SWOT Analysis of Microsoft

SWOT analysis of Microsoft reveals how the company, founded in 1975 by Bill Gates and Paul Allen, has evolved into a powerhouse in the global technology industry. From its humble beginnings with MS-DOS to becoming a dominant force in cloud computing, productivity software, and enterprise solutions, Microsoft remains one of the most valuable and influential companies in the world. Its flagship products—Windows, Office, and Azure—are household names and critical tools for businesses and individuals alike.

As of 2025, Microsoft is not just a software company but a multi-dimensional tech conglomerate, with strategic ventures in gaming (Xbox), social media (LinkedIn), cloud computing (Azure), collaboration tools (Teams), and AI (via OpenAI). Yet, like all businesses, Microsoft operates in a rapidly changing environment, facing intense competition, emerging technologies, and evolving consumer behavior.

To understand Microsoft’s current position and future potential, a comprehensive microsoft swot analysis is essential. This analysis helps dissect the company’s Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for investors, analysts, students, and business strategists.

Overview of Microsoft

- Industry: Information Technology, Software & Hardware

- Founded: April 4, 1975 (49 years ago) in Albuquerque, New Mexico, U.S.

- Founders: Bill Gates and Paul Allen

- Headquarters: One Microsoft Way, Redmond, Washington, United States

- Area Served: Worldwide

- Key People:

- Satya Nadella (Chairman & CEO)

- Brad Smith (Vice Chairman & President)

- Bill Gates (Co-founder & Technical Advisor)

- Revenue: USD 211.9 billion (FY 2023)

- Operating Income: USD 88.5 billion (FY 2023)

- Net Income: USD 73.4 billion (FY 2023)

- Employees: Approximately 221,000 (as of 2023)

- Website: www.microsoft.com

Additional Key Facts:

- Stock Symbol: MSFT (Listed on NASDAQ)

- Market Capitalization: Over USD 3 trillion (as of early 2025), making it one of the most valuable companies in the world

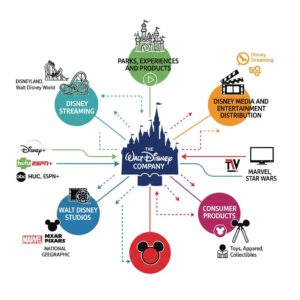

- Core Business Segments:

- Productivity and Business Processes (Office 365, LinkedIn, Dynamics)

- Intelligent Cloud (Azure, Windows Server, GitHub)

- More Personal Computing (Windows, Surface devices, Xbox, Bing)

- Global Reach: Operates in over 190 countries with data centers across the globe to support its Azure cloud infrastructure

- Notable Acquisitions: LinkedIn, GitHub, Nuance Communications, Activision Blizzard

- Innovation Areas: Artificial Intelligence, Quantum Computing, Cloud Infrastructure, Cybersecurity, Mixed Reality (HoloLens), and Enterprise Software Solutions

Why SWOT Analysis is Important?

SWOT analysis is a strategic planning framework that allows businesses to evaluate internal and external factors impacting their performance. For tech giants like Microsoft, which operate in volatile global markets, a SWOT analysis provides a clear picture of competitive advantages, areas of improvement, growth opportunities, and external risks. It helps in decision-making, resource allocation, and long-term planning.

Strengths of Microsoft

Microsoft’s strengths are foundational to its consistent market dominance and global brand recognition. Let’s dive deep into the company’s biggest assets:

Dominant Market Share in OS and Productivity Software

Microsoft’s Windows operating system continues to hold the lion’s share of the global desktop OS market, with over 70% of PCs running on Windows as of 2024. Similarly, Microsoft Office remains the go-to productivity suite for businesses and individuals, with tools like Word, Excel, PowerPoint, and Outlook deeply embedded in daily operations.

Example: In 2023, over 1.4 billion devices globally were actively using Windows, highlighting its extensive reach.

Strong Brand Reputation and Global Presence

Microsoft is consistently ranked among the most valuable brands in the world, competing with Apple, Google, and Amazon. The brand is synonymous with innovation, reliability, and enterprise trust. With offices in over 190 countries and a multilingual product suite, Microsoft’s global footprint is unmatched.

Live example: According to Interbrand’s 2024 Best Global Brands report, Microsoft was ranked #2 globally, with a brand value of over $400 billion.

