SWOT Analysis of Wells Fargo

When we talk about the “Big Four” U.S. banks, one name that has continued to dominate conversations for more than a century is Wells Fargo & Co. Established over 170 years ago, Wells Fargo has stood the test of time, growing from a stagecoach company in the mid-1800s to one of the most influential financial institutions in the world today.

The importance of analyzing the SWOT analysis of Wells Fargo in 2025 lies in its unique position. Despite facing one of the worst reputational crises in American banking history—the fake accounts scandal—Wells Fargo still commands a powerful market presence. With more than 225,000 employees worldwide, operations in multiple countries, and a strong foothold in consumer and commercial banking, the bank is both admired and criticized.

Understanding its strengths, weaknesses, opportunities, and threats gives us insights into how this financial giant is navigating global challenges like digital transformation, regulatory scrutiny, and stiff competition.

Company Overview

Before we dive into the Wells Fargo SWOT analysis, let’s take a closer look at the company itself.

| Company | Wells Fargo & Co.

|

| CEO | Charles W. Scharf

|

| Founders | Henry Wells, William Fargo

|

| Year Founded | March 18, 1852

|

| Headquarters | San Francisco, California, United States

|

| Employees (FY2023) | Approx. $82.6 billion

|

| Revenue (FY2023) | Approx. $82.6 billion

|

| Net Income (FY2023) | Approx. $20.6 billion |

| Ticker Symbol | NYSE: WFC

|

Products & Services

Wells Fargo offers one of the widest banking and financial service portfolios among U.S. banks. Its services include:

- Banking Services: Checking, savings, credit cards, and online banking.

- Loans: Personal, business, auto, mortgage, and student loans.

- Wealth & Investment Management: Advisory, brokerage, and asset management.

- Insurance: Life, health, and property insurance.

- Payroll & Merchant Services: Supporting businesses with payment and HR solutions.

Competitors

Wells Fargo operates in one of the most competitive financial landscapes in the world. As part of the “Big Four” U.S. banks, it goes head-to-head with some of the most powerful names in global banking and finance. Here’s a closer look at its major competitors:

JPMorgan Chase

Widely recognized as the largest bank in the United States by assets, JPMorgan Chase is not just Wells Fargo’s competitor but also a market leader in investment banking, wealth management, and digital banking innovations. Its scale, financial strength, and strong customer trust give it an edge in nearly every segment Wells Fargo operates in.

Bank of America

Another member of the Big Four, Bank of America rivals Wells Fargo across multiple areas—retail banking, credit cards, wealth management, and investment services. With a strong presence in both U.S. and international markets, Bank of America’s technological advancements and customer-centric services make it a formidable challenger.

Citibank

Citibank, the consumer division of Citigroup, is known for its global reach, with branches in more than 90 countries. Unlike Wells Fargo, which is more U.S.-focused, Citibank has a truly international footprint. This global presence helps Citibank attract multinational corporations and high-value clients.

Goldman Sachs

While Goldman Sachs is best known for investment banking and financial advisory, it has also expanded into consumer banking with products like Marcus. In the investment banking and trading segment, Wells Fargo faces stiff competition from Goldman’s deep expertise and global reputation.

Morgan Stanley

Similar to Goldman Sachs, Morgan Stanley dominates in investment banking and wealth management. Its stronghold in asset management and institutional services often puts it in direct competition with Wells Fargo’s wealth management and corporate banking divisions.

U.S. Bank

As the fifth-largest commercial bank in the United States, U.S. Bank competes with Wells Fargo in retail banking, commercial loans, and regional customer services. Though smaller in size, U.S. Bank’s strong focus on customer service and digital banking makes it a notable competitor, especially in the Midwest.

HSBC

HSBC is one of the world’s largest banking and financial services organizations, with a dominant presence in Asia, Europe, and the Middle East. For Wells Fargo, HSBC poses strong competition in international banking, trade financing, and cross-border services.

UBS

UBS, based in Switzerland, is a global leader in wealth management and investment banking. It competes with Wells Fargo particularly in attracting high-net-worth clients and institutional investors. With its strong global brand, UBS is a direct competitor in wealth and asset management.

