In a country where tradition meets innovation at every turn, Patanjali Ayurved Limited has emerged as one of the most disruptive forces in India’s fast-paced FMCG market. Launched in 2006 by Yoga icon Baba Ramdev and Ayurvedic scholar Acharya Balkrishna, the brand has rewritten the rules of consumer behavior by reintroducing Ayurveda to modern Indian households—not as an alternative, but as a primary lifestyle choice.

With its roots firmly planted in Indian culture and wellness, Patanjali quickly gained a massive following by offering a powerful mix of natural ingredients, homegrown values, and affordable pricing. In just over a decade, it has expanded from humble beginnings to a full-fledged FMCG giant with products ranging from Ayurvedic medicines and personal care to dairy, food, and even household cleaners.

As of FY 2023–24, Patanjali continues to be a household name with a stronghold across urban, semi-urban, and rural India. Its rising global presence, especially in the U.S., U.K., Russia, Canada, and the Middle East, further reflects its ambition to put Indian wellness on the world map.

Key Financial Snapshot (2023–24):

- Annual Revenue: ₹318 billion

- Net Profit: ₹263.71 crore

- Presence: Pan-India + growing international exports

- Employees: Over 6,300 and growing

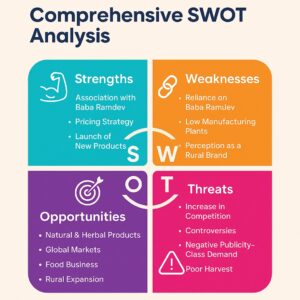

In this detailed breakdown, we’ll take a closer look at the SWOT analysis of Patanjali—exploring the strengths that have driven its growth, the weaknesses it needs to overcome, the opportunities that lie ahead, and the threats that could impact its momentum.

Whether you’re a business owner, a marketer, or simply a curious consumer, this analysis offers insights into what makes Patanjali one of India’s most fascinating success stories in the modern FMCG space.

About Patanjali

Patanjali Ayurved Limited isn’t just a brand—it’s a movement. A movement that taps into India’s rich Ayurvedic heritage, while embracing the efficiency and reach of modern business practices. At its core, Patanjali stands for self-reliance, natural living, and wellness for all.

Founders

- Baba Ramdev – The public face of the brand and a celebrated Yoga teacher with a massive following across India.

- Acharya Balkrishna – The business brain and Managing Director, known for his deep knowledge of Ayurveda and sharp operational insights.

Founded

- Year: 2006

- Location: Haridwar, Uttarakhand

Vision & Mission

To bring Ayurveda and holistic wellness into every Indian home by using modern production techniques while staying true to ancient Vedic knowledge and natural remedies.

Core Product Segments

- Ayurvedic Medicines (Chyawanprash, Giloy, Immunity boosters)

- Personal Care (Dant Kanti, Kesh Kanti, skin and hair oils)

- Food Products (Atta, noodles, biscuits, juices)

- Dairy & Beverages (Milk, curd, ghee, buttermilk)

- Natural Home Products (Detergents, floor cleaners, incense sticks)

Patanjali’s strength lies not just in what it sells—but what it represents. A growing tribe of health-conscious, value-driven consumers who prefer natural, Indian-made alternatives over synthetic, global brands. In many ways, Patanjali is redefining Swadeshi consumerism for the modern era.

Patanjali at a Glance

| Founders | Baba Ramdev and Balkrishna |

| Year of Establishment | 2006 |

| Annual Revenue ( as of 2023) | 318 billion Indian rupees |

| Net Profit of Patanjali ( as of 2023) | INR 263.71 crore |

| Origin of Patanjali | Haridwar, India |

| Type of Company | Private |

| Total no. of employees | 6,395 |

| Total assets | US$ 1.66 B |

- Industry: FMCG, Healthcare, Wellness

- Headquarters: Haridwar, Uttarakhand, India

- Type of Company: Private

- Founded By: Baba Ramdev and Acharya Balkrishna

- Core Philosophy: Rooted in Ayurveda and the Swadeshi movement

Key Product Categories:

- Ayurvedic medicines

- Personal care (toothpaste, shampoo, face wash)

- Food & beverages (atta, honey, juices)

- Dairy products (ghee, milk, curd)

- Herbal supplements and immunity boosters

- Cosmetics and skincare

- Cleaning agents and household essentials

Distribution Reach:

- 47,000+ retail counters across India

- 3,500+ authorized distributors

- Online presence on major e-commerce platforms such as Amazon, Flipkart, BigBasket

- Patanjali Chikitsalayas (clinics) and Arogya Kendras (health centers) in both urban and rural areas

- Swadeshi Kendras – Patanjali-exclusive outlets

Positioning:

Patanjali isn’t just a brand – it’s a nationwide wellness movement inspired by India’s ancient healing sciences. Its rapid growth and deep market penetration reflect the public’s trust in Ayurvedic and natural alternatives to mainstream products.

