Disney SWOT Analysis

The Walt Disney Company is one of the most iconic names in the global entertainment industry. From creating timeless animated classics like Snow White and the Seven Dwarfs in the 1930s to becoming a global leader in movies, theme parks, streaming platforms, and merchandise, Disney has built an empire that touches millions of lives every day. Conducting a SWOT analysis of Disney is essential to understand how this legendary brand maintains its stronghold in the ever-changing world of entertainment.

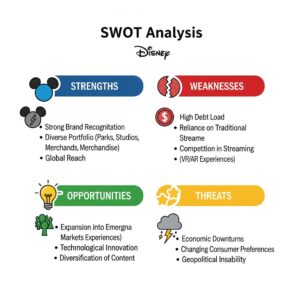

A Disney SWOT analysis provides a detailed look at the company’s Strengths, Weaknesses, Opportunities, and Threats. It highlights what Disney does exceptionally well, where it faces challenges, the new avenues it can explore, and the risks it needs to navigate in an increasingly competitive market. By studying the SWOT of Disney, we gain insights into the strategies that keep the company relevant despite changing consumer preferences, technological advancements, and intense competition.

In this blog, we will dive deep into a comprehensive SWOT analysis Disney, exploring its business segments, historical journey, real-life examples, and future potential. This detailed examination will help us understand why Disney continues to be a dominant force in global entertainment and how it can leverage its strengths to stay ahead.

Overview of Walt Disney

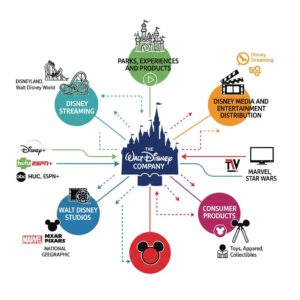

- Industry: Media, Entertainment, Theme Parks, Consumer Products

- Founded: October 16, 1923 (Over 100 years ago)

- Founders: Walt Disney, Roy O. Disney

- Headquarters: Team Disney Building, Walt Disney Studios, Burbank, California, U.S.

- Area Served: Worldwide (Over 190 countries)

- Key People:

- Mark Parker – Chairman

- Bob Iger – CEO

- Revenue: US $88.898 billion (2023)

- Operating Income: US $12.863 billion (2023)

- Net Income: US $2.354 billion (2023)

- Total Assets: US $205.579 billion (2023)

- Number of Employees: 225,000 (2023)

- Divisions: Disney Entertainment, Disney Experiences, ESPN (80%)

- Subsidiaries: National Geographic Partners (73%), Marvel Entertainment, Lucasfilm, Pixar, 20th Century Studios, ABC, Hulu, Hotstar, and more

- Stock Listing: NYSE: DIS

- Parent Brand Value: Consistently ranks among the top 10 most valuable brands globally

- Theme Parks: 12 parks across North America, Europe, and Asia including Disneyland, Walt Disney World, Tokyo Disneyland, Shanghai Disney Resort, etc.

- Streaming Services: Disney+, Hulu, ESPN+, Star+

- Famous Characters: Mickey Mouse, Donald Duck, Elsa, Iron Man, Darth Vader, Simba, Buzz Lightyear

- Website: thewaltdisneycompany.com

Additional Highlights:

- Centennial Legacy: Celebrated its 100th anniversary in 2023, marking a century of innovation in animation and entertainment.

- Major Acquisitions: Marvel (2009), Lucasfilm (2012), 21st Century Fox (2019) – expanding its content library and franchise power.

- Cultural Impact: Disney films and parks are considered cultural landmarks worldwide, shaping generations through storytelling.

- CSR & Sustainability: Actively involved in environmental initiatives, reducing carbon footprint in parks, and producing eco-friendly merchandise.

Strengths

Strong Brand Reputation & Global Recognition

Disney is synonymous with magic, family entertainment, and childhood nostalgia. This emotional connection gives Disney massive brand power, making audiences trust its new projects and stay loyal to its theme parks.

Example: Disneyland Paris attracts millions of visitors every year despite language and cultural differences because of Disney’s universal brand recognition.

Diversified Business Portfolio

Disney doesn’t rely on just one revenue source. It earns from theme parks, streaming services (Disney+), TV networks (ABC, ESPN), movies, and merchandise. This reduces risk because if one area slows down, others can cover the gap.

