, the group has planted over 18 million trees, and its Igatpuri plant was the first in the world to receive a carbon neutrality certificate.

Extensive After-Sales Network

With more than 1,100 authorized service centers, Mahindra offers reliable service support across Tier-1 to Tier-4 cities.

The ‘With You Hamesha’ mobile app enables customers to schedule services and receive real-time vehicle updates, improving satisfaction and loyalty.

Weaknesses

Overdependence on Indian Market

More than 60% of M&M’s revenue is generated from India, making it susceptible to domestic economic fluctuations and policy changes.

The GST rollout in 2017 and sudden implementation of BS6 norms in 2020 disrupted Mahindra’s sales and required last-minute pricing adjustments.

Weak Performance in Two-Wheelers and Compact Cars

Despite its dominance in UVs and tractors, Mahindra has struggled in two-wheelers and hatchbacks.

The Mahindra Gusto and Centuro failed to gain traction in a market dominated by Hero and Bajaj, leading to an eventual exit from the segment.

Quality and Recall Concerns

Frequent recalls can dent consumer trust, especially in urban markets.

In 2023, the Scorpio-N faced a voluntary recall due to airbag deployment issues, raising questions around quality assurance.

Sluggish EV Launches

Mahindra entered the EV segment early but failed to maintain momentum.

While the Reva e2o was launched as early as 2013, Tata Motors surged ahead with the Nexon EV, capturing over 70% of India’s passenger EV market by 2024.

Vulnerability to Raw Material Price Swings

The company is exposed to the global price volatility of steel, lithium, and semiconductors.

During the Russia-Ukraine war, Mahindra had to hike prices across all SUV models due to rising input costs and supply chain constraints.

Opportunities

Expanding EV Market in India

With India’s EV market expected to grow at a CAGR of 36% till 2030, M&M is in a strong position to lead, especially in electric SUVs and commercial EVs.

The launch of the XUV400 and the upcoming BE.05 under the Born Electric platform positions Mahindra to tap into rising eco-conscious urban buyers.

International Growth in Emerging Markets

Tractors and rugged vehicles have growing demand in countries with evolving agricultural infrastructure.

Mahindra’s recent expansion into Kenya and Nigeria has benefited from government-led farming reforms and mechanization subsidies.

Smart Farming & IoT Integration

With 5G rollout, there’s an opportunity to digitize agricultural machinery and services.

Mahindra’s ‘Krish-e’ platform already provides GPS-enabled plowing and AI-based crop advisory services to farmers in Maharashtra and Punjab.

Internal Digital Transformation

Leveraging Tech Mahindra’s IT prowess, Mahindra is rapidly digitizing internal operations and customer experience.

Over 8,500 dealerships use AI-enabled tablets for digital sales assistance, resulting in a 30% improvement in lead-to-conversion ratios.

Strategic Investments and Acquisitions

By investing in future-ready startups, Mahindra is strengthening its innovation pipeline.

The acquisition of Automobili Pininfarina enabled M&M to enter the high-performance EV space, while investment in agri-drone startup MITRA shows its AgriTech ambitions.

Rural Financing Opportunities

Mahindra Finance has the potential to offer micro-loans in untapped rural areas.

In Odisha and Madhya Pradesh, Mahindra Finance recently launched a new product line for financing solar-powered pumps and e-rickshaws, helping boost last-mile sales.

Threats

Intense Market Competition

From EVs to SUVs, M&M faces stiff competition on multiple fronts.

Tata’s Nexon EV, Hyundai’s Creta, and MG’s ZS EV have carved significant market share, while John Deere and Escorts continue to challenge Mahindra in tractors.

Changing Regulatory Environment

Policy instability can delay launches and disrupt pricing strategies.

In 2022, abrupt revisions to the FAME-II subsidy scheme affected Mahindra’s EV pricing model, leading to a temporary dip in bookings for the XUV400.

Commodity Price Inflation

Price volatility in steel, rubber, lithium-ion batteries, and electronic chips increases cost pressure.

In FY2023, the rise in global steel prices led Mahindra to increase the prices of its entire SUV lineup by up to ₹60,000.

Global Geopolitical Risks

Operations in multiple countries expose Mahindra to international trade and political tensions.

Due to sanctions and port delays during the Russia-Ukraine conflict, Mahindra’s tractor exports to Eastern Europe were impacted, causing a dip in global sales.