What is a SWOT Analysis?

SWOT Analysis is a strategic planning tool used to identify the internal and external factors that affect a company’s performance. It breaks down into:

- Strengths – What the company does well.

- Weaknesses – Internal challenges that need improvement.

- Opportunities – Market trends or external chances to grow.

- Threats – Risks that can hamper business growth.

Understanding the SWOT of a brand like Patanjali helps in analyzing its competitive edge, areas of improvement, and future roadmap.

SWOT Analysis of Patanjali

Strengths of Patanjali

Brand Power & Association

One of Patanjali’s biggest strengths is its direct association with Baba Ramdev. His influence and reputation as a Yoga Guru and Ayurvedic proponent have played a pivotal role in shaping public opinion in favor of the brand.

Example: When Patanjali was first launched, it barely spent on advertising. Baba Ramdev’s television shows and yoga camps served as natural promotion channels. His credibility automatically translated to trust in Patanjali products. Even today, people consider the products to be personally endorsed by him.

Product Strategy

Patanjali’s product strategy is firmly anchored in the principles of Ayurveda and natural wellness. It offers a wide array of herbal and chemical-free products that align with the values of health-conscious Indian consumers. Over the years, the brand has expanded aggressively, positioning itself as a holistic wellness provider catering to diverse daily needs.

Key Highlights of Patanjali’s Product Strategy:

- Strong Ayurvedic Foundation:

Every product is inspired by ancient Ayurvedic formulations, ensuring a connection with India’s rich traditional healing systems. - Extensive Product Portfolio (900+ SKUs):

Patanjali has a massive range covering multiple verticals:\n- Personal Care: Dant Kanti (toothpaste), Kesh Kanti (shampoo), aloe vera gel

- Health Supplements: Ashwagandha tablets, Chyawanprash, Giloy juice

- Food & Beverages: Atta, biscuits, instant noodles, fruit juices

- Dairy Products: Cow’s milk, curd, ghee, flavored milk

- Frozen Foods & FMCG Staples: Frozen veggies, pickles, spices, edible oils

- New & Innovative Launches:

Constantly diversifying with:

- Flavored dairy drinks

- Frozen food lines

- Upcoming ventures: Bottled mineral water, urea-free animal feed, and even Ayurvedic cosmetics.

- Herbal & Natural Positioning:

Patanjali’s products proudly emphasize being free from harmful chemicals, preservatives, and artificial additives—making them an ideal choice for health-first and environmentally conscious consumers. - Catering to Mass & Niche Markets:

Whether it’s basic grocery essentials or niche immunity-boosting remedies, Patanjali has created a strong presence across both urban and rural markets.

Pricing Advantage

A significant portion of India’s population falls under the middle and lower-income groups. Patanjali’s pricing strategy of 20-30% lower than popular MNC brands allows affordability without compromising on quality.

Example: A 200g tube of Patanjali Dant Kanti costs around ₹50, while a similar toothpaste from Colgate or Pepsodent may cost ₹75 or more.

Distribution & Technology

From offline to online, Patanjali has built an extensive network.

- Swadeshi Kendras and Chikitsalayas at medical outlets

- Retail tie-ups with Future Group and Reliance

- Online availability on platforms like Amazon, Flipkart, Big Basket

National Identity

Patanjali smartly aligns itself with the “Made in India” campaign and nationalist sentiments. The brand positions itself as a Swadeshi alternative to foreign FMCG brands.

Live Example: Patanjali’s ad campaigns often include patriotic themes, supporting vocal-for-local narratives, especially during Independence Day and Republic Day sales.

Weaknesses of Patanjali

Over-dependence on Leadership

The brand’s image is closely tied to Baba Ramdev and Acharya Balkrishna. Any controversy involving them directly impacts the company.

Example: In 2020, Patanjali faced backlash over claims that Coronil was a COVID-19 cure. Baba Ramdev had to retract statements under government pressure.

Operational Constraints

- Limited manufacturing capacity: Most plants are in Haridwar and Nepal.

- Scale issues: Unable to meet rising demands consistently.

Strategic Concerns

- Limited global presence: Unlike Dabur or HUL, Patanjali has yet to establish a robust international foothold.

- Perception of being a rural brand: Urban elite often view Patanjali products as “less premium”.

- Thin margins for distributors: Due to low product prices

- Over-diversification: Launching too many products at once sometimes results in quality dilution.