Cloud Computing Leadership (Azure)

Azure, Microsoft’s cloud platform, is the second-largest cloud services provider globally, after Amazon Web Services (AWS). It offers infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) solutions, catering to enterprises, startups, and government bodies.

Real case: The U.S. Department of Defense chose Azure for its $10 billion JEDI contract (later restructured), showcasing Microsoft’s credibility in secure cloud infrastructure.

Diversified Product Portfolio

Microsoft’s diverse portfolio reduces dependency on any single product. Key products include:

- Office 365 – productivity suite

- Windows – operating system

- Azure – cloud services

- LinkedIn – professional networking

- GitHub – code hosting

- Xbox – gaming console

- Teams – collaboration tool

This diversification helps Microsoft weather market changes and shift focus as needed.

Financial Stability and R&D Capabilities

Microsoft’s financial health is one of its core strengths. With strong cash flows, high profit margins, and consistent revenue growth, the company is well-positioned to invest in research, acquisitions, and innovation.

Financial highlight: In FY 2024, Microsoft reported $270 billion in revenue with a net income of $100 billion. It also invested over $27 billion in R&D, fostering new-age technologies in AI and cybersecurity.

Seamless Integration Across Devices and Platforms

Microsoft’s product ecosystem is designed to offer a truly unified experience, allowing users to move effortlessly across desktops, laptops, tablets, mobile apps, and cloud platforms. This interconnected design enhances productivity and simplifies work processes, especially for users juggling multiple devices.

Example: A document that’s started on Word desktop can be seamlessly edited later via Word Online or even a mobile app—without worrying about version conflicts or data loss.

Strong Presence in Enterprise and Government Sectors

Microsoft is the go-to technology partner for enterprise and government clients due to its long-standing reputation for scalability, security, and support. From defense departments to multinational corporations, Microsoft products serve as the backbone for mission-critical operations across the globe.

Example: The UK government relies on Microsoft 365 and Azure cloud infrastructure across departments to handle sensitive information, ensure secure communication, and support large-scale digital transformation efforts.

Commitment to Sustainability and Green Tech

Beyond business, Microsoft is taking a leadership role in environmental responsibility. The company has set ambitious sustainability goals, including becoming carbon negative by 2030 and water positive by 2030. Through innovative solutions, it’s empowering businesses to take charge of their environmental impact.

Initiative: The Microsoft Cloud for Sustainability enables organizations to measure, track, and reduce carbon emissions—playing a vital role in corporate environmental accountability.

Trusted Developer Community via GitHub

With its acquisition of GitHub, Microsoft has become a powerhouse for developers worldwide. GitHub offers a collaborative space for developers to build, share, and refine code, driving the open-source movement forward. It reinforces Microsoft’s developer-first approach and strengthens its innovation pipeline.

Fact: As of 2024, GitHub has over 100 million developers using the platform, collaborating on everything from passion projects to billion-dollar enterprise software.

Thriving Gaming Ecosystem (Xbox + Game Pass)

Microsoft has made significant strides in the gaming industry through its Xbox consoles, gaming studios, and the revolutionary Game Pass service. Its vision for the future of gaming includes cloud-based access, cross-platform play, and inclusive titles for diverse audiences.

Example: Xbox Game Pass offers subscribers unlimited access to a library of hundreds of games, redefining how gamers discover and enjoy new titles—without the need for physical purchases.

Scalable Business Solutions for SMEs and Enterprises

Microsoft doesn’t just cater to the corporate elite; it builds powerful, scalable tools that serve businesses of all sizes—from local startups to global giants. Products like Dynamics 365, Microsoft Teams, and Azure empower organizations to manage everything from customer relationships to internal operations

Example: A mid-sized company can deploy Dynamics 365 to streamline sales, customer service, and supply chain management—all from a single cloud-based solution.

Frequent Product Updates and Improvements

Microsoft continuously invests in enhancing its product offerings. Whether it’s user interface upgrades, performance enhancements, or added features, users benefit from a steady stream of updates that keep tools modern, secure, and efficient.

User Benefit: For instance, Windows 11 users now receive regular feature updates that improve startup speed, offer better window management, and add productivity-boosting tools—all without needing to purchase a new version.

