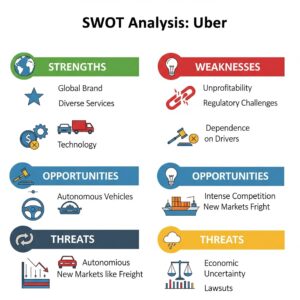

When we talk about modern transportation and the gig economy, Uber is one of the first names that comes to mind. This Uber SWOT Analysis 2025 dives deep into the company’s strengths, weaknesses, opportunities, and threats, giving a holistic view of where Uber stands today and what the future holds.

Uber, founded in 2009 in San Francisco, revolutionized ride-hailing and later diversified into food delivery, freight, and mobility solutions. From a simple idea of booking a cab through an app, it has grown into a global giant present in over 70 countries and 10,500+ cities. In 2023–2024, Uber achieved a major milestone by reporting its first annual operating profit after years of heavy investment and losses. As of Q1 2025, the company’s revenue touched ~$11.5 billion with a 14% growth, signaling a strong turnaround.

But with success comes challenges. The competitive landscape, regulatory hurdles, and evolving technology mean Uber must constantly adapt. This SWOT analysis for Uber provides an in-depth look at how the company can leverage its strengths, address weaknesses, seize opportunities, and mitigate threats.

Overview of Uber

Formerly Known As: UberCab (2009–2011)

Company Type: Publicly Traded Company

Industry: Transportation, Mobility as a Service (MaaS)

Founded: March 2009 (15 years ago)

Founders: Garrett Camp, Travis Kalanick

Headquarters: San Francisco, California, United States

Area Served: Operates in over 70 countries and approximately 10,500 cities worldwide

Key People:

- Ronald Sugar – Chairman of the Board

- Dara Khosrowshahi – Chief Executive Officer (CEO)

Core Services:

- On-demand taxi and ride-hailing services

- Food and grocery delivery through Uber Eats

- Package and courier delivery

- Freight transportation via Uber Freight

Official Website: www.uber.com

Strengths

Global Brand & Market Reach

Uber’s presence in over 70 countries and 10,500+ cities gives it unparalleled reach in the ride-hailing and delivery industry. No other platform matches Uber’s scale and brand awareness. In markets like the US, India, UK, and Australia, Uber has become synonymous with ride-hailing itself.

Example: In India, “book an Uber” is often used interchangeably with “book a cab,” highlighting its brand dominance.

Real Incident: During the pandemic, Uber’s extensive network allowed it to partner with governments and NGOs to deliver medical supplies and vaccines, demonstrating the power of its logistics reach.

Diverse Service Portfolio

Uber isn’t just about rides anymore. The company has built multiple revenue streams through:

- Uber Mobility: Core ride-hailing service.

- Uber Eats: Food and grocery delivery.

- Uber Freight: Connecting shippers and carriers.

- Uber One: Subscription model for discounts and perks.

- Micromobility: Scooters and bikes in urban centers.

Live Example: Uber Eats generated billions in revenue during COVID-19 when ride-hailing dipped. This diversification cushioned Uber during economic fluctuations and proved the value of having multiple verticals.

Technological Innovation & Data Capabilities

At its core, Uber is a tech and data company. Its real-time data infrastructure powers:

- Dynamic pricing based on demand.

- Smart routing to reduce travel time.

- Safety features like live trip tracking and emergency help.

Real Example: Uber’s upfront pricing model has been a game-changer. It allows riders to know fares before booking and has increased Uber’s take-rate from 32% to 42% over the years, boosting profitability.

Case: The use of AI and predictive analytics enabled Uber to optimize driver supply in busy metros like New York, reducing wait times by 20%.

Strategic Autonomous Vehicle (AV) Partnerships

Uber’s multi-partner AV strategy sets it apart. Rather than building self-driving cars in-house, Uber collaborates with:

- Waymo

- Avride

- WeRide

- Lucid

- Nuro

With ≈18 partners globally, Uber acts as an AV aggregator. In markets like Austin and Atlanta, Uber holds exclusivity for some AV deployments.

Incident: In late 2024, Uber integrated Waymo’s robotaxis into its Phoenix platform, offering seamless AV rides without a separate app, marking a major leap for AV adoption.

Financial Turnaround & Growth Momentum

After years of losses (~$32 billion till 2022), Uber achieved consistent profitability in 2023–2024.

