L’Oréal is a name synonymous with beauty, luxury, and innovation. As one of the largest cosmetics and personal care companies in the world, L’Oréal has remained a trendsetter in the beauty industry for over a century. With iconic slogans like “Because You’re Worth It,” the brand has resonated with millions across the globe.

In an ever-evolving and competitive market, understanding the internal strengths and weaknesses of a company along with the external opportunities and threats is essential. That is where strategic tools like SWOT analysis come into play.

A L’Oréal SWOT Analysis offers a clear snapshot of the company’s internal strengths and weaknesses while identifying the external opportunities and threats it faces. This strategic tool helps stakeholders, investors, marketers, and students evaluate how L’Oréal maintains its competitive edge in a fiercely dynamic industry.

In this blog, we delve deep into the SWOT analysis of L’Oréal, examining how the brand has navigated global challenges, maintained its industry leadership, and how it plans to sustain its position in a market with fierce L’Oréal competitors like Estée Lauder, Unilever, and Procter & Gamble.

Company Overview

- Founded: 1909 by Eugène Schueller, a French chemist

- Headquarters: Clichy, Hauts-de-Seine, France

- Industry: Cosmetics, Skincare, Haircare, and Personal Care

- Global Presence: Operates in over 150 countries

From its humble beginnings, L’Oréal has grown into a global powerhouse, employing over 88,000 people and owning more than 35 international beauty brands. It caters to every price point—from affordable drugstore items to ultra-luxurious skincare lines.

Brand Portfolio Highlights:

- Mass Market: L’Oréal Paris, Garnier, Maybelline New York

- Premium: Lancôme, Yves Saint Laurent Beauty, Giorgio Armani Beauty

- Professional: L’Oréal Professionnel, Kérastase

- Dermocosmetics: La Roche-Posay, Vichy

L’Oréal’s commitment to innovation and its ability to anticipate trends have allowed it to dominate key markets including Europe, North America, and increasingly, Asia-Pacific.

What is SWOT Analysis?

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It is a strategic planning technique that helps organizations identify both internal and external factors that could impact their performance and decision-making.

- Strengths and Weaknesses are internal factors.

- Opportunities and Threats arise from the external environment.

Purpose of SWOT Analysis:

- Helps companies understand their current market standing

- Identifies areas of competitive advantage and areas needing improvement

- Provides a roadmap for future strategic planning

For a company like L’Oréal, a SWOT analysis helps pinpoint where the brand excels, where it lags behind, and how it can better respond to evolving industry trends and L’Oréal competitors.

