SWOT Analysis of Tata Steel (Updated 2026)

Tata Steel is not just a company — it’s the backbone of India’s industrial journey. Founded in 1907 by the visionary Jamsetji Tata, it became Asia’s first integrated private steel company and has since grown into one of the top global steel producers. With operations in over 100 countries and manufacturing units spread across 26 nations, Tata Steel has shaped industries, empowered infrastructure, and contributed to nation-building for over 116 years.

From the steel rails that powered India’s first railway lines to the cutting-edge alloys used in today’s electric vehicles, Tata Steel has been part of every chapter in the country’s development story. In FY 2024, despite global economic fluctuations, Tata Steel generated a revenue of ₹2.3 lakh crore (US$28 billion), solidifying its position as a global steel powerhouse.

But in a world of rising competition, digital disruption, and evolving sustainability norms, even industrial legends need strategic clarity. That’s where a SWOT analysis of Tata Steel becomes vital. It uncovers the company’s Strengths, Weaknesses, Opportunities, and Threats, offering a crystal-clear view of where Tata Steel stands in 2026 — and where it’s headed.

This detailed analysis dives deep into Tata Steel’s business model, market performance, global presence, innovation journey, and risk profile — giving you a 360° view of one of India’s most trusted and transformative enterprises.

Company Overview

| Founder | Jamsetji Tata and Dorabji Tata

|

| Founding Date | August 26, 1907

|

| Origin | Jamshedpur, Jharkhand, India |

| Headquarters | Mumbai, Maharashtra, India |

| Present CEO & MD | T. V. Narendran

|

| Type of Company | Public |

| Number of Employees | 77,000+ |

| Annual Revenue (as of FY24) | US$28 billion |

| Net Profit (as of FY24) | US$−590 million |

| Total assets (as of FY24) | US$33 billion |

Tata Steel, a flagship company of the prestigious Tata Group, is a century-old pioneer in the global steel industry. Known for its resilience, innovation, and ethical business practices, the company has left a strong imprint in both domestic and international markets. Here’s a detailed snapshot of Tata Steel’s foundation, leadership, operations, and financial standing as of 2024:

Founding Date: August 26, 1907

Founders: Jamsetji Tata and Dorabji Tata

Place of Origin: Jamshedpur, Jharkhand, India

Headquarters: Mumbai, Maharashtra, India

Parent Organization: Tata Group – One of India’s largest and most respected business conglomerates spanning technology, automotive, chemicals, and consumer services

Global Reach and Presence

- Operational Presence: Active in over 26 countries with manufacturing and mining operations

- Commercial Footprint: Presence in more than 50 nations

- Global Recognition: One of the world’s most geographically diversified steel producers

Key Leadership (as of FY 2024)

- Chairman: Natarajan Chandrasekaran

- Vice Chairman: Noel Tata

- CEO & Managing Director: T. V. Narendran

Financial Snapshot (FY 2024)

- Revenue: ₹230,980 crore (approximately US$28 billion)

- Operating Income: ₹6,667 crore (approximately US$800 million)

- Net Income: ₹-4,910 crore (approximately US$-590 million)

- Total Assets: ₹273,424 crore (approximately US$33 billion)

- Total Equity: ₹92,433 crore (approximately US$11 billion)

Workforce and Strength

- Number of Employees: Over 77,000 professionals globally

- Years of Legacy: 116+ years of industrial leadership and innovation

Backed by the unwavering values of the Tata brand—trust, sustainability, and excellence—Tata Steel continues to be a benchmark in the global steel industry, serving key sectors like infrastructure, automotive, construction, and engineering with high-performance steel solutions.

Products and Markets

Tata Steel’s impressive product portfolio and broad market coverage are central to its position as one of the world’s leading steel manufacturers. The company doesn’t just produce steel — it shapes infrastructure, powers industries, and supports everyday life across the globe.

Core Product Categories

Tata Steel offers an extensive range of high-quality steel products to serve various sectors:

- Flat Steel – Used widely in automotive panels, appliances, and shipbuilding.

- Long Steel Products – Essential for construction beams, bars, and structural applications.

- Structural Steel – Supports heavy infrastructure like bridges, buildings, and industrial complexes.

- Wire Products – Includes wires for electrical and construction uses.

- Steel Casing Pipes – Applied in the oil, gas, and water industries for high-pressure fluid transport.

- Household Steel Goods – Steel-based kitchenware, storage items, and utility products for home use.

These products are engineered to match industry-specific needs, ensuring durability, strength, and performance.