Fun Facts

- Wells Fargo was the first U.S. bank to introduce online banking in 1995, pioneering digital services before most competitors.

- The Wells Fargo Museum in San Francisco celebrates the bank’s history, including its iconic stagecoach legacy.

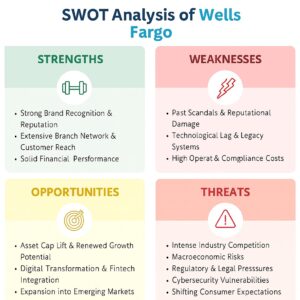

SWOT Analysis of Wells Fargo

Now, let’s examine the Wells Fargo SWOT analysis—its strengths, weaknesses, opportunities, and threats—to understand where it stands in 2025.

Strengths of Wells Fargo

Global Presence

One of the biggest strengths of Wells Fargo is its widespread global presence. The bank operates in more than 30 countries and serves over 70 million customers worldwide. This international reach allows Wells Fargo to spread risks across multiple markets rather than depending solely on the U.S. economy. For example, during periods of U.S. economic slowdown, its operations in other regions help cushion the financial impact.

Live Example:

In 2023, Wells Fargo expanded its corporate banking operations in Asia-Pacific, especially in Singapore and Hong Kong, to tap into the fast-growing markets of Southeast Asia. This move was aimed at supporting multinational clients who are increasing their presence in Asia, showcasing how its international network directly supports its growth strategy.

Strong Brand Recognition

Despite facing several controversies, Wells Fargo still enjoys strong brand recall. The iconic stagecoach logo is deeply associated with the bank’s 170-year history and symbolizes trust, resilience, and heritage. Brand recognition matters in banking because customers often prefer institutions they’ve “heard of” or grown up seeing.

Live Example:

According to YouGov’s 2024 brand index, Wells Fargo still ranked among the top 10 most recognized financial brands in the United States. Even though its reputation has taken a hit, its name recognition gives it a competitive edge, especially among long-term customers who remain loyal.

Strong Financials & Profit Recovery

Another major strength is Wells Fargo’s financial recovery after years of setbacks. In 2023, the bank posted a net income of over $20.6 billion, marking one of its strongest profit rebounds in recent years. This proves its resilience and ability to recover from crises.

Live Example:

During the pandemic in 2020, Wells Fargo reported a net income decline of nearly 90% due to loan defaults and low interest rates. However, by 2023, thanks to rising interest rates and cost-cutting measures, it bounced back with profits crossing $20 billion. This turnaround reassured investors that Wells Fargo remains financially solid despite past challenges.

Part of the U.S. Big Four Banks

Wells Fargo is part of the “Big Four” U.S. banks, along with JPMorgan Chase, Bank of America, and Citigroup. This membership itself is a competitive advantage because it means the bank has scale, customer trust, and market dominance. Being one of the top four players automatically puts it in a leadership position in the U.S. banking sector.

Live Example:

In 2024, the combined assets of the Big Four banks made up over 40% of total U.S. banking assets, and Wells Fargo’s share within this group positioned it as a key national player. Its size ensures it is included in major financial initiatives, such as partnerships with the U.S. Treasury and Federal Reserve programs.

Top 20 Global Bank by Assets

According to S&P Global’s 2023 rankings, Wells Fargo is consistently among the top 20 largest banks in the world by assets. With trillions of dollars under management, this size demonstrates financial strength and the ability to compete with international banking giants.

Live Example:

As of late 2023, Wells Fargo reported total assets of nearly $1.9 trillion, making it larger than many European banks such as Barclays and Deutsche Bank. This asset strength reassures both retail and institutional clients that their money is backed by one of the world’s biggest financial institutions.

Leader in the Middle Market Segment

Wells Fargo is widely respected as a leader in middle-market banking, focusing on companies that are larger than small businesses but not yet global corporations. This segment often gets overlooked by bigger banks, but Wells Fargo has made it a specialty.

