SWOT Analysis of LG

Welcome! Today we explore the SWOT analysis of LG Company, looking closely at what drives its success and where it can improve. LG Electronics, originally founded as GoldStar in South Korea in the late 1940s, has grown into a global leader in consumer electronics, home appliances, and energy solutions. Over the decades, it has built a reputation for innovation, quality, and reliability, making it one of the most recognized brands in the tech industry.

The purpose of conducting a SWOT analysis for LG Electronics is to evaluate its internal strengths and weaknesses alongside external opportunities and threats. This approach helps us understand how the company operates in a highly competitive market and what strategies it can adopt to sustain its growth in the future. By identifying these factors, LG can leverage its advantages and address challenges to maintain its position as a market leader.

As a company that thrives on innovation, LG has continuously introduced cutting-edge technologies in televisions, smartphones, and smart home appliances. Its strong research and development capabilities allow it to stay ahead of trends and cater to changing consumer demands. At the same time, LG’s global presence in over 100 countries gives it a strong distribution network and brand visibility.

However, like any large corporation, LG also faces its share of challenges. Increasing competition from rivals such as Samsung, Sony, and emerging Chinese brands puts pressure on its market share and pricing strategies. Additionally, rapid technological changes mean LG must constantly invest in R&D to avoid falling behind. This SWOT analysis of LG provides a clear picture of where LG stands today and how it can continue to evolve in the years ahead.

Overview of LG

- Formerly Known As: Lucky-Goldstar (1983–1995)

- Company Type: Public

- Industry: Conglomerate (Consumer Electronics, Home Appliances, Chemicals, Telecommunication, Energy Solutions)

- Founded: 5 January 1947 (77 years ago)

- Founder: Koo In-hwoi

- Headquarters: Seoul, South Korea

- Area Served: Worldwide (operations in over 100 countries)

- Key Subsidiaries: LG Electronics, LG Chem, LG Display, LG Energy Solution

- Global Workforce: Over 70,000 employees

- Revenue: Over $55 billion annually (approx.)

- Core Strengths: Innovation-driven products, strong R&D, global distribution network

- Website: lgcorp.com

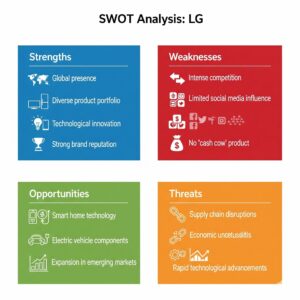

LG SWOT Analysis

Strengths

Strong brand reputation and global recognition

LG is one of those brands you’ll find in homes across the world. From India to North America, people trust it for quality and reliability. Its consistent ranking among the top global brands by Interbrand shows how deeply it has earned consumer confidence. This reputation allows LG to stand shoulder-to-shoulder with industry giants.

Example: In India, LG’s home appliances dominate urban and rural markets alike. Products like the LG 5-star refrigerators are often seen as the “go-to” option for families because of their energy savings and durability.

Diversified product portfolio

LG doesn’t put all its eggs in one basket. It has a strong presence in multiple industries – from TVs and washing machines to EV batteries and telecom displays. This wide range reduces business risk and allows it to stay stable even if one segment faces a slowdown.

Example: During the pandemic, when TV sales surged due to home entertainment demand, LG’s display panel division offset the losses in its automotive components segment.

Technological innovation

Innovation is LG’s biggest strength. It has been a pioneer in OLED TVs, advanced AI-based appliances, and futuristic concepts. At CES 2025, LG unveiled the wireless OLED evo M5 TV and ThinQ ON hub with Microsoft AI Copilot, catching global attention.

Example: The LG Styler steam closet became a hit among professionals and hotels because it refreshes clothes without water or chemicals – an innovation that solved a real-life problem of garment care.

Vertical integration and supply chain control

LG produces many of its key components through subsidiaries like LG Display. This gives it control over quality, pricing, and supply, while also reducing dependency on third parties.