Accessibility and Inclusive Design

Microsoft has embraced inclusive design principles to make technology accessible to everyone. Whether someone is visually impaired, has mobility challenges, or faces learning disabilities, Microsoft tools are built to accommodate and empower diverse users.

Example: Tools like Windows Narrator for the blind, Seeing AI for visually impaired users, and real-time captioning in Microsoft Teams for the hearing impaired are examples of the company’s commitment to digital inclusivity.

Leading Role in Education Technology

Education is a key focus area for Microsoft, with tools and services designed to enhance teaching, learning, and school administration. Microsoft supports institutions with secure communication platforms, digital collaboration tools, and curriculum-aligned learning apps.

Example: Microsoft Teams for Education, coupled with OneNote Class Notebooks and Minecraft Education Edition, has transformed classrooms into interactive digital learning spaces across schools and universities.

Advanced Security Capabilities

With cyber threats becoming increasingly sophisticated, Microsoft has positioned itself as a trusted cybersecurity provider. Its tools offer proactive protection, threat detection, and automated response mechanisms for individuals and enterprises alike.

Use Case: Microsoft Sentinel allows IT teams to detect, investigate, and respond to security incidents in real-time—making it a critical asset for high-risk sectors like finance and healthcare.

Broad Partner Ecosystem

Microsoft’s massive network of partners, resellers, consultants, and solution providers allows its products and services to reach customers everywhere with tailored implementation and support. This ecosystem drives business continuity, support, and innovation at scale.

Example: The Microsoft Partner Network includes more than 400,000 partners globally, offering everything from cloud migration services to custom application development.

Backward Compatibility and Legacy Support

Microsoft recognizes the importance of stability for businesses and individual users alike. Its commitment to backward compatibility ensures that users don’t have to abandon legacy systems immediately after upgrades.

Example: Many apps and programs developed for Windows 10 or earlier continue to work flawlessly on Windows 11, reducing disruption and cost during transitions.

User-Friendly Interface and Familiarity

Microsoft products have become second nature for millions of users globally. The intuitive interface of Office apps and the Windows OS make it easy for users to get started without a steep learning curve.

Benefit: An employee on their first day can confidently create documents in Word or reports in Excel with minimal guidance—something very few software suites can claim.

Strong Presence in Collaboration and Communication Tools

Microsoft has become a leader in the digital workspace with tools that support real-time collaboration and communication. With features like shared calendars, file co-editing, and integrated task management, teams stay connected and productive.

Example: Microsoft Teams allows employees to chat, hold meetings, assign tasks, and share files all in one place—especially valuable in hybrid and remote work environments.

Proactive Approach to Digital Transformation

Microsoft isn’t just selling software—it’s guiding businesses on how to modernize and thrive in the digital age. Its frameworks, toolkits, and cloud solutions help companies navigate technological change with confidence.

Example: The Microsoft Cloud Adoption Framework provides organizations with structured guidance to adopt and manage cloud technologies at their own pace.

Visionary Leadership and Company Culture

Since Satya Nadella became CEO, Microsoft has undergone a cultural transformation marked by humility, collaboration, and continuous innovation. The company now embraces open-source tools, cross-platform development, and bold technological bets.

Result: This culture shift has contributed to Microsoft’s resurgence in areas like cloud computing, developer engagement, and product innovation—proving that leadership and vision matter as much as code.

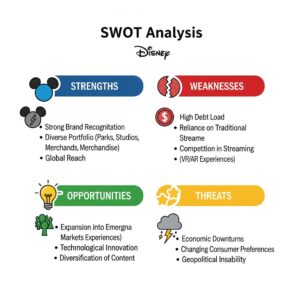

Weaknesses of Microsoft

Even giants have areas that need improvement. Here are some key Microsoft weaknesses:

Limited Success in Mobile OS and Hardware Markets

Microsoft’s attempt to enter the smartphone market with Windows Phone was a notable failure. Despite acquiring Nokia’s handset division, Microsoft couldn’t compete with Android and iOS. This failure forced the company to retreat from mobile OS and hardware production.

Example: In 2017, Microsoft announced it would stop developing new features for Windows Phone, officially ending its mobile ambitions.

Dependence on Windows and Office Products

While diversification exists, a significant chunk of Microsoft’s revenue still comes from Windows and Office. Any disruption in the PC market or change in consumer behavior (e.g., moving to free tools like Google Workspace) can affect its bottom line.