- Q1 2025: Revenue $11.5B (+14%)

- Adjusted earnings up 359% to $0.83/share

- 30M Uber One members worldwide

Live Example: Uber’s aggressive cost optimization in Europe, including shutting down underperforming city operations, improved margins and showcased disciplined growth.

Weaknesses

Profitability Not Yet Fully Stable

Despite turning profitable, Uber’s profitability still depends on promotions and pricing tactics. Past cumulative losses of $32 billion highlight the fragile nature of sustained earnings.

Example: In 2024, Uber slashed prices in competitive markets like London to counter Bolt and Lyft, leading to lower margins despite increased trips.

Labor Model & Driver Concerns

Uber’s gig economy model has faced criticism globally:

- Low driver earnings.

- Lack of benefits.

- Ongoing classification debates (employee vs contractor).

Real Incident: In 2023, California’s Proposition 22 legal battle reignited discussions around worker rights, impacting Uber’s legal costs and public image.

Reputational & Ethical Scandals

Uber’s history includes:

- Sexual harassment allegations (2017 scandal).

- #DeleteUber campaign (2017) due to political controversies.

- Past data breaches and internal cultural issues.

Current Issue: In 2025, Uber faced an FTC lawsuit over deceptive billing for Uber One subscriptions, bringing back scrutiny over transparency and ethics.

Regulatory Scrutiny & Legal Risks

Uber is under constant watch from regulators:

- Labor classification battles.

- Privacy fines (e.g., €290M fine in Netherlands, 2024).

- Safety-related lawsuits.

Example: The EU’s Digital Services Act has increased compliance costs for Uber, especially around data handling and driver safety obligations.

Opportunities

Scaling AV Integration via Platform Model

Uber’s platform-based approach to AVs allows it to:

- Expand robotaxi access via partners.

- Avoid massive R&D costs.

- Monetize AV adoption at scale.

Example: In 2025, Uber’s partnership with WeRide in Southeast Asia created the region’s first large-scale AV ride-hailing network without owning a single vehicle.

Service Diversification & Local Commerce

Uber is expanding beyond rides and food:

- Groceries and local product delivery

- Uber Direct for merchants

- Travel bookings

- Ad monetization (≈$1B annual run rate)

Incident: Uber’s integration with major retail chains in the US for same-day delivery has positioned it as a key player in local commerce.

Targeting Under-Penetrated Markets

Uber is focusing on suburban and rural expansion, now accounting for 20%+ of trips. With urban markets saturating, these areas offer growth potential.

Real Example: In India, Uber introduced “Uber Auto” in Tier-2 cities, tapping into an entirely new customer base with affordable pricing.

Sustainability & Green Mobility

Uber is investing heavily in:

- Uber Green: EV rides.

- Charging infrastructure partnerships.

- Multimodal transport integration.

Example: Uber pledged to become a fully electric platform in London by 2025 and globally by 2030, aligning with government regulations and environmental goals.

Data & AI Monetization

Uber’s rich user data is a goldmine for:

- Targeted ads.

- Predictive demand models.

- Cross-selling services.

Incident: In 2024, Uber’s personalized recommendations in Uber Eats drove a 15% increase in order value, proving the power of AI-driven insights.

Threats

Intensifying Competition: Robo-Taxis & Aggregators

Players like Waymo and Tesla are launching independent robotaxi networks, threatening Uber’s dominance.

Real Incident: In 2025, Waymo’s Dallas launch bypassed Uber completely, sparking concerns about AV providers going direct-to-consumer.

Ongoing Regulatory & Labor Pressures

Global legal shifts on gig worker classification and wage mandates could increase operational costs significantly.

Example: In Spain, strict labor laws forced Uber to reclassify drivers as employees, reducing flexibility and increasing overhead.

Macroeconomic & Cost Inflation Risks

Economic downturns and inflation can reduce discretionary travel. Currency fluctuations, especially in Latin America, impact earnings.

Incident: Uber’s 2024 earnings in Brazil were hit by currency depreciation, despite higher trip volumes.

Brand Erosion from Safety & Ethics Fallout

High-profile safety cases impact public trust. Litigation over passenger safety and assault cases remain a challenge.

Example: A 2024 lawsuit in New York involving a passenger assault gained media attention, highlighting the need for stronger safety protocols.

Cybersecurity & Privacy Vulnerabilities

Past breaches make Uber a target for hackers. Heavy fines under GDPR and other regulations pose risks.