Rapid Technological Disruption

With the rise of AI, autonomous driving, and hydrogen fuel technologies, auto companies must constantly innovate.

Startups like Ola Electric and legacy brands like Tesla are pushing boundaries with autonomous features, OTA updates, and next-gen batteries—areas where Mahindra must invest rapidly to remain competitive.

Competitors of Mahindra and Mahindra

Understanding the competitive landscape of Mahindra & Mahindra (M&M) provides valuable context for its market strategies. Despite being a powerhouse in tractors and utility vehicles, M&M faces stiff competition across its diverse business segments. Below are the key players challenging Mahindra’s dominance:

Tata Motors

Tata Motors is perhaps Mahindra’s most formidable rival, especially in the SUV and EV segments. Vehicles like the Tata Nexon EV have taken a strong lead in the electric car market, outpacing Mahindra’s electric offerings like the e-Verito and XUV400. In 2024, Tata Motors held over 70% share of the EV market, a figure that highlights Mahindra’s challenge in this segment. Additionally, Tata’s premium SUVs like the Harrier and Safari directly compete with Mahindra’s Scorpio-N and XUV700, both in pricing and positioning.

Maruti Suzuki

As India’s largest passenger car manufacturer, Maruti Suzuki significantly limits Mahindra’s presence in the compact and mid-size car market. With best-sellers like the WagonR, Swift, and Brezza, Maruti appeals to middle-class and first-time buyers due to its mileage, affordability, and extensive service network. In 2023 alone, Maruti sold over 1.5 million units, dominating both urban and semi-urban markets—segments where Mahindra still lags behind.

John Deere

In the agricultural equipment space, Mahindra leads in India, but John Deere dominates globally. Known for its high-end tractors and smart farming technologies, John Deere is a strong competitor in North America, Brazil, and parts of Europe—markets where Mahindra aims to grow. For instance, in the U.S., John Deere’s precision farming solutions and autonomous tractors appeal to large-scale farmers seeking efficiency, challenging Mahindra’s value-driven approach.

Ashok Leyland

A major player in the commercial vehicle space, Ashok Leyland is a direct competitor to Mahindra Trucks and Buses Ltd. While Mahindra has made inroads into the light commercial vehicle segment with models like Blazo and Furio, Ashok Leyland dominates the heavy truck and bus markets, especially with its school buses and intercity coach buses. Their strong presence in state transport contracts adds to Mahindra’s challenges in expanding its commercial footprint.

Hyundai Motor India

Hyundai’s strong product design, tech-forward cars, and urban brand appeal make it a direct threat to Mahindra’s growing SUV line-up. Hyundai models like the Creta and Venue are positioned against Mahindra’s XUV300 and XUV700, with Hyundai often winning over tech-savvy consumers through features like connected car technology (Bluelink) and high fuel efficiency. Hyundai’s aggressive marketing and consistent launches keep it top-of-mind in metro markets.

Conclusion

In conclusion, this SWOT analysis of Mahindra and Mahindra reveals a company that is resilient, diversified, and innovation-driven. It remains a market leader in several domains while facing pressure in a few others.

To stay competitive, Mahindra must:

- Accelerate its EV rollouts

- Strengthen quality control processes

- Reduce dependence on the Indian market

- Explore strategic partnerships and acquisitions

- Focus on digital transformation and IoT-led innovation

With strategic execution, Mahindra is well-poised to become a future-ready global conglomerate.

FAQs

Q1: What are the main strengths of Mahindra & Mahindra? Mahindra’s main strengths include a diversified business model, leadership in tractor manufacturing, robust R&D, a strong brand presence, and sustainability initiatives.

Q2: What are the weaknesses of Mahindra & Mahindra? Some key weaknesses include dependence on the Indian market, delays in EV launches, underperformance in two-wheelers, and past product recalls.

Q3: How is Mahindra expanding in the EV market? Mahindra is investing in new EV models like XUV700 EV, setting up dedicated EV manufacturing plants, and collaborating with firms like Volkswagen.

Q4: What opportunities lie ahead for Mahindra? Mahindra has growth potential in EVs, smart farming, international markets, digital transformation, and hybrid tractors.

Q5: Who are the key competitors of Mahindra & Mahindra? Major competitors include Tata Motors, Maruti Suzuki, John Deere, Ashok Leyland, and Hyundai Motor India.