Example: LG Display supplies panels not only for LG TVs but also for Apple’s iPhones and high-end laptops, showing how its vertical integration benefits both B2C and B2B markets.

Sustainability and CSR orientation

LG has made eco-friendliness part of its identity. It’s investing billions in renewable energy and sustainable manufacturing. This aligns with consumer demand for green products and builds brand goodwill.

Example: LG’s “Zero Carbon 2030” initiative has already led to solar-powered factories in South Korea, making headlines for reducing emissions by thousands of tons annually.

Weaknesses

Exit from the smartphone market

LG couldn’t sustain its smartphone business and shut it down in 2021 after years of losses. This not only meant losing a major product category but also highlighted its struggle in a highly competitive market.

Example: Even though LG introduced innovations like the LG Wing swivel-screen phone, it failed to match the marketing power of Samsung’s Galaxy series or Apple’s iPhones, leading to its exit.

Lack of a standout “hero” product

While LG is known for quality, it doesn’t have a single product that defines its brand globally. Unlike the iPhone or Samsung Galaxy, no LG product has become a cultural icon.

Example: Even though LG OLED TVs are industry-leading, they don’t have the same universal recognition as Apple’s iPhone or Dyson’s vacuum cleaners, which are synonymous with their categories.

Inconsistent marketing and limited social media presence

LG struggles to create a strong, unified marketing strategy worldwide. Its social media engagement is also weaker compared to tech rivals, especially among younger audiences.

Example: Samsung’s #DoWhatYouCant campaign went viral globally, while LG’s campaigns rarely make it to mainstream conversations on Instagram or TikTok.

Dependence on external markets

A large chunk of LG’s revenue comes from exports, making it vulnerable to trade wars, currency fluctuations, and geopolitical tensions.

Example: When the US imposed tariffs on imported steel and aluminum in 2025, LG had to shift some appliance production to Mexico to avoid cost spikes.

No major “cash cow” product line

Unlike Samsung’s Galaxy series or Sony’s PlayStation, LG lacks a consistent high-profit product that can carry the brand during tough times.

Example: LG’s TV division generates good revenue but doesn’t bring in the kind of massive profits that Samsung’s flagship phones do, which fund other innovations.

Rising costs and declining operating profit

Despite record revenues in 2024, LG’s operating profit fell by over 50% in Q4 due to rising logistics costs and weaker demand in TVs and automotive parts.

Example: Inflation-driven shipping costs in 2024 forced LG to increase prices in several markets, leading to reduced consumer demand for high-end TVs.

Opportunities

Growth in emerging markets

Markets like India, Southeast Asia, and Africa are growing rapidly, offering LG a chance to capture millions of first-time buyers. Localized pricing and products can drive deeper penetration.

Example: LG’s affordable 4K TVs and budget washing machines have seen huge success in rural India, where first-time buyers are upgrading from basic appliances.

Smart home, IoT, and AI platforms

The demand for connected devices is exploding, and LG’s ThinQ platform is well-positioned to dominate this segment. Creating an integrated smart home ecosystem can be a game-changer.

Example: LG’s InstaView fridge that suggests recipes based on what’s inside has become popular among busy urban families in South Korea and the US.

Expansion in EV components and renewable energy

With the electric vehicle revolution in full swing, LG’s focus on EV batteries and motors is a massive growth area. Renewable energy storage solutions also present huge opportunities.

Example: LG supplies batteries to Tesla’s competitors, including GM and Hyundai, making it a critical player in the EV supply chain.

Strategic collaborations and acquisitions

Partnerships with tech leaders help LG stay ahead in innovation. Its acquisitions of startups also bring in fresh ideas and technology.

Example: LG’s collaboration with Microsoft to integrate AI Copilot into home devices is expected to make their smart appliances more intuitive than competitors’.

Rising demand for sustainable solutions

Consumers want energy-efficient, eco-friendly products. LG’s green initiatives can strengthen its market position.

Example: LG’s inverter ACs that consume 40% less power are gaining popularity in hot climates like India and Southeast Asia due to both cost savings and environmental appeal.