Incident: The €290M GDPR fine in 2024 emphasized Uber’s need to strengthen its data protection systems.

Top Competitors of Uber

Lyft

- Why it’s a competitor: Lyft is Uber’s closest rival in North America. Both offer ride-hailing, carpooling, and bike/scooter rentals.

- What makes it different: Lyft focuses heavily on the U.S. and Canada and positions itself as a more community-driven, driver-friendly platform.

- Example: In cities like San Francisco and Los Angeles, riders often compare Uber and Lyft prices in real-time to pick the cheapest ride.

Ola Cabs

- Why it’s a competitor: Ola dominates the Indian ride-hailing market and has expanded to Australia, New Zealand, and the UK.

- What makes it different: Offers a mix of cabs, auto-rickshaws, and bike taxis, catering to both budget and premium customers.

- Example: In Bengaluru, Ola’s auto-rickshaw service competes directly with Uber Auto, giving riders affordable last-mile connectivity.

Didi Chuxing

- Why it’s a competitor: Known as the “Uber of China,” Didi forced Uber to exit the Chinese market in 2016 after a tough battle.

- What makes it different: Operates in multiple countries, integrates AI-driven safety features, and offers a range of services like taxis, private cars, and even bus bookings.

- Example: In Beijing, most commuters use Didi instead of Uber because of better pricing and local dominance.

Grab

- Why it’s a competitor: Grab is the biggest ride-hailing and super-app platform in Southeast Asia.

- What makes it different: Beyond rides, it offers food delivery, grocery services, and digital payments.

- Example: In Singapore and Malaysia, people use Grab to book a ride and simultaneously order food within the same app, something Uber offers via Uber Eats in some markets.

Bolt (formerly Taxify)

- Why it’s a competitor: Bolt is rapidly expanding in Europe, Africa, and some parts of Asia, giving Uber stiff competition.

- What makes it different: Known for lower commission rates for drivers and competitive fares for passengers.

- Example: In cities like Tallinn and Warsaw, Bolt often undercuts Uber on pricing, making it the first choice for budget-conscious riders.

Curb

- Why it’s a competitor: Curb integrates with licensed taxis in the U.S., bridging the gap between traditional cab services and app-based bookings.

- What makes it different: Works with professional taxi drivers, ensuring regulated fares and local compliance.

- Example: In New York City, many commuters use Curb to hail yellow cabs directly through an app instead of waiting on the street.

BlaBlaCar

- Why it’s a competitor: Specializes in long-distance carpooling, which overlaps with Uber’s UberPool and intercity ride services.

- What makes it different: Focuses on cost-sharing for long trips, making it cheaper than traditional ride-hailing.

- Example: In France, travelers often use BlaBlaCar for a 200 km trip at half the price of an Uber.

Careem (acquired by Uber)

- Why it’s a competitor: Even though Uber acquired Careem, it still operates as a separate brand in the Middle East.

- What makes it different: Offers localized services like cash payments, delivery, and corporate ride solutions in Gulf countries.

- Example: In Dubai, Careem is often preferred because of its integration with local payment systems and Arabic-language support.

Via

- Why it’s a competitor: Via specializes in shared rides and micro-transit solutions, focusing on reducing congestion.

- What makes it different: Works with cities and public transportation systems to provide on-demand shuttle services.

- Example: In Chicago, Via operates as a cheaper shared alternative to UberPool for office commuters.

Conclusion

Uber enters 2025 with strong momentum, backed by a diversified business model, tech-driven innovation, and a global presence. However, it must navigate labor issues, regulatory hurdles, and intensifying AV competition. The SWOT analysis Uber 2025 highlights that the company’s success will depend on balancing innovation with social accountability and operational efficiency.

Uber’s ability to adapt to market shifts while strengthening its ethical and regulatory framework will define its next decade. With the right strategy, Uber can maintain its position as the leader in global mobility.

FAQs

What is Uber SWOT Analysis?

A strategic tool to evaluate Uber’s strengths, weaknesses, opportunities, and threats in 2025.

What is the main strength highlighted in this SWOT Uber Analysis?

Uber’s biggest strength is its global scale and diversified services, combined with strong technology and data-driven operations.

Why is Uber SWOT 2025 important?

It provides insights into Uber’s evolving business model, especially after its financial turnaround and growing AV partnerships.

What industries does Uber operate in?