Slower Innovation Compared to Competitors in Some Segments

In areas like smart assistants, hardware innovation, and consumer AI products, Microsoft often trails behind rivals like Apple (Siri, iPhone) and Google (Assistant, Pixel). This cautious approach sometimes causes the company to miss first-mover advantages.

Security Vulnerabilities and Software Bugs

Microsoft has been a frequent target for cyber-attacks due to its large user base. Windows systems have historically suffered from security flaws, requiring frequent patches. These vulnerabilities erode customer trust and pose risks to enterprises.

Real incident: In 2021, the Microsoft Exchange Server breach affected thousands of organizations, revealing critical security lapses.

Overdependence on Enterprise Customers

A large portion of Microsoft’s business is tied to enterprise and government contracts. While profitable, it makes the company vulnerable to economic slowdowns or regulatory changes affecting large institutions.

Real-world concern: Budget cuts or policy shifts in public sectors could directly impact license renewals and cloud subscriptions.

Mixed Performance in Consumer Hardware

While the Surface line has had moderate success, other consumer electronics like the Zune music player and Kinect sensor failed to gain long-term traction.

Example: Kinect was once bundled with Xbox but was eventually discontinued due to lack of developer interest and user demand.

Complex Licensing and Pricing Models

Microsoft’s enterprise software pricing can be confusing, with multiple tiers, versions, and subscription models. This often frustrates customers and makes comparison with simpler offerings from Google or Apple more appealing.

Feedback: Many small businesses report difficulty understanding what they’re actually paying for in Microsoft 365 plans.

Antitrust and Regulatory Scrutiny

Given its size and influence, Microsoft frequently faces legal challenges and antitrust investigations, especially in the EU and US. These not only affect its reputation but can also lead to fines or restrictions on business practices.

Example: In 2023, the European Commission launched a probe into Microsoft bundling Teams with Office 365, citing anti-competitive behavior.

Opportunities for Microsoft

The future holds immense promise. Let’s explore the emerging opportunities for Microsoft:

Expansion in AI, Machine Learning, and Cloud Services

Microsoft’s investments in AI, especially through its partnership with OpenAI, are game-changing. Azure’s AI services, integration of ChatGPT into Bing and Office (Copilot), and development of generative AI tools present major growth avenues.

Live example: In 2023, Microsoft integrated Copilot into Word and Excel, allowing users to automate document creation and analysis through natural language input.

Growth Potential in Emerging Markets

With rising internet penetration in regions like Africa, South Asia, and Latin America, Microsoft has an opportunity to expand its ecosystem—Windows, Teams, Office 365—at scale. Affordable pricing and cloud accessibility will be key.

Strategic Acquisitions and Partnerships

Microsoft’s strategic acquisitions keep enhancing its portfolio. Notable ones include:

- LinkedIn (2016)

- GitHub (2018)

- Nuance Communications (2021)

- Activision Blizzard (2023)

These acquisitions strengthen its hold in professional networking, coding, voice AI, and gaming.

Rising Demand for Cybersecurity Solutions

Cybersecurity is no longer optional—it’s essential. Microsoft Defender, Sentinel, and Azure Security Center are increasingly adopted by enterprises. The company’s trusted brand positions it as a leading cybersecurity solution provider.

Hybrid Work and Remote Collaboration Tools

Post-pandemic, the shift to hybrid work is permanent. Microsoft Teams, Outlook, and Viva are gaining momentum as integrated productivity tools for remote-first organizations.

Example: By mid-2024, Microsoft Teams had over 320 million monthly active users, becoming a key player in enterprise communication.

Digital Learning and Skilling Initiatives

With a global skills gap in tech, Microsoft’s educational platforms are in high demand.

Live Example: LinkedIn Learning, owned by Microsoft, partnered with governments in the UK and Germany to upskill workers in AI, coding, and cybersecurity.

Growing Gaming Industry

Cloud gaming is on the rise, and Microsoft is tapping into this with Xbox Cloud Gaming via Game Pass.

Live Example: In 2024, Xbox Cloud Gaming expanded to Samsung Smart TVs, allowing people to play without a console.

Rising Environmental Awareness

Microsoft has committed to becoming carbon negative by 2030, opening doors for eco-conscious innovation.

