Intel Corporation, founded on July 18, 1968, by Robert Noyce and Gordon Moore, is headquartered in Santa Clara, California, right in the heart of Silicon Valley. Known as a pioneer of the semiconductor industry, Intel has been instrumental in shaping the digital revolution. From powering the first personal computers to driving the backbone of today’s cloud, AI, and data-centric technologies, Intel remains one of the most influential companies in the world.

But in a fast-changing technology landscape, legacy alone isn’t enough. Intel operates in one of the most competitive industries where innovation cycles are short, competitors are aggressive, and global disruptions can reshape market dynamics overnight. To understand Intel’s current position and where it is headed, a SWOT analysis of Intel is essential. This framework helps evaluate Intel’s strengths, weaknesses, opportunities, and threats to assess its strategy in 2025 and beyond.

Intel at a Glance

Before diving into the SWOT framework, let’s look at some key highlights that define Intel’s presence:

Revenue (2023):

- ~$54.2 billion (Marketing91)

- ~$77.9 billion (IIDE – based on reporting differences)

Founded: July 18, 1968

Headquarters: Santa Clara, California, USA

Core Offerings:

- Microprocessors

- Chipsets

- Memory solutions

- Networking hardware

- Cloud & AI technologies

Global Presence:

- Operations in 63 countries

- Partners with OEMs like Dell, HP, Lenovo, Apple

- Works with major cloud hyperscalers

Brand Recognition:

- Iconic “Intel Inside” campaign made Intel a household name

- Intel processors still power the majority of PCs worldwide

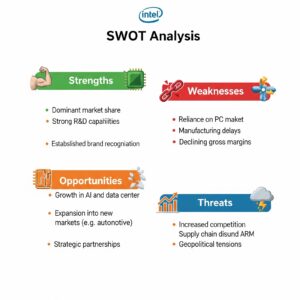

Strengths of Intel

Technology Leadership and the “Intel Inside” Legacy

Intel has always been seen as the face of innovation in the chip industry. The “Intel Inside” campaign in the 1990s was a masterstroke—it made Intel a household name rather than just a supplier hidden inside PCs. Even today, the small sticker on laptops from Dell or HP gives customers confidence in the product’s quality.

Example: A consumer buying a Dell Inspiron in 2023 may not know every technical detail but still feels reassured by the “Intel Inside” branding, which directly influences purchase decisions.

Strong Brand Equity and Value

With a brand worth $28.2 billion in 2023, Intel enjoys an influence that most semiconductor companies don’t. Its name carries credibility in both consumer and enterprise markets. OEMs prefer Intel chips because the brand automatically signals quality to customers

Example: Lenovo, in its global marketing for ThinkPads, highlights Intel processors in premium models because it enhances the laptop’s appeal, even to non-tech-savvy buyers.

Dominant Market Share in PC Processors

Intel still leads the PC processor space, with around 78% market share. Its Core i5 and i7 remain bestsellers in mid-range and premium laptops. Even though AMD has gained traction, Intel continues to be the default choice.

Example: In Q1 2023, most business laptops used by companies like Infosys and Accenture were powered by Intel’s Core processors, showing Intel’s grip on enterprise computing.

Diversified Product Portfolio

Intel has expanded beyond CPUs into areas like Optane memory, FPGAs (Altera), AI accelerators, and Mobileye’s autonomous driving systems. This diversification helps Intel spread risk and tap into future technologies.

Example: Mobileye has partnered with BMW, Volkswagen, and Ford to develop self-driving features, positioning Intel at the forefront of automotive innovation.

Robust Financial Strength for R&D

Intel’s ability to spend over $15 billion on R&D in 2022 is proof of its financial stability. This funding fuels advancements in quantum computing, AI, and semiconductor manufacturing. With support from the U.S. CHIPS Act, Intel is further strengthening its U.S.-based fabs.

Example: Intel recently announced a $20 billion investment in new manufacturing plants in Ohio, backed by U.S. government incentives, boosting its domestic manufacturing capabilities.

Strong OEM and Industry Relationships

Intel has built long-term partnerships with giants like Dell, HP, Lenovo, and Microsoft. These ties ensure that Intel chips remain the go-to for large production runs and enterprise systems.