Threats

Intense competition

LG faces stiff competition from Samsung, Sony, Haier, and aggressive Chinese brands offering similar features at lower prices.

Example: TCL’s budget 4K TVs in India and the US have eaten into LG’s market share by offering almost identical features at 20% lower prices.

Tariffs and macroeconomic volatility

Global trade policies and currency fluctuations can hit LG hard since it’s heavily export-driven.

Example: US tariffs on imported washers in 2025 forced LG to invest in US-based manufacturing to avoid losing competitiveness.

Supply chain and regulatory risks

LG’s dependence on a global supply chain exposes it to raw material shortages and compliance challenges.

Example: The 2021 chip shortage delayed LG’s TV and appliance production, directly affecting sales in key markets.

Risk of greenwashing allegations

Brands making big sustainability claims are under scrutiny. Any misstep can damage trust.

Example: LG once faced criticism for overstating the energy efficiency of some appliances in Europe, which led to tighter audits on their marketing claims.

Rapid technological evolution

Tech moves fast, and falling behind even for a year can make products obsolete.

Example: When Samsung introduced 8K TVs ahead of LG, it temporarily lost its edge in the premium TV market until it launched its own models.

Top Competitors of LG

Samsung

Why it’s a major competitor:

Samsung is LG’s biggest rival across almost every category—ranging from TVs and refrigerators to air conditioners and mobile devices. Both brands constantly compete for dominance in the global consumer electronics market.

Example:

In the TV segment, Samsung’s QN90F Mini‑LED and S95D OLED models often edge out LG’s C5 and G5 in HDR brightness, glare reduction, and gaming features. (Sources: Tom’s Guide, TechRadar)

TCL

Why it’s a major competitor:

TCL has quickly risen to become the second-largest premium smart TV brand globally by offering high-performance Mini‑LED panels at competitive prices.

Example:

The TCL QM8K Mini‑LED TV achieves over 4,400 nits of HDR brightness with superior color volume, outperforming LG’s QNED92 despite being more budget-friendly. (Sources: TechRadar, Tom’s Guide)

Hisense

Why it’s a major competitor:

Hisense delivers a diverse range of products from budget TVs to high-end ULED and Mini‑LED models. In 2023, it led the ultra‑large TV segment among OEMs.

Example:

The Hisense U8QG Mini‑LED surpasses LG’s QNED92 in peak brightness (3,900 nits vs. 1,200), wider color gamut, and price efficiency, making it a strong alternative. (Source: Tom’s Guide)

Sony

Why it’s a major competitor:

Sony dominates the premium TV segment, renowned for exceptional image processing, color accuracy, and benchmark performance.

Example:

At the Value Electronics TV Shootout, Sony’s Bravia 8 II OLED was crowned the “King of TVs,” outperforming LG’s G5, Samsung’s S95F, and Panasonic’s Z95B in overall picture quality. (Sources: Tom’s Guide, TechRadar)

Panasonic

Why it’s a major competitor:

Panasonic continues to be a strong Japanese rival, especially in TVs and home appliances, with a focus on energy efficiency and high-end audio systems.

Example:

The Panasonic Z95B OLED stood out in HDR performance at the same shootout, excelling in dynamic range and immersive sound—areas where LG sometimes trails. (Source: Tom’s Guide)

Haier

Why it’s a major competitor:

Haier dominates the global home appliance market, particularly in smart refrigerators and washing machines across Asia and Africa.

Example:

Haier led global major appliance sales for nearly a decade and continues to challenge LG in the budget to mid-tier appliance category. (Sources: Wikipedia, MBA Skool)

Whirlpool

Why it’s a major competitor:

Whirlpool is a leading North American appliance brand, directly competing with LG in washing machines, dryers, and refrigerators.

Example:

Whirlpool often tops consumer reliability ratings in the US, making it a strong rival to LG in the household appliance segment. (Source: Wikipedia)

Other Key Competitors

- Midea/Carrier‑Midea: Competes with LG in the HVAC and smart appliance markets, especially in Asia and the Middle East.