Live Example:

In 2023, Wells Fargo’s Middle Market Banking Group financed over $200 billion in commercial and industrial loans, supporting sectors such as healthcare, manufacturing, and technology startups. This has made Wells Fargo the go-to bank for midsize companies seeking growth capital in the U.S.

Ranked among America’s Largest Corporations

Being ranked #47 on the Fortune 500 list in 2024 is another indicator of Wells Fargo’s enduring strength. This recognition highlights the bank’s consistent revenue generation and market dominance in the corporate world.

Live Example:

The Fortune 500 ranking is based on revenue, and Wells Fargo posted over $82 billion in revenue in FY2023. This placed it ahead of some major corporations like Coca-Cola and Disney, proving just how significant its presence is in corporate America.

Highly Valuable Global Banking Brand

Brand value is a critical strength for banks, and according to Brand Finance’s Global Banking 500 Report 2024, Wells Fargo ranked #6 among the world’s most valuable banking brands. Despite reputational issues, its value is supported by customer loyalty and market share.

Live Example:

Brand Finance valued Wells Fargo’s brand at over $30 billion in 2024, keeping it ahead of several global rivals such as Barclays and Credit Suisse. This shows that investors and customers still see Wells Fargo as a bank with staying power.

Recognized for Community Lending

Wells Fargo has consistently been recognized for its community lending initiatives, focusing on affordable housing, small business support, and local community development. Such initiatives not only strengthen its reputation but also reinforce customer trust.

Live Example:

In 2023, Wells Fargo pledged $500 million toward affordable housing programs across the U.S. This included projects in cities like Los Angeles and New York, where housing affordability remains a critical issue. Such investments enhance its role as a socially responsible institution.

Wide Range of Service Offerings

Perhaps one of Wells Fargo’s biggest strengths is its diverse portfolio of services. Unlike banks that specialize in one or two areas, Wells Fargo offers everything from retail banking and mortgages to wealth management and insurance. This “one-stop shop” model ensures customers don’t have to look elsewhere for their financial needs.

Live Example:

In 2023, Wells Fargo reported growth in its wealth and investment management division, with assets under management exceeding $600 billion. This growth came even as other banks struggled, showing how its wide range of services creates multiple income streams and strengthens customer loyalty.

Weaknesses of Wells Fargo

Despite being one of the largest banks in the world, Wells Fargo has several weaknesses that continue to impact its growth, customer trust, and overall brand reputation.

Fake Accounts Scandal & Its Long-Lasting Impact

One of the most damaging events in Wells Fargo’s history was the fake accounts scandal of 2016. It was revealed that employees, under immense pressure to meet sales quotas, opened millions of unauthorized accounts in customers’ names without their knowledge or consent. This wasn’t just an isolated event—it became a full-blown crisis that exposed deep flaws in the bank’s culture and governance.

Even years later, the damage still lingers. In 2020, Wells Fargo agreed to pay $3 billion to settle federal investigations related to the scandal. Beyond the financial penalties, the real loss has been customer trust. Many clients closed their accounts, and some shifted to rivals like JPMorgan Chase and Bank of America, both of which capitalized on Wells Fargo’s reputation crisis.

Live Example: According to a 2023 survey by Morning Consult, Wells Fargo still ranked lower than its peers in customer trust scores, showing how hard it has been for the bank to fully recover from the scandal.

Missed Opportunities Due to Federal Reserve Asset Cap

In 2018, the Federal Reserve placed an unprecedented asset cap on Wells Fargo, limiting its ability to grow its balance sheet beyond $1.95 trillion. This punishment was imposed until the bank improved its governance and risk management practices.

This restriction has prevented Wells Fargo from competing on equal footing with rivals like JPMorgan Chase, which grew significantly in both assets and market share during the same period. Analysts estimate that Wells Fargo lost billions in potential revenue because it was unable to expand aggressively into areas like corporate lending and investment banking.

Live Example: As of 2024, Wells Fargo’s total assets stood at around $1.9 trillion, compared to JPMorgan’s $3.9 trillion. This stark difference highlights how the cap has stunted Wells Fargo’s growth compared to its peers.