Example: Microsoft’s Surface lineup continues to use Intel processors in most models, showing the level of trust Intel enjoys with a global software leader.

Vertical Integration in Manufacturing

Unlike AMD or Nvidia, which rely on foundries like TSMC, Intel manufactures its own chips. This gives it control over production and innovation. Despite delays, this integrated approach provides resilience.

Example: During the global chip shortage in 2021, Intel’s in-house fabs helped it maintain relatively better supply compared to some fabless competitors who were fully dependent on TSMC.

Expanding Presence in Data Centers and Cloud

Intel’s Xeon processors dominate the server and cloud space, powering AWS, Google Cloud, and Microsoft Azure. As cloud adoption skyrockets, this remains a steady growth engine.

Example: AWS instances like M5 and C5 are built on Intel Xeon processors, which handle millions of daily workloads for startups and Fortune 500 companies alike.

Strong Global Presence

With operations in more than 60 countries, Intel’s supply chain and customer network are global. Its R&D centers in the U.S., Israel, and Ireland allow it to spread innovation worldwide.

Example: Intel’s research lab in Haifa, Israel, was the birthplace of the Intel Core architecture, which still forms the backbone of today’s processors.

Weaknesses of Intel

Heavy Reliance on the Shrinking PC Market

PC sales are dropping—IDC reported a 16% decline in 2023. Since a large chunk of Intel’s revenue comes from PCs, this overdependence makes it vulnerable as consumer focus shifts to mobile and cloud solutions.

Example: During the COVID boom in 2020–21, Intel thrived on laptop demand. But by 2023, when demand shrank, Intel’s revenues dipped sharply, showing its overexposure to PCs.

Service Gaps in Emerging Markets

Intel has been criticized for weaker after-sales support in regions like India and Southeast Asia. AMD has been quicker to team up with local providers, giving it better service credibility.

Example: In India, AMD partnered with companies like Redington for widespread service support, while Intel customers often complain about longer response times for replacements.

Overproduction and Inventory Challenges

Intel has misjudged demand several times, leading to huge unsold stock. In 2022, it had to write down billions of dollars in inventory, a direct financial setback.

Example: Intel’s overproduction of PC chips in 2022 coincided with falling laptop demand post-pandemic, leaving warehouses piled up with unsold products.

High R&D Costs Pressuring Margins

Intel invests heavily in R&D—about 20% of its revenue, higher than rivals. While this enables innovation, when projects get delayed, the financial strain is massive.

Example: Intel’s prolonged struggle with 10nm technology meant years of spending without market-ready products, cutting into profitability.

Manufacturing Delays and Missed Tech Windows

Intel’s 10nm and 7nm delays allowed TSMC and Samsung to move ahead in advanced chipmaking. Similarly, its slow entry into GPUs let Nvidia capture the AI acceleration market.

Example: Apple, frustrated with Intel’s delays, switched from Intel chips to its own M1 ARM processors in 2020, a huge blow to Intel’s prestige and market share.

Absence in Mobile Processor Market

Intel’s failure to seize the smartphone revolution remains one of its biggest mistakes. ARM-based processors dominate, and Intel has no presence.

Example: Qualcomm’s Snapdragon powers most Android phones, while Apple’s A-series runs iPhones. Intel chips, once tried in early smartphones, disappeared after repeated failures.

Overdependence on x86 Architecture

Intel’s reliance on x86 chips makes it less competitive in areas demanding low power and efficiency. ARM processors are becoming common even in servers.

Example: Amazon’s Graviton processors, based on ARM, are increasingly used by AWS customers for cost efficiency, reducing reliance on Intel Xeon CPUs.

Slower Innovation in AI and GPUs

Intel has lagged in GPUs and AI chips, while Nvidia dominates with CUDA and AMD makes strides with Radeon Instinct. Intel’s Arc GPUs and Habana Labs AI units are still catching up.

Example: OpenAI and Google both rely heavily on Nvidia GPUs for training AI models, showing Intel’s absence in one of the fastest-growing markets.