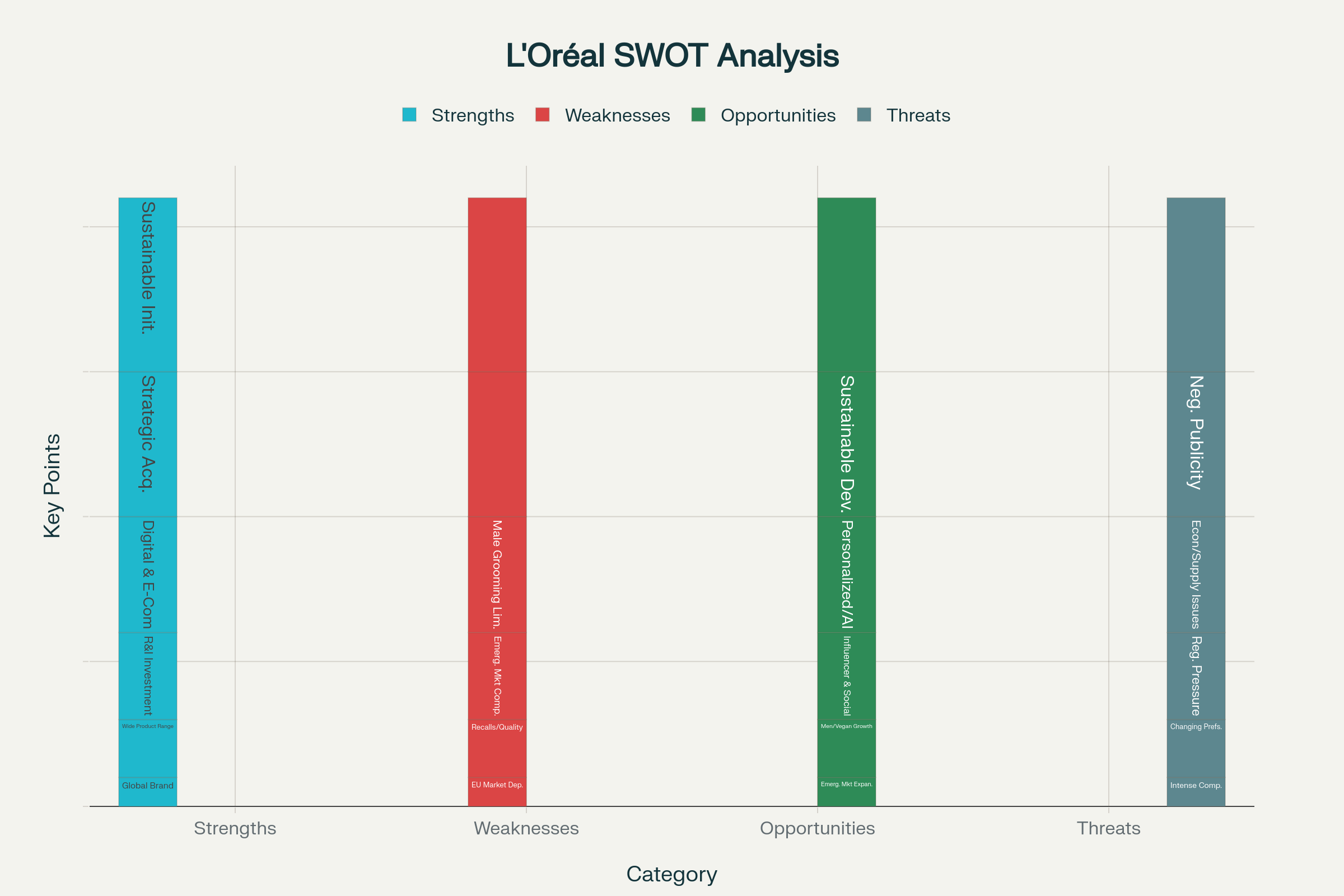

Strengths of L’Oréal

Strong Global Brand Recognition and Heritage

L’Oréal stands as one of the most recognizable names in the beauty industry, built over more than 110 years. Its iconic slogan “Because you’re worth it” has become more than a tagline—it’s a declaration of self-worth. The brand’s long-standing history gives it unmatched authenticity, trust, and emotional connection with consumers globally.

Example:

In 2023, L’Oréal was ranked the world’s most valuable cosmetics brand by Brand Finance, ahead of Estée Lauder and Nivea.

Diverse and Wide-Ranging Product Portfolio

L’Oréal caters to all beauty needs—be it skincare, haircare, cosmetics, or fragrances—across different income groups and age brackets. This variety helps stabilize revenue even when one product segment underperforms.

Example:

During the COVID-19 pandemic, while makeup sales declined, L’Oréal’s skincare brands like CeraVe and La Roche-Posay saw double-digit growth due to increased focus on skin health.

High Investment in Research & Innovation

Innovation is at L’Oréal’s core. The brand operates 21 research centers across 11 countries and invests heavily in developing new technologies. From AI-driven personalization to dermatological research, L’Oréal constantly pushes the boundaries.

Example:

L’Oréal’s “Perso” device uses AI to customize skincare and lipstick based on real-time environmental data and skin analysis.

It also launched the “My Skin Track UV” – the first battery-free wearable UV sensor.

Strong Digital Presence and E-Commerce Channels

L’Oréal has embraced digital transformation with agility. Through AR, AI, and influencer marketing, the brand offers an immersive and personalized online shopping experience.

Example:

L’Oréal’s ModiFace lets users virtually try on makeup using augmented reality across apps like Amazon, Instagram, and its own e-commerce platforms.

In China, L’Oréal collaborates with beauty influencers on Douyin (TikTok China) to reach millions of Gen Z users.

Strategic Acquisitions and Brand Collaborations

L’Oréal expands its global presence by acquiring high-potential brands and collaborating with influencers and celebrities. This strategy allows it to penetrate niche markets and stay relevant to evolving trends.

Example:

The acquisition of brands like NYX (youth-focused), CeraVe (dermatology-based skincare), and IT Cosmetics (influencer-driven) helped L’Oréal tap into new customer segments and grow faster in North America.

Sustainability Initiatives and Ethical Practices

Under its “L’Oréal for the Future” program, the brand has made bold environmental commitments. From climate action to sustainable packaging and social inclusion, L’Oréal aims to lead by example.