Industries Served

Tata Steel’s multi-industry focus showcases its adaptability and relevance across economic sectors:

- Automotive Industry

– Supplies advanced high-strength steel to car manufacturers like Tata Motors, improving vehicle safety and fuel efficiency. - Construction & Infrastructure

– Tata Steel is a key contributor to India’s metro rail projects, flyovers, and smart city initiatives, offering pre-engineered building solutions and construction-grade steel. - Agriculture

– Under the Tata Agrico brand, the company manufactures high-quality steel tools and implements that support farming and irrigation systems. - Consumer Goods

– Provides steel to make durable kitchenware, utensils, and steel storage systems commonly used in Indian households. - Energy & Power

– Offers steel pipes, transmission towers, and structures vital for the oil, gas, wind, and power industries. - Engineering & Industrial Equipment

– Manufactures precision steel parts and components used in heavy machinery, mining, and industrial equipment.

Market Presence and Global Footprint

Tata Steel’s geographical spread reinforces its brand’s strength and stability:

- Production and mining operations in over 26 countries, including:

- India

- United Kingdom

- Vietnam

- Mozambique

- Australia

- The Netherlands

- Sales and distribution networks span across 50+ countries, making Tata Steel a truly global entity.

Strategic Expansion

A major turning point in Tata Steel’s global journey was its 2007 acquisition of Corus, a British-Dutch steel company. This move made Tata Steel one of the top global steel players, significantly expanding its capacity, reach, and customer base in Europe.

Live Example:

Tata Steel UK, formerly Corus, supplies premium steel solutions to sectors like aerospace and construction. Its Colorcoat brand is widely used in roofing and cladding for commercial buildings across Europe, known for aesthetic appeal and longevity.

Major Competitors

Tata Steel operates in a highly competitive landscape. Some of its primary rivals include:

- ArcelorMittal – The world’s largest steel producer.

- JSW Steel – A major domestic competitor with aggressive capacity expansion.

- SAIL (Steel Authority of India Ltd.) – A government-owned steelmaker.

- Essar Steel – Focused on integrated steel production.

- Jindal Steel and Power – Known for forward and backward integration.

- VISA Steel – A niche player with strong ferroalloy offerings.

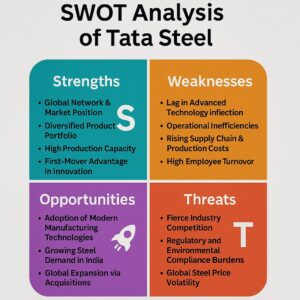

SWOT Analysis of Tata Steel

Strengths

Global Network & Market Position

Tata Steel operates across six continents and exports to over 100 countries. Its European arm, Tata Steel Europe, positions it among the world’s most geographically diversified steel producers.

Example: During the COVID-19 pandemic, Tata Steel’s diverse manufacturing footprint helped mitigate supply chain disruptions.

Diversified Product Portfolio

From value-added steel used in luxury cars to low-carbon structural steel for green buildings, Tata Steel offers solutions across the board. This product diversification helps minimize risk and ensures consistent revenue streams.

High Production Capacity

The Jamshedpur plant alone produces over 10 million tonnes of steel annually. Tata Steel’s annual crude steel capacity stands at 34 million tonnes.

First-Mover Advantage in Innovation

Tata Steel was the first Indian company to introduce green steel through hydrogen-based steelmaking trials in the Netherlands in 2022.

Live Example: The use of Graphene in its products has opened up applications in aerospace and electronics.

Strong Brand Equity of Tata

The Tata name is associated with trust, quality, and ethical business practices. Tata Steel continues to leverage this goodwill globally.

Integrated Operations in India

Tata Steel’s captive iron ore and coal mines ensure a steady supply of raw materials, giving it cost and quality control benefits. The Kalinganagar plant in Odisha is a prime example of integration and scale.

Financial Diversification

Beyond steel, Tata Steel also has strategic investments in mining, energy, and logistics, reducing its dependency on a single sector.

Weaknesses

Lag in Advanced Technology Adoption

Compared to ArcelorMittal or Baosteel, Tata Steel has been slower in automating production and integrating AI into manufacturing.

Operational Inefficiencies

Disjointed operations, especially in Europe, lead to higher per-unit costs and reduced synergies.

Example: Tata Steel Europe has struggled to match the profitability of its Indian counterpart due to outdated plants and high energy costs.

Rising Supply Chain & Production Costs

Fluctuations in coking coal prices and logistical bottlenecks in India increase production costs.

High Employee Turnover

At lower operational levels, Tata Steel sees a high attrition rate, which affects productivity and increases recruitment/training expenses.

Eroding Market Share

Despite its legacy, Tata Steel’s market share in India is under pressure from JSW Steel and international players entering India through partnerships.