Vulnerability to Geopolitical Risks

Intel’s global supply chains face risks from trade wars and tensions around Taiwan and China. Any disruption could hit its operations and sales.

Example: The U.S.-China chip war has already limited Intel’s ability to sell advanced chips to Chinese companies like Huawei, directly cutting into potential revenues.

Opportunities for Intel

Expansion in Emerging Markets

Countries like India, Brazil, and Southeast Asia are rapidly digitizing. From smart classrooms in India to e-governance in Indonesia, demand for affordable laptops and servers is rising. Intel can ride this wave by offering region-specific solutions.

Example: India’s “Digital India” project aims to bring internet access to every village, creating massive demand for affordable processors in education and rural connectivity.

Customized Chips and FPGAs

Intel’s Altera acquisition positioned it strongly in the FPGA market. These chips are essential in defense, telecom, and AI because they can be reprogrammed for different workloads.

Example: Telecom giants like Ericsson use FPGAs for 5G base stations, where Intel has a strong foothold.

Growth in Autonomous Vehicles (AVs)

Intel’s Mobileye unit already works with automakers like BMW and Volkswagen, supplying ADAS (driver-assistance systems). As AV adoption accelerates, Intel could dominate this space.

Example: In 2023, Mobileye went public with a valuation of over $16 billion, proving the growth potential of autonomous driving technologies.

Drones, 5G, and Quantum Computing

Intel is investing heavily in futuristic technologies. Drones for logistics, 5G networks for faster connectivity, and quantum computing for next-gen problem-solving are all high-growth markets.

Example: Intel’s collaboration with Ericsson on 5G network solutions has already shown results in Europe, making it a competitor to Qualcomm and Huawei.

Potential Return to Mobile/Smartphone Market

Intel missed the smartphone boom, but it still has room to re-enter by targeting edge computing and AI-powered mobile chips. Collaborations with Android makers could revive its position.

Example: Google’s Tensor chip shows how custom processors can boost smartphones; Intel could partner with a brand like Xiaomi or Oppo to tap into this segment.

Strategic Mergers & Acquisitions (M&A)

Just like Intel’s $15.3 billion acquisition of Mobileye paid off, acquiring AI chip startups or semiconductor design firms could give it an edge over Nvidia and AMD.

Example: Nvidia’s attempted $40 billion Arm acquisition shows how big players use M&A to dominate—Intel can’t afford to stay behind.

Sustainability and Green Chips

With governments demanding carbon neutrality, Intel’s focus on energy-efficient processors and net-zero manufacturing by 2040 will win eco-conscious customers.

Example: Tech companies like Microsoft and Google prefer suppliers with strong green credentials, giving Intel a competitive advantage.

Cloud and AI Boom

The surge in cloud computing and AI adoption means more demand for high-performance processors. Intel’s Xeon chips power a large chunk of servers globally, but demand is far from saturated.

Example: Amazon AWS and Microsoft Azure rely on Intel-based servers for enterprise workloads, giving Intel a steady growth path.

Chip Manufacturing in the U.S. and Europe

With governments pushing for chip independence after COVID disruptions, Intel is investing billions in new fabs in Ohio (U.S.) and Germany. Subsidies and incentives make this a huge opportunity.

Example: The U.S. CHIPS Act provides $52 billion in subsidies, and Intel is one of the biggest beneficiaries.

Threats Facing Intel

Fierce Competition

Intel faces AMD, Nvidia, Qualcomm, and HiSilicon (Huawei) in different product categories. AMD’s Ryzen CPUs and EPYC server chips are stealing Intel’s market share, while Nvidia rules GPUs.

Example: In 2023, AMD’s EPYC processors secured contracts with cloud providers like Google Cloud, directly challenging Intel Xeon.

Overdependence on Chips

Intel relies almost entirely on chip sales, unlike Apple which earns from services too. This heavy reliance makes Intel vulnerable to market swings.

Example: Apple’s move to its in-house M1 and M2 chips cost Intel billions in lost MacBook sales.

Pricing Pressure in Price-Sensitive Markets

Emerging markets demand high-performance but low-cost processors. AMD’s aggressive pricing has made it popular in India and Southeast Asia.