Example: When COVID-19 shut down theme parks in 2020, Disney+ subscriptions skyrocketed past 73 million, helping the company maintain strong revenues.

Creative Storytelling & Iconic Characters

Disney is a master at creating emotional stories that appeal across generations. Its characters become cultural symbols, kept alive through reboots, merchandise, and theme park attractions.

Example: Frozen’s Elsa became a global phenomenon, leading to sequels, Broadway shows, merchandise, and rides like “Frozen Ever After” in Epcot.

Strong Financial Performance

Disney has historically posted high revenues and profits. Marvel and Lucasfilm acquisitions multiplied box office hits, while Disney+ added recurring income. Parks and resorts deliver strong margins during normal operation.

Example: “Avengers: Endgame” grossed over $2.7 billion worldwide, making it one of the highest-grossing films ever and boosting Disney’s financials massively.

Technological Innovations in Entertainment & Theme Parks

Disney leads in immersive tech to enhance experiences, such as animatronics, projection mapping, and wearable tech like MagicBands. This creates a unique edge and customer satisfaction.

Example: “Star Wars: Galaxy’s Edge” uses cutting-edge animatronics and VR-like experiences in rides such as “Rise of the Resistance,” making it a top attraction worldwide.

Weaknesses

High Operational Costs

Running massive parks, blockbuster movie studios, and streaming infrastructure costs billions. Projects require constant investment in IP and expansions, which can strain finances.

Example: Shanghai Disneyland cost over $5 billion to build and requires huge ongoing maintenance and staffing expenses to keep operations smooth.

Overdependence on Specific Franchises and Characters

Disney relies heavily on classics, Marvel, and Star Wars. If interest drops or a franchise underperforms, revenue takes a hit. New original content hasn’t matched the success of established IPs.

Example: When “Solo: A Star Wars Story” underperformed at the box office, Disney reconsidered its Star Wars release strategy due to franchise fatigue.

Limited Presence in Certain Markets

In some regions like India, Africa, and smaller Asian markets, Disney faces strong competition from local content platforms. Theme parks are concentrated in the US, Europe, and East Asia, leaving gaps in direct physical presence.

Example: In India, Disney+ Hotstar faces fierce competition from platforms like JioCinema and Zee5, limiting its dominance despite the Disney brand.

Vulnerability to Copyright Expiration

Disney’s early works are nearing the public domain, which reduces exclusive control over its iconic content unless refreshed or reimagined.

Example: The original 1928 “Steamboat Willie” version of Mickey Mouse enters the public domain in 2024, forcing Disney to rely on newer versions and trademarks to maintain exclusivity.

Opportunities

Expansion into Emerging Markets

Disney can tap into rapidly growing economies like India, Southeast Asia, and Latin America where demand for entertainment and streaming is booming. Creating localized content, merchandising, and even smaller theme parks designed for these markets can boost revenue.

Example: Disney+ Hotstar in India has become one of Disney’s biggest streaming platforms due to tailored content like IPL cricket rights and regional movies. Similarly, Shanghai Disney Resort is a prime example of Disney adapting to an emerging market.

Growth in Streaming Services (Disney+)

With over 100 million+ global subscribers (as of mid‑2025), Disney+ is a major revenue driver. Expanding internationally, bundling with Hulu and ESPN+, and creating localized shows can attract millions more.

Example: The show Ms. Marvel, set in Pakistan and India, successfully drew South Asian audiences, proving the power of localized programming. Disney+ also bundles services in the U.S. as “Disney Bundle” to increase retention and ARPU (Average Revenue per User).

Technological Advancements like AR/VR in Entertainment

Disney’s Imagineering division is pushing immersive tech for theme parks and home use. Augmented and Virtual Reality can create new ways to experience Disney stories.

Example: Star Wars: Galactic Starcruiser used mixed-reality experiences for guests. Disney is also experimenting with AR features in the Play Disney Parks app, turning park visits into interactive adventures.

Collaborations and Acquisitions to Expand Content Library

Strategic acquisitions and partnerships can keep Disney ahead in content diversity and audience reach. Buying regional studios or gaming platforms can also open new revenue streams.