Aging Systems and Technology Gaps

While the banking industry has rapidly moved toward digital transformation, Wells Fargo has struggled to keep pace. Its aging IT infrastructure has resulted in system outages and customer dissatisfaction. For example, in 2019, Wells Fargo suffered a major outage that left millions of customers unable to access their accounts online or use ATMs for more than 24 hours.

While competitors like Goldman Sachs have introduced cutting-edge digital platforms, and JPMorgan Chase has invested heavily in AI-powered banking, Wells Fargo has been slower to modernize. This technology gap makes the bank less attractive to younger, tech-savvy customers who expect seamless mobile and online experiences.

Live Example: In 2023, JPMorgan announced a $14 billion technology budget, while Wells Fargo’s tech investment was significantly smaller, limiting its ability to innovate at the same pace.

Negative Publicity Incidents Beyond the Scandal

The fake accounts scandal was just the tip of the iceberg. Wells Fargo has been plagued by repeated negative incidents that keep surfacing in the news. These include:

- Improper auto loan insurance charges where customers were forced to pay unnecessary insurance fees.

- Mortgage overcharging, where borrowers were wrongly charged for rate lock extensions.

- Discrimination cases, where Wells Fargo was accused of unfair lending practices against minority groups.

These recurring problems reinforce the perception that Wells Fargo lacks strong internal controls and customer-first values.

Live Example: In 2022, Wells Fargo agreed to pay $3.7 billion in fines and compensation to settle claims related to widespread mismanagement of auto loans, mortgages, and deposit accounts. This was one of the largest settlements in U.S. banking history.

High Operational Costs

Wells Fargo spends billions annually on legal fees, regulatory compliance, and settlements. These costs weigh heavily on profitability and limit the bank’s ability to reinvest in innovation and growth.

While peers like JPMorgan and Bank of America allocate large chunks of their budgets toward digital advancements, Wells Fargo continues to funnel huge amounts into damage control and compliance.

Live Example: Between 2016 and 2023, Wells Fargo paid over $7 billion in fines, settlements, and penalties related to scandals and compliance failures. This not only drained financial resources but also weakened investor confidence.

Opportunities for Wells Fargo

Despite its challenges, Wells Fargo has immense opportunities to rebuild trust, expand its offerings, and strengthen its position in global banking.

Growing Investment Banking Market Share

Traditionally, Wells Fargo has been more focused on consumer and commercial banking than on investment banking. However, the investment banking sector continues to grow, driven by capital markets, M&A activity, and global trade. Expanding here could help Wells Fargo diversify its revenue streams and reduce overreliance on retail banking.

Live Example: In 2023, JPMorgan and Goldman Sachs dominated global investment banking revenue. If Wells Fargo can strengthen its advisory and capital market services, even capturing a small percentage of this trillion-dollar market could significantly boost profits.

Commercial & Industrial Lending Growth

Wells Fargo is already a leader in middle-market lending, serving businesses that are too large for community banks but smaller than multinational corporations. As U.S. businesses recover and expand post-pandemic, the demand for commercial and industrial loans is rising.

This is a segment where Wells Fargo has an established reputation, and scaling this could solidify its competitive edge.

Live Example: According to the Federal Reserve’s 2024 reports, U.S. commercial and industrial loan balances grew by nearly 7% year-over-year, signaling strong demand that Wells Fargo could capitalize on.

Digital Infrastructure Transformation

The biggest growth opportunity for Wells Fargo lies in digital transformation. By upgrading its cloud systems, integrating artificial intelligence, and partnering with fintechs, Wells Fargo can compete more effectively with digital-first banks and enhance customer experiences.

This includes adopting AI-driven chatbots, improving fraud detection systems, and offering personalized financial advice through mobile apps.

Live Example: In 2023, JPMorgan introduced AI-powered predictive tools for customer spending and saving habits. Wells Fargo has the chance to follow suit, closing the gap and regaining relevance among tech-savvy millennials and Gen Z customers.

Expansion in Emerging Economies

Currently, Wells Fargo remains heavily reliant on the U.S. market for its revenue. Expanding into emerging economies such as Asia, Africa, and Latin America, where middle-class populations are growing rapidly, presents a major opportunity.