Example: Many Indian gamers prefer AMD Ryzen over Intel because it delivers better performance at a lower price point.

Supply Chain Fragility

COVID-19 showed how fragile semiconductor supply chains are. Intel depends on external suppliers for raw materials, making it vulnerable to disruptions.

Example: In 2021, the global chip shortage forced automakers like Ford and GM to cut production, indirectly hurting Intel’s revenues from automotive chips.

Geopolitical Risks

The U.S.–China trade war and export bans directly affect Intel, as China is one of its biggest markets. Any escalation means lost revenue.

Example: In 2022, the U.S. government restricted exports of advanced chips to China, forcing Intel to halt deals with major Chinese tech firms.

Intellectual Property (IP) Risks

Chip designs are prone to IP theft and legal battles. Intel has faced multiple patent disputes, draining time and money.

Example: In 2021, Intel was ordered to pay $2.18 billion in a patent infringement case involving VLSI Technology.

Delay in Technology Roadmap

Intel has often struggled with delays in moving to smaller nodes like 7nm, allowing AMD and TSMC to get ahead in efficiency.

Example: Intel’s delay in 10nm chips gave AMD a huge head start with its 7nm Ryzen processors.

Shifts in Customer Preferences

Big tech companies are increasingly designing their own chips, reducing dependency on Intel

Example: Amazon developed its own Graviton ARM-based chips for AWS, which are cheaper and energy-efficient compared to Intel Xeon.

Cybersecurity Risks

As processors power critical infrastructure, security flaws like Meltdown and Spectre (2018) shook Intel’s reputation. Such incidents expose it to lawsuits and customer mistrust.

Example: After the Spectre vulnerability, Microsoft had to issue emergency security patches for Intel chips, frustrating enterprise customers.

Competitors of Intel

Advanced Micro Devices (AMD)

AMD is Intel’s most direct competitor in the CPU and GPU market.

- Strengths: AMD’s Ryzen processors have given Intel tough competition in desktops and laptops, while its EPYC server processors are widely used in data centers for their performance and cost-efficiency.

- AI & GPUs: Through its Radeon GPUs and acquisition of Xilinx (FPGA leader), AMD is expanding into AI and adaptive computing—fields Intel also wants to dominate.

- Example: Major tech giants like Google Cloud and Microsoft Azure use AMD’s EPYC chips in their servers, reducing Intel’s monopoly in the server processor market.

NVIDIA

NVIDIA is a GPU powerhouse and a rising leader in AI computing.

- Strengths: NVIDIA’s CUDA platform and GPUs (like A100, H100) dominate AI training and machine learning workloads. Intel has its own GPU line (Intel Arc, Xe series), but it lags far behind NVIDIA in performance and adoption.

- AI Focus: NVIDIA is not just about graphics anymore—it has become the backbone of AI, powering models like ChatGPT and autonomous driving systems.

- Example: NVIDIA’s partnership with Tesla for AI-powered self-driving cars and OpenAI for training large AI models puts it far ahead of Intel in the AI race.

Qualcomm

Qualcomm is best known for its dominance in mobile processors (Snapdragon), but it is also pushing into PC and AI markets.

- Strengths: Qualcomm’s chips are ARM-based, meaning they are energy-efficient and optimized for mobile and lightweight devices—something Intel struggles with.

- AI Expansion: Qualcomm is embedding AI engines directly into its Snapdragon processors, making smartphones and laptops more AI-capable without needing big servers.

- Example: Microsoft’s upcoming Copilot+ PCs will use Qualcomm’s Snapdragon X Elite processors, showing how Qualcomm is eating into Intel’s laptop market share.

Apple (Apple Silicon)

Apple used to rely on Intel for Mac processors but has now shifted to its in-house Apple Silicon chips (M1, M2, M3 series).

- Strengths: Apple’s ARM-based chips are highly power-efficient and deliver exceptional performance per watt, leaving Intel chips looking outdated in MacBooks.

- AI Integration: Apple is also embedding AI capabilities directly into its chips for on-device machine learning.

- Example: The MacBook Air with M2 chip outperformed many Intel-based laptops in performance benchmarks, while lasting much longer on battery.