- Electrolux: Offers premium European-style washing machines and fridges.

- Philips: Competes in lighting and small appliances.

- Apple & Huawei: Once rivals in smartphones, they now dominate the market LG exited in 2021. (Sources: Marketing91, Owler, Craft.co)

Conclusion

In summary, the LG SWOT analysis highlights a company with vast global presence and strong innovation potential, yet one that must overcome certain structural challenges—especially in brand positioning and long-term profitability. By capitalizing on its strengths in OLED technology, AI-driven solutions, and sustainable initiatives, while working to resolve weaknesses such as inconsistent marketing and the lack of a true flagship product line, LG can build a stronger competitive edge for 2025 and beyond. The rising smart-home trend, expanding opportunities in emerging markets, and rapid growth in EV and energy sectors offer significant room for expansion. How effectively LG adapts to these changes will ultimately define its success in the coming decade.

At the same time, LG must focus on creating deeper customer connections and reinforcing its identity as a premium brand. Investing in strategic partnerships, enhancing user experience across product lines, and maintaining a balance between innovation and affordability will be key. With the right execution, LG has the potential not just to keep pace with industry leaders, but to shape the future of consumer electronics and sustainable technology on a global scale.

Frequently Asked Questions (FAQs)

What does the SWOT analysis of LG Electronics reveal?

It shows that LG’s biggest strengths lie in its powerful brand reputation, innovative technologies, and wide product range across home appliances, consumer electronics, and energy solutions. However, the analysis also points out weaknesses like inconsistent marketing strategies and a lack of a strong flagship identity in some product categories. Opportunities include tapping into the growing smart home market, electric vehicle components, and renewable energy. On the other hand, LG faces threats from intense global competition, fluctuating tariffs, and changing regulatory environments.

Why did LG exit the smartphone market?

LG officially pulled out of the smartphone business in 2021 after facing continuous financial losses and failing to gain market share against strong competitors like Apple, Samsung, and Chinese brands. The decision allowed LG to focus on more profitable areas like home appliances, EV components, and smart technologies.

How is LG planning its future growth?

LG is putting major investments into smart home AI platforms such as ThinQ ON, expanding its electric vehicle battery and HVAC (heating, ventilation, and air conditioning) systems, and moving deeper into renewable energy. They are also forming key partnerships with tech giants like Microsoft to strengthen their IoT and AI ecosystems.

Is LG’s brand strong in emerging markets?

Yes, LG has built a solid reputation in emerging markets. For example, in India, LG is one of the top players in home appliances and consumer electronics, known for its quality products and reliable after-sales service, even in smaller towns and rural areas.

What are LG’s biggest strengths in the market?

LG’s global brand recognition, diversified product portfolio, strong R&D capabilities, and customer trust are its core strengths. Its ability to innovate in multiple segments, from TVs to energy solutions, also gives it a competitive edge.

What weaknesses does LG need to address?

LG needs to work on building stronger flagship products, improving its marketing consistency across regions, and reducing dependency on certain product segments. The company also faces challenges in maintaining profitability in highly competitive sectors.

What opportunities can LG leverage in the coming years?

LG can capitalize on the booming smart home and IoT market, the rising demand for EV components, and the global shift towards renewable energy solutions. Expanding AI integration in home and industrial products also opens up huge potential.

What are the major threats to LG’s business?

The biggest threats include stiff competition from global and regional brands, rapid technological changes, price wars, fluctuating trade tariffs, and strict environmental regulations in various countries.

Who is LG’s biggest overall competitor?

Samsung remains LG’s closest and most comprehensive rival, competing across TVs, displays, appliances, and formerly smartphones.

How does LG differentiate itself from competitors like Samsung or Sony?

LG focuses on combining innovation with value. Products like their OLED TVs, energy-efficient home appliances, and ThinQ AI ecosystem highlight their ability to deliver cutting-edge technology while maintaining accessibility in different price ranges. A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.