Live Example: Through its Cloud for Sustainability platform, Microsoft helps companies like ABB and Johnson Controls track and reduce carbon emissions.

Strengthening Developer Ecosystem

GitHub, owned by Microsoft, is a hub for millions of developers. The more developers thrive, the more Microsoft’s ecosystem grows.

Live Example: GitHub now supports over 100 million developers (as of 2024), and tools like Codespaces are redefining how coding is done.

Threats Facing Microsoft

No matter how strong a company is, external challenges can impact its growth and stability. Microsoft, despite its size and dominance, faces several threats that could influence its business performance in the short and long term. Let’s explore the most pressing threats Microsoft is dealing with:

Intense Competition from Tech Giants

Microsoft faces tough competition from major players like Apple, Google, and Amazon Web Services (AWS). Each of these companies dominates a specific segment:

- Google competes with Google Workspace, Gmail, and Android, providing free or lower-cost alternatives to Microsoft’s paid services.

- Apple has created a loyal ecosystem through seamless software-hardware integration, which limits Windows’ penetration in the premium consumer market.

- AWS leads the global cloud computing space, posing a direct threat to Azure’s growth.

Example: Google’s push for Chromebooks in schools has affected Microsoft’s education sector market, especially in the U.S.

Rapid Technological Advancements

Technology is evolving faster than ever. From AI and machine learning to quantum computing and blockchain, companies that fail to adapt risk falling behind. Microsoft must continually innovate to stay relevant, which requires massive investments and constant R&D upgrades.

Example: Open-source platforms and lightweight Linux-based OS alternatives have grown rapidly, challenging Microsoft’s traditional desktop dominance.

Regulatory Pressures and Antitrust Scrutiny

Governments and regulatory bodies are closely monitoring big tech companies. Microsoft’s acquisitions and market dominance have attracted scrutiny in the U.S., EU, and other regions.

Live Case: The $69 billion Activision Blizzard acquisition was delayed for months due to antitrust concerns raised by regulators in the UK and U.S. This uncertainty not only delayed business expansion but also affected investor confidence.

Cybersecurity Risks and Data Breaches

As a major cloud and enterprise solutions provider, Microsoft is a frequent target for cyberattacks. Any breach can damage customer trust and lead to financial and reputational loss.

Example: In 2023, a group of Russian hackers, known as Midnight Blizzard, breached Microsoft’s internal systems and accessed sensitive emails. The attack raised global concerns about cloud security, even for large tech firms.

Economic Fluctuations and Global Uncertainties

Like all global businesses, Microsoft is vulnerable to economic downturns, geopolitical tensions, and currency fluctuations. Rising inflation, reduced IT spending, or a global recession can directly impact sales and subscriptions.

Example: During the 2022–2023 global inflation surge, many businesses delayed tech upgrades and software license renewals, affecting enterprise revenue for Microsoft and its peers.

Open-Source Software Movement

The growing popularity of open-source alternatives like Linux, LibreOffice, and Apache OpenOffice poses a long-term threat to Microsoft’s proprietary software model. Many governments and educational institutions are now encouraging open-source adoption to cut costs.

Example: The Indian state of Kerala switched many of its government systems from Windows to Linux, saving licensing fees and promoting open-source education.

Over-Reliance on Subscription Models

While Microsoft 365’s subscription-based model brings recurring revenue, it also exposes the company to customer fatigue and churn. If users feel the value doesn’t justify the price, they may switch to free alternatives.

Example: Some small businesses are moving from Microsoft Teams and Office to Zoho and Google Workspace for budget-friendly solutions.

Environmental and Sustainability Challenges

As a company with massive data centers and hardware production, Microsoft faces increasing pressure to reduce its carbon footprint and adopt sustainable practices. Failure to meet environmental goals could attract backlash from regulators and eco-conscious investors.

Example: Greenpeace and other NGOs have rated tech companies on their sustainability. Microsoft has pledged to be carbon negative by 2030, but it must follow through to avoid reputational damage.

Dependency on Third-Party Vendors

Microsoft relies on global vendors for hardware, components, and services. Supply chain disruptions, like those seen during the COVID-19 pandemic, can delay product releases and increase costs.

Example: The global chip shortage in 2021–2022 affected Xbox Series X production, causing unmet demand during key seasons like Black Friday and Christmas.