Samsung Electronics

Samsung is both a chip manufacturer and a chip designer, making it a strong competitor to Intel.

- Strengths: Samsung is a leader in memory chips (DRAM, NAND) and also designs processors like Exynos for mobile devices.

- Manufacturing Edge: Samsung is one of the few companies that rivals TSMC in advanced chip manufacturing, a space where Intel has fallen behind.

- Example: Samsung’s 3nm chip production started earlier than Intel’s, highlighting its manufacturing leadership.

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC is not a direct consumer brand like Intel but is Intel’s biggest rival in manufacturing.

- Strengths: TSMC is the world’s largest contract chipmaker, producing chips for Apple, AMD, NVIDIA, and Qualcomm.

- Weakness for Intel: Intel both designs and manufactures chips, but since TSMC is ahead in 3nm and 5nm technologies, companies prefer TSMC’s fabs.

- Example: Apple’s A17 Pro chip (used in iPhone 15 Pro) is made by TSMC on 3nm technology—Intel can’t match this scale yet.

Broadcom

Broadcom is a strong competitor in networking, storage, and custom silicon.

- Strengths: It specializes in chips for data centers, cloud, and broadband communication, all areas where Intel also plays.

- AI Push: With its custom chips for cloud providers, Broadcom is becoming a serious AI infrastructure player.

- Example: Broadcom provides chips for Google Cloud networking systems, directly competing with Intel’s network solutions.

IBM

While IBM is not a mainstream CPU player anymore, it competes with Intel in enterprise and AI hardware.

- Strengths: IBM’s Power Systems and quantum computing initiatives offer high-performance alternatives for specific workloads.

- AI Edge: IBM integrates AI through its Watson AI platform and enterprise solutions.

- Example: IBM’s z16 mainframe uses AI acceleration for fraud detection, something Intel cannot replicate at the same scale.

Arm Holdings

Arm doesn’t manufacture chips but licenses its ARM architecture to companies like Apple, Qualcomm, and Samsung.

- Strengths: ARM-based designs dominate smartphones and are now moving into laptops and servers, threatening Intel’s x86 dominance.

- AI Role: ARM cores are being optimized for AI processing in edge devices.

- Example: Amazon’s Graviton processors for AWS (built on ARM) are cheaper and more efficient than Intel Xeon processors.

Micron Technology

Micron competes with Intel in the memory and storage market.

- Strengths: A leader in DRAM and NAND flash memory, Micron often outpaces Intel in memory innovations.

- Example: Micron’s LPDDR5X memory is widely used in smartphones and laptops, while Intel lags in advanced memory development.

Conclusion

The SWOT analysis of Intel reveals that the company is built on a strong foundation of brand power, financial strength, and diversified product lines. However, weaknesses like overdependence on PCs, manufacturing delays, and lack of presence in mobile processors highlight critical gaps.

Intel’s opportunities lie in expanding into emerging markets, investing in autonomous driving, AI, and sustainability. But threats from intense competition, geopolitical risks, and supply chain vulnerabilities demand strategic agility.

Intel’s competitive advantage lies in its scale, brand equity, and legacy in semiconductor design, but its future success depends on how well it adapts to disruptive technologies in 2025 and beyond.

FAQs

What industry is Intel in?

Intel is in the semiconductor industry, specializing in designing and manufacturing microprocessors, chipsets, memory, networking hardware, and AI/cloud technologies.

What is Intel’s biggest strength?

Intel’s biggest strength lies in its dominant market share in PC processors and its strong global brand value built through the “Intel Inside” campaign. The brand continues to influence consumer and enterprise buying decisions, even when competitors offer similar or better specs.

Why is Intel considered an industry leader?

Intel is seen as a leader because of its long history of innovation, robust financial power, and vertical integration in manufacturing. Unlike many competitors that rely on foundries like TSMC, Intel produces its own chips, giving it better control over quality and supply.

What are Intel’s main weaknesses?