Example: Disney’s acquisition of Marvel, Lucasfilm, and 21st Century Fox massively expanded its IP portfolio. A future example could be acquiring an esports platform or partnering with Nintendo for gaming content.

Threats

Intense Competition

Disney competes with global streaming giants and traditional media rivals.

Example: Netflix dominates with a vast original library and low-cost plans in countries like India. Universal Studios competes in theme parks with attractions like Harry Potter World. Local players like Zee5 or Tencent Video cater to regional tastes, challenging Disney+.

Changes in Consumer Preferences

Younger audiences prefer short-form, interactive, and personalized experiences over traditional content.

Example: Platforms like TikTok and games like Fortnite engage millions of Gen Z users daily. Disney+ is experimenting with short-form Marvel “Legends” episodes to cater to this trend.

Economic Downturns Affecting Theme Park Attendance

Recessions reduce discretionary spending, impacting park visits and per-capita spending.

Example: During COVID‑19, Disney’s Parks & Resorts revenue dropped by billions due to closures. Similarly, during the 2008-09 recession, attendance and merchandise sales declined sharply.

Piracy and Copyright Challenges

Piracy erodes streaming revenue, especially in high-growth markets. Enforcement of digital rights is costly and complex.

Example: Avengers: Endgame was one of the most pirated films ever, with leaked versions spreading online within days. In India and Southeast Asia, pirated Disney+ Hotstar content is shared widely via Telegram channels and torrent sites, impacting subscriptions.

Conclusion

Summary of Disney’s SWOT Insights

- Strengths: Iconic brand, diversified business segments, creative storytelling, global reach, technological edge.

- Weaknesses: High operational cost, reliance on legacy franchises, limited market penetration in some regions, copyright risk.

- Opportunities: Emerging market expansion, streaming growth via Disney+, AR/VR innovation, further acquisitions.

- Threats: Fierce competitors, shifting viewer habits, macroeconomic disruption, piracy and copyright erosion.

Leveraging Strengths and Opportunities

To maintain leadership, Disney should:

- Invest in strong local content production in emerging markets.

- Expand immersive experiences using emerging technologies.

- Refresh older franchises and develop new IP continually.

- Continue bundling streaming offerings and refine pricing models for diverse global audiences.

Final Thoughts on Disney’s Future

Disney stands at a crossroad where its legacy storytelling and global brand remain unmatched—but the world is evolving fast. Success lies in balancing tradition with innovation: honoring classic characters while embracing new platforms, formats, and markets. Disney’s legacy as the king of entertainment seems secure—but only if the company continues to adapt and lead in the digital age.

FAQs (Frequently Asked Questions)

What is a SWOT analysis of Disney?

A SWOT analysis of Disney assesses its internal Strengths (e.g. brand power), Weaknesses (e.g. high costs), Opportunities (e.g. streaming and new markets), and Threats (e.g. competition), offering a strategic snapshot of the company today.

Why is Disney’s brand reputation so powerful?

Because Disney has spent a century building emotional connections through storytelling, memorable characters (Mickey, Marvel heroes, Star Wars, princesses), and consistent quality across media and parks.

How is Disney expanding in emerging markets?

Through Disney+ international expansions, local-language programming (e.g. Mandarin Disney+ Originals in China, teen dramas in India), merchandise licensing, and partnerships for regional theme park attractions.

What major threats does Disney face today?

Key threats include strong competition from Netflix and other streaming platforms, shifting consumer behavior toward short‑form and mobile content, economic downturns impacting park revenue, and piracy/copyright risks.

How significant is Disney+ to Disney’s future?

Disney+ is central. As global streaming consumption grows, Disney+ drives recurring revenue, content promotion, and direct audience relationships—crucial for future growth.

What are Disney’s biggest strengths?

Iconic brand recognition, diversified portfolio, creative storytelling, financial stability, and tech innovations in entertainment.

What are Disney’s key weaknesses?

High operational expenses, overreliance on franchises, limited penetration in certain regions, and vulnerability to copyright expiration.

How does Disney handle piracy issues?

By implementing digital rights management (DRM), pursuing legal actions, and quickly addressing leaks, though piracy remains a challenge in markets like India and Southeast Asia.

What opportunities can drive Disney’s future growth?

Emerging markets, AR/VR-based immersive experiences, expanding Disney+, and acquiring regional studios or gaming platforms.

A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.