Example:

L’Oréal has pledged to achieve carbon neutrality across all sites by 2025 and uses 100% recyclable packaging for brands like Garnier.

In India, L’Oréal supports women entrepreneurs through its “Beauty for a Better Life” initiative.

Weaknesses of L’Oréal

Overdependence on the European Market

Despite being a global player, a significant portion of L’Oréal’s revenue still comes from Europe. This creates vulnerability to regulatory shifts, inflation, or political instability within the EU zone.

Example:

In 2022, Europe accounted for over 30% of L’Oréal’s global sales. Any economic downturn in key countries like France, Germany, or the UK could impact overall profitability.

Product Recalls and Quality Concerns

Although infrequent, product recalls can damage consumer trust and brand image. These incidents also highlight the need for tighter quality control, especially in global supply chains.

Example:

In 2017, Garnier Fructis shampoo was recalled in multiple markets due to ingredient discrepancies. Though handled quickly, such recalls can affect customer confidence.

High Competition in Emerging Markets

In developing countries, L’Oréal often struggles to compete with local brands offering similar products at much lower prices. These regional players understand local preferences better and may offer more customized solutions.

Example:

In India, brands like Himalaya and Patanjali offer herbal beauty products at competitive prices, giving L’Oréal tough competition in rural and price-sensitive urban segments.

Limited Success in Male Grooming Market

While L’Oréal has tried to enter the male grooming segment, it hasn’t achieved dominant market share. Established brands already have deep-rooted presence and brand loyalty among men.

Example:

Despite launching Men Expert, L’Oréal lags behind rivals like Gillette, Nivea Men, and Beardo in countries like India and Brazil, where male grooming is a growing trend.

Opportunities for L’Oréal

Expansion into Emerging Markets

The beauty industry is witnessing rapid growth in emerging markets like India, Nigeria, Vietnam, and Brazil, where rising middle-class income and increasing beauty awareness are fueling demand. These regions are no longer passive markets—they actively seek global brands with local relevance. L’Oréal’s strategy of tailoring products to suit local needs gives it a competitive advantage.

Example:

L’Oréal invested ₹1,100 crore in India to set up its largest manufacturing plant in Pune, making the country a global export hub. In China, the brand’s Magic Retouch became a bestseller, thanks to its appeal to local haircare needs.

Growth in Men’s Grooming and Vegan Beauty Products

The traditional gender divide in beauty is shrinking. Men are investing more in skincare and grooming, while consumers across genders are choosing vegan, cruelty-free, and ethical products. This is not a fad—it’s a shift in values.

Example:

L’Oréal’s Barber Club range, under L’Oréal Men Expert, specifically targets bearded men, while the brand Garnier is now officially cruelty-free certified by Cruelty Free International—a move widely applauded by conscious buyers.

Rise of Influencer Marketing and Social Commerce

With the boom of platforms like Instagram, TikTok, and YouTube, influencer marketing has become a game-changer. L’Oréal has leveraged both macro-influencers and micro-creators to reach Gen Z and millennials directly, making brand interactions more relatable and real.

Example:

The brand’s #WorthIt campaign featured diverse influencers like Leila Bekhti and Aja Naomi King, promoting self-worth and inclusivity. On TikTok, L’Oréal’s partnership with creators like Meredith Duxbury helped boost sales of their Infallible foundation.

Personalized Beauty and AI-driven Skincare Solutions

Consumers today don’t want a “one-size-fits-all” approach. They expect skincare tailored to their unique skin tone, type, and issues. L’Oréal has pioneered this trend using AI and machine learning.

Example:

SkinConsultAI, developed in partnership with dermatologists, scans selfies to assess skin age and offer recommendations. Similarly, ModiFace powers AR try-ons for makeup and hair color, allowing customers to virtually test products before buying.

Green and Sustainable Product Development

Sustainability is no longer optional. Consumers are making buying decisions based on packaging, sourcing, and carbon footprint. L’Oréal is responding with eco-designed products and greener manufacturing.

Example:

The Elvive Dream Lengths No Haircut Cream is packaged with recycled plastic, and Garnier’s solid shampoo bars reduce plastic waste by 80%. L’Oréal’s “For the Future” program pledges carbon neutrality for all sites by 2025.

Threats to L’Oréal

Intense Competition from Global and Local Brands

The beauty industry is one of the most saturated markets, with established giants like Estée Lauder, Unilever, and Procter & Gamble alongside niche local brands offering clean, artisanal, or culturally rooted alternatives.