By offering trade finance, remittance services, and digital banking, Wells Fargo could capture a large share of new banking customers in these regions.

Live Example: According to the World Bank, financial inclusion in Africa and South Asia has grown significantly in the past five years, with millions opening bank accounts for the first time. Competitors like HSBC and Standard Chartered have already capitalized on these markets—Wells Fargo could do the same to diversify its revenue base.

Threats to Wells Fargo

Just like any global bank, Wells Fargo faces a series of external challenges that can directly influence its growth, stability, and reputation. Let’s break down these threats in detail, with examples to show how they play out in the real world.

Global Economic Fluctuations

Banking thrives when the economy is stable. However, interest rate hikes, inflation, and recessionary pressures can drastically impact Wells Fargo’s business. When interest rates rise, borrowing becomes more expensive, reducing loan demand. On the other hand, during recessions, people and businesses often struggle to repay existing loans, leading to higher defaults.

Example: In 2022–2023, the Federal Reserve raised interest rates aggressively to combat inflation in the U.S. As a result, banks like Wells Fargo saw a decline in mortgage originations—fewer people were taking home loans due to high borrowing costs. According to Wells Fargo’s 2023 earnings report, mortgage banking income dropped by over 50% year-on-year, reflecting how directly macroeconomic conditions affect its revenues.

Negative Public Perception

Perhaps the most persistent threat to Wells Fargo is the lingering trust deficit from the fake accounts scandal revealed in 2016. Even though the bank has paid billions in fines and changed leadership, the stigma still haunts its brand.

Customers and investors often ask, “Why Wells Fargo?” when other banks like JPMorgan Chase or Bank of America appear safer and more transparent. Negative publicity has made many potential customers hesitant to choose Wells Fargo for their long-term banking needs.

Example: In 2023, a survey by American Banker revealed that Wells Fargo ranked near the bottom in customer trust among major U.S. banks. This clearly shows how reputational damage from past scandals continues to hurt its image, even years later.

Pandemic-Related Risks

Although the peak of COVID-19 is behind us, its aftershocks still affect the financial sector. Small businesses that took emergency loans during the pandemic are still recovering, and many face difficulties in repaying. Similarly, consumer credit delinquencies have risen, affecting banks’ loan portfolios.

Example: In 2021, Wells Fargo had to set aside billions for loan loss reserves due to potential defaults. While some reserves were later released as conditions improved, the uncertainty around long-term pandemic impacts—especially for small businesses—still lingers. Even in 2023, Wells Fargo reported an increase in credit card delinquencies and auto loan defaults, reflecting that households are still under financial stress.

Federal Reserve Asset Cap

One of Wells Fargo’s biggest hurdles remains the Federal Reserve’s asset cap, imposed in 2018 after the fake accounts scandal. This cap prevents Wells Fargo from growing its balance sheet beyond $1.95 trillion until it proves that governance and risk controls are fully reformed.

This restriction has been a massive barrier to growth, especially when competitors like JPMorgan Chase and Bank of America are expanding their lending and assets aggressively.

Example: According to analysts at Bloomberg (2023), Wells Fargo has potentially lost billions in lending opportunities due to this cap. Businesses and consumers who could have borrowed from Wells Fargo often went to competitors instead, directly impacting the bank’s market share.

Ongoing Investigations & Legal Scrutiny

Wells Fargo has been under a constant regulatory microscope since its scandals came to light. From fake accounts to improper auto insurance charges and mortgage overcharging, the bank has faced multiple lawsuits and compliance issues.

Currently, investigations into Zelle payment scams have added to its challenges. Customers across the U.S. reported that fraudsters were exploiting weaknesses in Zelle’s payment system, and some accused Wells Fargo of failing to adequately protect users.

Example: In 2022, the Consumer Financial Protection Bureau (CFPB) ordered Wells Fargo to pay $3.7 billion in fines and customer restitution for mismanagement of auto loans, mortgages, and overdraft fees. In 2023, lawsuits related to Zelle scams also kept the bank in the headlines, further damaging customer confidence.