Intel’s major weaknesses include:

- Overdependence on the shrinking PC market

- Delays in chip manufacturing (10nm, 7nm)

- Missed opportunities in the mobile processor market

- High R&D costs impacting profitability

- Slower progress in AI and GPUs compared to Nvidia and AMD

- Exposure to geopolitical risks and supply chain disruptions

Why did Intel fail in the smartphone market?

Intel failed in smartphones because it couldn’t compete with ARM-based processors (Qualcomm Snapdragon, Apple’s A-series) that were more energy-efficient and better suited for mobile devices. Despite several attempts, Intel exited the smartphone processor market after repeated failures.

What opportunities does Intel have for growth?

Intel’s growth opportunities include:

- Expanding in emerging markets like India, Brazil, and Southeast Asia

- Leveraging FPGAs and custom chips for telecom and defense

- Scaling autonomous driving with Mobileye

- Investing in 5G, drones, and quantum computing

- Tapping into the cloud and AI boom through Xeon processors

- Building new fabs in the U.S. and Europe with government support

- Focusing on sustainable and green chip manufacturing

What threats does Intel face?

Intel faces multiple threats, including:

- Intense competition from AMD, Nvidia, Apple, Qualcomm, and TSMC

- Pricing pressure in cost-sensitive markets like India and Southeast Asia

- Shifting customer preferences, with tech giants like Apple and Amazon designing their own chips

- Geopolitical tensions, especially U.S.–China trade conflicts

- Supply chain fragility, highlighted during COVID-19

- Cybersecurity risks, as seen in the Spectre and Meltdown flaws

- Intellectual property (IP) disputes and patent lawsuits

Who are Intel’s main competitors?

Intel’s key competitors are:

- AMD (Ryzen, EPYC processors)

- Nvidia (GPUs, AI computing)

- Qualcomm (ARM-based mobile and PC processors)

- Apple Silicon (M1, M2, M3 chips replacing Intel in Macs)

- Samsung (Exynos processors, memory, foundry business)

- TSMC (leading contract chipmaker)

- Broadcom (networking and storage chips)

- IBM (Power Systems, quantum computing)

- Arm Holdings (chip architecture licensing)

- Micron Technology (memory and storage solutions)

How is Intel performing financially?

Intel’s revenue in 2023 was reported as ~$54.2 billion (Marketing91) and ~$77.9 billion (IIDE) depending on reporting differences. Despite fluctuations, Intel has strong financial muscle, allowing it to invest over $15 billion annually in R&D and billions more in new fabs.

What role does Intel play in AI and cloud computing?

Intel’s Xeon processors dominate data centers and cloud infrastructure, powering AWS, Microsoft Azure, and Google Cloud. While it lags behind Nvidia in AI training chips, Intel is working on AI accelerators and leveraging acquisitions like Habana Labs to catch up.

How does Intel plan to compete in manufacturing?

Intel is investing heavily in domestic fabs in the U.S. (Ohio) and Europe (Germany), backed by subsidies from the U.S. CHIPS Act ($52 billion) and EU initiatives. These investments aim to reduce reliance on Asian foundries and restore Intel’s leadership in advanced manufacturing nodes.

What makes Intel vulnerable compared to rivals?

Intel’s vulnerabilities include:

- Lagging behind TSMC in process technology (3nm, 5nm)

- Overdependence on x86 architecture while ARM gains ground

- Slow adaptation to mobile and edge computing

- Brand reputation damage from past security flaws like Spectre

What is Intel doing in autonomous vehicles?

Through its Mobileye unit, Intel develops advanced driver-assistance systems (ADAS) and autonomous driving solutions. Mobileye partners with automakers like BMW, Volkswagen, and Ford, and went public in 2023 with a valuation of over $16 billion, showing strong growth potential.

How is Intel addressing sustainability?

Intel has committed to reaching net-zero greenhouse gas emissions by 2040 and is working on energy-efficient processors. This aligns with global demand for green technology, making Intel an attractive choice for eco-conscious partners like Microsoft and Google.

What is the future outlook for Intel?

Intel’s future depends on how well it catches up in manufacturing, strengthens its AI offerings, and diversifies beyond PCs. Its brand, financial strength, and global partnerships provide a solid foundation, but success will require strategic agility in competing with AMD, Nvidia, and TSMC.