Uber operates in transportation, mobility as a service (MaaS), food delivery, freight logistics, and micromobility (bikes & scooters).

What are the biggest threats to Uber?

Autonomous vehicle competition, regulatory pressure, labor disputes, and cybersecurity risks pose the most significant challenges.

How is Uber improving profitability?

Through strategic pricing, Uber One memberships, service diversification, and partnerships in AV and local commerce.

What opportunities can Uber leverage in the future?

AV integration, rural market expansion, sustainability initiatives, and monetizing data through AI-driven services.

What is Uber’s biggest strength in 2025?

Uber’s biggest strength is its global reach (70+ countries, 10,500+ cities) and diversified services supported by advanced technology and data-driven operations.

How has Uber’s diversified portfolio helped its business?

Services like Uber Eats and Uber Freight created multiple revenue streams, cushioning losses during mobility downturns (e.g., pandemic).

How does Uber use technology to gain an advantage?

Uber leverages AI, real-time data, dynamic pricing, and predictive analytics for efficient routing, safety features, and personalized services.

What are Uber’s key achievements in financial turnaround?

Uber posted its first annual operating profit in 2023–2024 and achieved $11.5B revenue with 14% growth in Q1 2025.

What role do AV (autonomous vehicle) partnerships play in Uber’s strengths?

Uber’s platform model integrates AV partners like Waymo and WeRide, giving it AV access without heavy R&D costs and enabling large-scale deployment.

Is Uber’s profitability stable?

Not fully. Despite turning profitable, earnings are still sensitive to promotions, pricing strategies, and market competition.

What are the major labor issues Uber faces?

Low driver earnings, lack of benefits, and the global debate over contractor vs employee classification are key challenges.

How have scandals impacted Uber?

Past ethical controversies, sexual harassment scandals, and data breaches have affected public trust and brand reputation.

What regulatory challenges does Uber face?

Uber faces labor classification lawsuits, privacy fines, and compliance costs under laws like the EU Digital Services Act.

What are Uber’s biggest opportunities in 2025?

AV integration, rural market expansion, sustainability initiatives, and monetizing AI-driven data insights are major opportunities.

How is Uber expanding into under-penetrated markets?

By introducing affordable services like Uber Auto in Tier-2 and rural areas, which now account for 20%+ of trips.

What is Uber’s sustainability goal?

Uber aims to become fully electric in London by 2025 and globally by 2030 via Uber Green and EV infrastructure partnerships.

How is Uber monetizing data?

Uber leverages user data for targeted ads, predictive demand modeling, and personalized recommendations (e.g., Uber Eats upselling).

Who are Uber’s biggest competitors?

Lyft, Ola, Didi Chuxing, Grab, Bolt, Curb, BlaBlaCar, Careem, and Via are major competitors across different regions.

How does autonomous vehicle competition threaten Uber?

AV providers like Waymo and Tesla may bypass Uber and launch their own direct-to-consumer robotaxi networks.

What are the major regulatory threats for Uber?

Global labor law changes, stricter wage mandates, and driver reclassification as employees could significantly raise operational costs.

How do economic factors affect Uber?

Inflation, currency fluctuations, and economic downturns reduce discretionary travel and impact revenue in sensitive markets.

Why is cybersecurity a critical threat for Uber?

Past data breaches and heavy GDPR fines highlight Uber’s vulnerability to hacking and the need for stronger data protection.

Who is Uber’s closest rival in the US?

Lyft is Uber’s biggest competitor in North America, offering similar ride-hailing and micromobility services.

Which company forced Uber to exit China?

Didi Chuxing dominated the Chinese market, leading Uber to sell its China operations in 2016.

Which platform dominates Southeast Asia?

Grab is the top super-app in Southeast Asia, combining ride-hailing, food delivery, and payments.

How does Ola challenge Uber in India?

Ola offers cabs, autos, and bikes catering to budget and premium segments, with strong penetration in Tier-2/3 cities.

How is Uber improving profitability?

Through strategic pricing, Uber One memberships, diversifying services, AV partnerships, and cost optimization.

What is Uber One?

Uber One is a subscription program offering discounts and perks across Uber services, now with 30M+ members.

How did Uber survive during the pandemic?

Uber Eats and package delivery helped offset mobility losses, showing the importance of its diversified model.

How does Uber integrate with local commerce?

Through Uber Direct, partnerships with retail chains for same-day delivery, and ad monetization (~$1B annual run rate).

A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.