Intense Competition

The U.S. and global banking industry is one of the most competitive sectors. Wells Fargo’s rivals—especially JPMorgan Chase, Bank of America, and Citigroup—have surged ahead in terms of digital transformation, investment banking strength, and global expansion.

JPMorgan Chase, for instance, has invested billions in artificial intelligence and blockchain technologies, while Wells Fargo has struggled with outdated systems and service outages. This gap puts Wells Fargo at a disadvantage when competing for tech-savvy customers and corporate clients.

Example: In 2023, JPMorgan reported record profits of $49.6 billion, fueled by both consumer and investment banking. In contrast, Wells Fargo, despite profit recovery, is still far behind in market leadership. The difference reflects how competition is pulling customers and businesses away from Wells Fargo.

Conclusion

The SWOT analysis of Wells Fargo shows a banking powerhouse that continues to balance its strengths (brand recognition, financial recovery, global reach) with serious weaknesses (reputational damage, regulatory restrictions).

Its opportunities lie in digital transformation, global expansion, and growing investment banking—areas where it must act quickly to remain competitive. But its threats, particularly reputational damage and regulatory scrutiny, are hurdles that will take years to fully overcome.

Despite its setbacks, Wells Fargo remains a dominant player in global banking, one that is determined to rebuild its reputation while leveraging its competitive advantages.

FAQs

What are Wells Fargo’s biggest strengths?

Wells Fargo strengths include its global presence, strong brand recognition, wide range of services, and leadership in middle-market lending.

Why Wells Fargo faced scandals?

The fake accounts scandal arose from unrealistic sales targets, leading employees to open unauthorized accounts. This damaged trust and resulted in billions in fines.

What is Wells Fargo’s competitive advantage?

Its competitive advantage lies in its middle-market lending, diverse product portfolio, and being part of the U.S. Big Four banks.

How is Wells Fargo planning for the future?

Wells Fargo is investing in digital infrastructure, AI, and fintech partnerships, while expanding lending and exploring growth in emerging economies.

Is Wells Fargo still a strong bank?

Yes, despite challenges, Wells Fargo remains one of the largest and most valuable banks in the world, with a Fortune 500 ranking and a global footprint.

What are Wells Fargo’s main weaknesses?

Its key weaknesses include reputation damage from past scandals, regulatory fines, reliance on the U.S. market, and slower adoption of digital innovation compared to competitors.

What opportunities can Wells Fargo explore in the future?

Wells Fargo can benefit from digital transformation, fintech collaborations, global expansion, sustainable financing, and growth in wealth management & retirement services.

What are the biggest threats facing Wells Fargo?

Major threats include fierce competition, regulatory challenges, cybersecurity risks, declining importance of physical branches, and global economic uncertainty.

How did the fake accounts scandal impact Wells Fargo?

The scandal in 2016, where millions of unauthorized accounts were created, severely damaged customer trust, led to billions in fines, and tarnished its brand image, which still affects its reputation today.

Is Wells Fargo investing in digital banking?

Yes. Wells Fargo is investing heavily in AI-driven services, mobile apps, and cybersecurity to catch up with fintech players and competitors like Chase and Bank of America.

How does Wells Fargo compare to its competitors?

Wells Fargo lags behind JPMorgan Chase and Bank of America in global presence and digital innovation, but it remains strong in U.S. retail and mortgage banking.

What role does Wells Fargo play in wealth management?

Wells Fargo has a significant wealth management division serving millions of high-net-worth individuals, managing assets worth hundreds of billions, making it a strong player in this sector.

What risks does Wells Fargo face from fintech companies?

Fintech firms like PayPal, Chime, and Robinhood pose risks by offering faster, cheaper, and more customer-friendly digital banking solutions, which could erode Wells Fargo’s market share.

Why is Wells Fargo important to study in 2025?

Studying Wells Fargo is crucial because it is a historic financial giant adapting to digital disruption, regulatory scrutiny, and shifting customer behavior, making it a case study in resilience and transformation.