Example:

In India, Mamaearth and Forest Essentials are fast capturing market share with their ayurvedic and toxin-free promise. In Korea, Amorepacific dominates with K-beauty innovations, forcing global players like L’Oréal to constantly innovate.

Changing Consumer Preferences

Today’s beauty consumers are informed and skeptical. They demand transparency, prefer minimalist routines, and expect clean, safe ingredients. Traditional formulations can feel outdated if not adapted quickly.

Example:

When parabens and sulfates were found in shampoos, many consumers shifted to cleaner options. Brands like The Ordinary (minimalist and ingredient-led) gained cult status, while L’Oréal had to reformulate many of its lines to meet these expectations.

Regulatory Pressures and Evolving Cosmetic Laws

Global operations mean navigating multiple and often conflicting regulations. Laws on animal testing, banned ingredients, and labelling are complex and can delay product rollouts or even force reformulations.

Example:

L’Oréal had to alter its testing strategies in China, where animal testing was once mandatory. In the EU, strict REACH regulations banned certain synthetic chemicals, leading to reformulation of some L’Oréal products.

Global Economic Uncertainties and Supply Chain Issues

Geopolitical tensions, pandemics, and economic instability affect raw material sourcing, manufacturing, and distribution. Even luxury brands are not immune to these disruptions.

Example:

During COVID-19, L’Oréal faced packaging delays and raw material shortages. Similarly, the Russia-Ukraine war disrupted supply chains in Eastern Europe, leading to increased costs and delayed launches.

Negative Publicity or Social Media Backlash

With the speed of digital communication, one wrong statement or campaign can trigger a global PR crisis. The beauty of social media reach is matched by the risk of backlash.

Example:

In 2020, L’Oréal was criticized after dropping model Munroe Bergdorf, leading to accusations of performative activism during the Black Lives Matter movement. The brand later re-engaged with her, but not before facing widespread criticism online.

Top Competitors of L’Oréal

L’Oréal may be a global beauty giant, but it operates in a fiercely competitive industry. From premium brands to affordable local players, the company faces challenges from all sides. Here’s a detailed look at its key competitors across various segments:

Estée Lauder Companies

Estée Lauder is one of L’Oréal’s most direct global competitors, especially in the prestige beauty category. Known for its high-end skincare, makeup, and fragrance lines, Estée Lauder has a strong presence in department stores and luxury retail outlets worldwide.

Example:

Brands like Estée Lauder, MAC, Clinique, Bobbi Brown, and La Mer directly compete with L’Oréal’s Lancôme, Yves Saint Laurent Beauty, and Kiehl’s.

Estée Lauder has also embraced digital growth and influencer collaborations, similar to L’Oréal’s marketing strategy.

Unilever

Unilever is a major player in the mass-market personal care segment. With a wide range of skincare and haircare products, it competes with L’Oréal in price-sensitive markets.

Example:

Brands like Dove, Tresemmé, Sunsilk, and Pond’s challenge L’Oréal Paris and Garnier in markets like India, Southeast Asia, and Latin America.

Unilever’s focus on sustainable beauty and ethical sourcing also mirrors L’Oréal’s green initiatives.

Procter & Gamble (P&G)

While P&G is more famous for household and hygiene products, its beauty division is a strong rival in haircare and grooming.

Example:

Pantene and Head & Shoulders compete directly with L’Oréal Paris, Elvive, and Garnier in the global shampoo and conditioner market.

Olay also competes with L’Oréal’s skincare brands like Revitalift and Age Perfect.

P&G’s pricing strategy and global reach make it a powerful competitor in both developed and emerging markets.

Shiseido

This Japanese multinational is a formidable competitor in the luxury beauty and skincare space, particularly across Asia.

Example:

Shiseido’s prestige skincare line and brands like NARS, Clé de Peau Beauté, and Anessa compete with L’Oréal’s luxury division in Asian and global markets.

Shiseido also invests heavily in research and innovation, creating a tech-driven edge similar to L’Oréal.

Coty Inc.

Coty is a major player in fragrance, makeup, and professional beauty. It owns and manages an extensive portfolio of brands, including celebrity and designer lines.

Example:

Brands like Rimmel, Max Factor, and CoverGirl compete with L’Oréal Paris and Maybelline in drugstore makeup.