Shifting Consumer Preferences

Consumers today are prioritizing mobile-first, lightweight, and user-friendly tools. Microsoft’s legacy in desktop software sometimes makes it appear less agile or modern compared to newer, cloud-native platforms.

Example: Platforms like Notion, Slack, and Zoom gained rapid popularity during the pandemic, challenging Microsoft’s hold on productivity and collaboration software.

Intellectual Property and Patent Disputes

With a large product base and presence across industries, Microsoft often finds itself involved in legal disputes over patents and intellectual property rights. These legal battles can be costly and time-consuming.

Example: In past years, Microsoft has had multiple patent clashes, including disputes with Motorola and other Android-based phone makers over technology licensing fees.

Competitors of Microsoft

Operating Systems (OS)

Main Competitor: Apple (macOS) & Google (Chrome OS)

Apple’s macOS provides a premium OS experience on its Mac devices, attracting creatives and professionals with its sleek interface and performance.

Live Example: macOS Ventura powers the latest MacBook Air and Mac Studio systems used by design studios and film editors.

Google’s Chrome OS

It is a lightweight, web-based OS dominating the education sector with affordable Chromebooks.

Live Example: Schools across the U.S. and India distribute Chromebooks powered by Chrome OS for digital learning.

Cloud Computing (Azure)

Main Competitor: Amazon (AWS) & Google (Google Cloud Platform – GCP)

Amazon Web Services (AWS) is the industry leader with the broadest cloud offering and first-mover advantage.

Live Example: Netflix uses AWS to stream billions of hours of video content globally.

Google Cloud Platform (GCP) is a strong player in AI-based cloud services and data analytics.

Live Example: PayPal uses GCP to analyze customer behavior and enhance fraud detection.

Productivity Software (Office 365)

Main Competitor: Google (Google Workspace)

Google Workspace offers cloud-first tools like Google Docs, Sheets, Slides, and Gmail, appealing to startups and educational institutions.

Live Example: Many NGOs and tech startups in India and Africa operate entirely on Google Workspace to cut licensing costs and ensure easy collaboration.

Search Engine & AI Integration (Bing + Copilot)

Main Competitor: Google Search

Google Search remains the most dominant search engine, deeply integrated with Google Assistant and Google Lens.

Live Example: As of 2024, Google processes over 8.5 billion searches per day, making it the go-to tool for both individuals and businesses globally.

Enterprise Communication & Collaboration (Microsoft Teams)

Main Competitor: Slack, Zoom, Google Meet

Slack offers flexible, app-integrated team communication especially loved by tech companies.

Live Example: Companies like Airbnb and Shopify rely heavily on Slack for daily team communication.

Zoom became a household name during the pandemic for video conferencing.

Live Example: Schools and universities used Zoom for remote classes globally in 2020–2023.

Google Meet is a key player integrated within Google Workspace.

Live Example: Educational institutions and government offices use Meet for seamless video meetings.

Gaming (Xbox)

Main Competitor: Sony (PlayStation) & Nintendo (Switch)

Sony PlayStation is Microsoft’s biggest rival in the console war, often leading in exclusive game titles.

Live Example: Titles like God of War and Spider-Man 2 are only available on PlayStation 5.

Nintendo Switch dominates the handheld gaming market and family-friendly games.

Live Example: Animal Crossing: New Horizons on Switch became a global hit during COVID lockdowns.

Developer Platforms (GitHub)

Main Competitor: GitLab, Bitbucket (by Atlassian)

GitLab offers built-in DevOps and CI/CD capabilities, popular among agile development teams.

Live Example: NASA and Alibaba use GitLab to manage their software development cycles.

Bitbucket, integrated with Jira and Trello, is favored by teams already using Atlassian tools.

Live Example: Startups using Jira for project management often pick Bitbucket for smoother workflow integration.

Web Browsers (Microsoft Edge)

Main Competitor: Google Chrome, Mozilla Firefox, Apple Safari

Google Chrome remains the most used browser worldwide due to its speed, extensions, and mobile syncing.

Live Example: Chrome holds over 65% of the global browser market share in 2024.

Safari, Apple’s default browser, is optimized for Mac and iOS users.

Live Example: iPhone users overwhelmingly use Safari for its smooth Apple ecosystem experience.