Post-Acquisition Challenges

The Corus acquisition in 2007 is a classic example. Despite expectations, integration was plagued with operational mismatches and financial burden.

Real Incident: Tata Steel had to write off massive amounts from its balance sheet due to underperformance in its UK operations, prompting major restructuring.

Opportunities

Adoption of Modern Manufacturing Technologies

Tata Steel can implement the Cortex process, Hismelt, and direct smelting to reduce emissions and improve production efficiency.

Growing Steel Demand in India

India’s push for smart cities, housing for all, and infrastructure development under PM Gati Shakti Yojana will fuel steel demand.

Example: The upcoming Mumbai-Ahmedabad bullet train project and metro rail expansion plans are major steel-intensive ventures.

Global Expansion via Acquisitions

Tata Steel has already ventured into Vietnam, Thailand, and Mozambique. Africa remains a ripe continent for future expansion.

Strategic Partnerships & Joint Ventures

Collaborations with tech companies can drive innovation. For example, partnering with Siemens for smart steel plant technology.

Digital Transformation & Online Platforms

E-commerce for steel products (via platforms like Aashiyana by Tata Steel) enables B2C engagement and a new revenue stream.

Regulatory Shifts Favoring Organized Players

Government clampdown on pollution and unlicensed operations will benefit Tata Steel as a compliant and sustainable enterprise.

Threats

Fierce Industry Competition

With JSW Steel aiming to surpass Tata in crude steel capacity, and ArcelorMittal-Nippon India becoming aggressive, market competition is intense.

Regulatory and Environmental Compliance Burdens

Steelmaking is carbon-intensive. Regulations on emissions and mining restrictions could strain margins.

Example: The European Green Deal requires steep carbon emission cuts, impacting Tata Steel Europe’s operations.

Global Steel Price Volatility

Overcapacity in China continues to create pricing pressure globally. This impacts Tata Steel’s profitability in export markets.

Risk of Business Model Imitation

Competitors can replicate Tata Steel’s models of integration, digital commerce, and sustainability without the legacy burden.

Demographic Shifts in Consumer Behavior

Young consumers prioritize sustainable brands. Tata Steel needs continuous innovation to stay relevant for newer market expectations.

Skilled Labor Shortage

AI and robotics in manufacturing demand specialized skills. A lack of talent may hinder future operational goals.

Market Saturation

Urban areas are becoming saturated; rural demand for steel remains underdeveloped due to poor infrastructure.

IPR Risks in Foreign Markets

Operating in countries with weak intellectual property rights, such as China or certain African nations, poses a risk to Tata Steel’s proprietary technology.

Conclusion

Tata Steel is a trailblazer in the global steel industry. Despite operational and technological challenges, the company remains a key player due to its diversified portfolio, strong brand equity, and integrated value chain.

To future-proof its leadership:

- It must fast-track technological upgrades.

- Continue focusing on sustainable manufacturing.

- Expand further into emerging markets.

With visionary leadership, a robust legacy, and the adaptability to embrace future trends, Tata Steel is well-positioned to shape the global steel narrative.

FAQs: SWOT Analysis of Tata Steel

Q1. What is the SWOT analysis of Tata Steel?

The SWOT analysis of Tata Steel examines its Strengths (e.g., global reach, product range), Weaknesses (e.g., tech lag, high costs), Opportunities (e.g., growing demand, tech upgrades), and Threats (e.g., competition, price volatility).

Q2. What are the strengths of Tata Steel?

Tata Steel’s strengths include its integrated operations, diverse portfolio, brand trust, global reach, and high production capacity.

Q3. What are the key weaknesses in Tata Steel’s operations?

Some weaknesses include delayed tech adoption, high employee turnover, inefficiencies in European operations, and cost pressures.

Q4. What opportunities does Tata Steel have in the future?

Opportunities lie in Indian infrastructure growth, adoption of green steel technologies, global expansion, and digital platforms.

Q5. Who are the main competitors of Tata Steel?

Key competitors include JSW Steel, SAIL, ArcelorMittal, Jindal Steel, and Essar Steel.

Q6. How does Tata Steel deal with threats?

Tata Steel counters threats through innovation, sustainability initiatives, strategic partnerships, and market diversification.

Q7.How is Tata Steel positioned in the global steel market?

Tata Steel is one of the world’s most diversified steel producers, with operations across six continents and a significant footprint in both emerging and developed markets.

Q8. What are the main threats faced by Tata Steel?

Major threats include global price volatility, regulatory compliance costs, competition, and skilled labor shortages.

Q9. How does Tata Steel benefit from the Tata Group brand?

Being part of the Tata Group provides Tata Steel with unmatched brand equity, trust, and customer loyalty, both in India and abroad.