Fragrance lines from Calvin Klein, Marc Jacobs, and Gucci rival L’Oréal’s designer perfumes.

Coty’s collaborations with influencers and celebrities make it a growing digital rival.

Revlon

Although smaller in scale, Revlon remains a significant competitor in the affordable cosmetics segment, particularly in North America and parts of Europe.

Example:

Revlon’s lipstick and foundation ranges directly challenge Maybelline and L’Oréal Paris products in the drugstore beauty category.

Revlon’s strength lies in nostalgia and brand familiarity, though it has struggled in recent years with innovation and digital presence.

Beiersdorf

The German company behind Nivea, Beiersdorf is a direct rival in skincare and body care, especially in mid-range mass markets.

Example:

Nivea’s moisturizers, creams, and men’s grooming products compete with Garnier and L’Oréal Men Expert in Europe, Asia, and Africa.

Its strong foothold in male skincare gives it a distinct competitive advantage where L’Oréal is still catching up.

Johnson & Johnson (Now Kenvue)

While Johnson & Johnson recently spun off its consumer health business into Kenvue, it remains a major competitor in the dermatological skincare space.

Example:

Brands like Neutrogena and Aveeno rival L’Oréal-owned La Roche-Posay and CeraVe in dermatology-recommended skincare.

Kenvue’s focus on science-backed skincare mirrors L’Oréal’s clinical positioning in certain segments.

Amorepacific

A key Asian beauty competitor, especially in South Korea and China, Amorepacific is gaining international traction with K-beauty trends.

Example:

Its brands like Laneige, Innisfree, and Sulwhasoo challenge L’Oréal’s skincare dominance in Asia and appeal to global Gen Z audiences.

With a strong digital and influencer strategy, Amorepacific is rapidly scaling beyond Asia.

Local & Indie Brands

In addition to global giants, L’Oréal also faces increasing competition from local brands and indie startups that are quick to innovate and align with consumer trends such as vegan, organic, or cruelty-free products.

Example:

In India, brands like Mamaearth and Forest Essentials are popular among millennial consumers.

In the US, indie brands like The Ordinary and Glossier are gaining traction with their minimalist, transparent marketing—posing a direct challenge to traditional legacy brands like L’Oréal.

Conclusion

The SWOT analysis of L’Oréal reveals a brand built on innovation, diversity, and global appeal. While it faces challenges in terms of competition, changing consumer behavior, and regional dependencies, L’Oréal’s proactive strategies in sustainability, digital transformation, and R&D set it apart.

As the world changes, L’Oréal continues to evolve, proving time and again why it remains a leader in beauty. With a keen eye on trends and a deep commitment to quality and innovation, the brand is well-positioned to continue its legacy.

FAQs

What are L’Oréal’s biggest strengths?

L’Oréal’s biggest strengths include its global brand reputation, diverse product portfolio, strong digital presence, and commitment to innovation and sustainability.

How is L’Oréal addressing sustainability?

Through the “L’Oréal for the Future” initiative, the company aims to reduce carbon emissions, implement eco-friendly packaging, and promote water and energy conservation.

Which markets are key for L’Oréal’s future growth?

Emerging markets like India, China, Brazil, and several African nations are critical to L’Oréal’s future expansion and revenue growth.

What are L’Oréal’s major weaknesses?

L’Oréal faces challenges such as overdependence on the European market, occasional product recalls, price competition from regional brands, and limited success in the male grooming segment.

How does L’Oréal stay ahead of its competitors?

L’Oréal invests heavily in research and development, adopts advanced digital marketing strategies, collaborates with influencers, and frequently acquires niche brands to stay competitive and trend-relevant.

What opportunities can L’Oréal leverage in the future?

L’Oréal can expand further into the men’s grooming segment, increase focus on personalized beauty solutions through AI, and tap into the rising demand for organic and cruelty-free products.

What threats does L’Oréal face in the global market?

Key threats include economic instability in Europe, growing competition from local and digital-first beauty brands, shifting consumer preferences toward sustainable and ethical products, and global supply chain disruptions.

Has L’Oréal successfully embraced digital transformation?

Yes, L’Oréal has integrated AR-powered virtual try-ons, influencer marketing, e-commerce expansion, and AI tools for skin analysis, making it a front-runner in digital beauty innovation.

A passionate blogger and digital marketer, specializing in creating engaging content and implementing result-driven marketing strategies. She is dedicated to helping brands grow their online presence and connect with their audience effectively.