Opportunities for Patanjali

Market Expansion

- Natural product demand: Global rise in chemical-free and herbal product adoption

- Untapped rural markets: Huge market potential where Baba Ramdev’s image resonates well

- Global Ayurvedic boom: Increasing interest in Ayurveda in Europe, the U.S., and Middle East

Strategic Growth

- Product diversification: Entering Khadi, organic clothing, herbal cosmetics

- Digital-first approach: Leveraging YouTube, Instagram, and influencer marketing

- Innovation: Investing in research to develop unique Ayurvedic formulations

- Luxury line: Launching premium Ayurvedic products for urban clientele

Partnerships & Tie-Ups

- Modern Retail: Collaborations with retail chains like Future Group, Reliance Retail

- Global Expansion: Targeting ethnic stores abroad with Ayurvedic kits and herbal teas

Threats to Patanjali

Competitive Pressure

Patanjali is facing stiff competition from giants like:

- HUL: Lever Ayush

- Dabur: Traditional Ayurvedic credibility

- Marico: Natural hair care products

- Sri Sri Ayurveda: Similar product range

Reputational Risks

- Controversial Ads: The “Putrajeevak Beej” ad claiming to determine a child’s gender sparked nationwide criticism.

- Legal Scrutiny: In 2023, the Supreme Court warned Patanjali over misleading ads and health claims without clinical backing.

- Negative Publicity: A few Patanjali products were flagged by Nepalese drug authorities for substandard quality.

These incidents affect consumer trust and brand image.

Operational Challenges

- Poor Harvests: Being heavily dependent on agricultural inputs, a weak monsoon or crop disease can disrupt raw material sourcing.

- Regulatory Barriers: Global markets have stricter compliance norms.

- Cybersecurity threats: With e-commerce comes the risk of data breaches.

- Cultural Sensitivity: Exporting Indian products to foreign markets without cultural customization can backfire.

- Environmental Expectations: The modern consumer demands eco-friendly packaging and ethical sourcing.

Top Competitors of Patanjali

Dabur India Ltd

India’s oldest Ayurvedic brand, trusted for generations with products like Chyawanprash, Vatika, and healthcare items.

Hindustan Unilever Limited (HUL)

With the launch of Lever Ayush, HUL entered the Ayurvedic game with a massive distribution and ad budget.

ITC Ltd

Known for personal care products under Fiama, Vivel, and its wellness portfolio.

Emami Ltd

Makers of Zandu, BoroPlus, Navratna Oil – well-established in the herbal care segment.

Baidyanath Group

Another traditional Ayurvedic firm with strong presence in medicine and healthcare.

Each of these brands has a loyal customer base and strong supply chains, making competition tough for Patanjali, especially in urban and premium markets.

Conclusion

Patanjali’s journey from a humble Ayurvedic setup in Haridwar to becoming one of India’s most talked-about FMCG giants is nothing short of inspirational. Rooted in the rich heritage of Ayurveda and propelled by powerful storytelling, strategic pricing, and national pride, Patanjali has carved a unique space for itself in a competitive market.

However, as the brand continues to grow, it must evolve. The challenges it faces today—like quality concerns, over-dependence on its founders, and limited global reach—can no longer be ignored if Patanjali wants to become a sustainable, globally respected brand.

To thrive in the long term, Patanjali must focus on the following priorities:

- Strengthen Research & Development (R&D): Invest in innovation backed by science to enhance product credibility, especially for the global market.

- Maintain Consistent Product Quality: As the product portfolio grows, so should the quality assurance practices. Consistency will drive customer trust.

- Expand Internationally: The global wellness industry is booming. With Ayurveda gaining popularity worldwide, Patanjali is in a prime position to export not just products but a philosophy of holistic living.

- Smart Product Diversification: Focus on expanding in areas that align with Patanjali’s core identity—natural, sustainable, and Ayurvedic. Avoid overstretching into unrelated categories.

- Reduce Reliance on Personalities: Create a leadership structure and brand identity that can stand strong even without the constant presence of Baba Ramdev or Acharya Balkrishna.

- Stay Compliant & Transparent: Legal challenges and misleading ads have dented the brand’s image in the past. Embracing compliance and transparency is key to regaining and retaining trust.

In essence, Patanjali stands at a pivotal juncture. With a loyal customer base, deep cultural roots, and an unmatched understanding of the Indian market, the brand has everything it needs to lead the next wave of natural wellness—both in India and across the world.

But sustained success will depend not on tradition alone, but on how responsibly and strategically it adapts to the demands of a changing world.

FAQs

Q1. What is the SWOT analysis of Patanjali?

SWOT analysis of Patanjali examines its Strengths (Ayurveda-based brand, pricing, distribution), Weaknesses (over-dependence on Baba Ramdev, quality issues), Opportunities (global expansion, product diversification), and Threats (competition, regulatory issues).

Q2. Who are the top Patanjali competitors?

Some of the major competitors of Patanjali include Dabur, HUL, ITC, Emami, and Baidyanath.

Q3. What are the disadvantages of Patanjali products?

Disadvantages include occasional quality issues, misleading health claims, limited premium offerings, and poor international presence.

Q4. Is Patanjali expanding internationally?

Yes, Patanjali is eyeing global expansion into markets like the U.S., Canada, UAE, and European countries.

Q5. How does Patanjali maintain low product prices?

Through low margins, indigenous sourcing, and simplified supply chains, Patanjali keeps its prices 20-30% lower than competitors.