Mozilla Firefox is open-source and valued for its privacy controls.

Live Example: Privacy-focused users and developers in Europe often prefer Firefox over other browsers.

Enterprise Resource Planning & CRM (Dynamics 365)

Main Competitor: Salesforce, SAP, Oracle

Salesforce dominates the CRM market with its cloud-based platform and marketing automation.

Live Example: American Express uses Salesforce to manage customer data and personalize services.

SAP is a leader in ERP software, especially in manufacturing and supply chain sectors.

Live Example: BMW and Nestlé run complex operations using SAP’s ERP suite.

Oracle provides robust database and ERP solutions for large-scale enterprises.

Live Example: Oracle ERP Cloud is widely used by telecom and government agencies globally.

Hardware & Devices (Surface, Xbox, Hololens)

Main Competitor: Apple, Dell, HP, Lenovo, Meta (AR/VR)

Apple is a direct rival with its iPads, MacBooks, and iPhones providing strong hardware-software integration.

Live Example: Many creative professionals prefer MacBooks for video editing and graphic design.

Dell, HP, Lenovo compete in the laptop/PC segment with affordable and enterprise-friendly hardware.

Live Example: Lenovo ThinkPads are widely used in universities and corporate offices for reliability.

Meta (formerly Facebook) is a key player in AR/VR with the Quest headset, competing with Microsoft’s HoloLens.

Live Example: Meta Quest 3 is being adopted by gaming enthusiasts and training institutions alike.

Search Advertising & Business Ads (Bing Ads)

Main Competitor: Google Ads, Amazon Ads, Facebook Ads

Google Ads dominates search advertising with its massive audience reach and ROI-driven targeting.

Live Example: Small businesses globally use Google Ads to appear on top of search results and drive traffic.

Amazon Ads are rising rapidly, especially for e-commerce brands.

Live Example: Brands like Samsung and LG heavily advertise on Amazon for product visibility.

Meta Ads (Facebook + Instagram) are a top choice for social media targeting.

Live Example: D2C brands use Facebook Ads to run carousel campaigns targeting mobile users.

Learning & Certification Platforms (Microsoft Learn)

Main Competitor: Coursera, Udemy, Google Skillshop, AWS Training

Coursera partners with top universities to offer degree and certification programs.

Live Example: IBM and Google offer job-ready certifications in data science and IT through Coursera.

Udemy provides thousands of affordable, on-demand courses on every topic imaginable.

Live Example: Freelancers and developers use Udemy to learn Python, Excel, or web design at their own pace.

Google Skillshop and AWS Training directly rival Microsoft Learn by offering free, role-specific training.

Live Example: Cloud practitioners often certify via AWS Cloud Practitioner or Google Cloud Digital Leader tracks.

Conclusion

The SWOT analysis of Microsoft reveals a company that is remarkably strong in its core areas, financially resilient, and strategically positioned for future growth. Its dominant market share, cloud leadership, and R&D focus place it ahead in the global tech race. However, challenges such as cybersecurity threats, regulatory scrutiny, and intense competition require continuous vigilance and innovation.

Microsoft’s ability to adapt, expand into new technologies like AI, and offer hybrid solutions will determine its relevance in the coming decade. If it continues to invest wisely and remain consumer-centric, Microsoft will not only retain its leadership position but also redefine the future of technology.

FAQs

What is the SWOT analysis of Microsoft?

SWOT analysis of Microsoft evaluates the company’s internal strengths and weaknesses, along with external opportunities and threats. It helps assess Microsoft’s market position, future potential, and strategic direction.

What are the major strengths of Microsoft?

Key strengths include a dominant OS market share, trusted global brand, strong financials, leadership in cloud computing (Azure), and a diversified product portfolio.

What are Microsoft’s weaknesses?

Microsoft weaknesses include its past failures in mobile OS, overdependence on Windows and Office, slower innovation in some areas, and recurring cybersecurity issues.

What opportunities lie ahead for Microsoft?

Opportunities include expanding into AI and cloud computing, entering emerging markets, acquiring innovative companies, and offering cybersecurity and hybrid work tools.

What are the threats to Microsoft’s growth?

Microsoft faces threats from tech competition (Apple, Google, AWS), regulatory actions, cyber threats, economic instability, and the pace of technological change.

A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.