SWOT Analysis of Nivea

When it comes to skincare, few brands enjoy the universal trust and recognition that Nivea does. Known for its iconic blue and white packaging, Nivea has become a household name across generations. Millions around the world use its creams, lotions, and body care products daily. But behind this global success lies a story of strategy, challenges, and opportunities. This is where the SWOT analysis of Nivea comes into play—helping us understand the strengths, weaknesses, opportunities, and threats that shape the brand’s journey in the ever-evolving skincare industry.

In this blog, we’ll explore Nivea’s history, its market strategies, key challenges, controversies, and its competitors, while diving deep into a detailed Nivea SWOT analysis.nivea net worth

About Nivea

Before diving into the SWOT framework, let’s take a step back and look at the origins of this global skincare legend.

Owned by the German company Beiersdorf AG, Nivea is today one of the world’s most loved and trusted personal care brands. But its story began over a century ago, in 1911, when it introduced something that would change skincare forever—Nivea Creme, the world’s first stable oil-and-water-based moisturizing cream.

The breakthrough came thanks to Dr. Isaac Lifschütz, who developed Eucerit—an emulsifying agent that made it possible to create a cream both smooth and long-lasting. Alongside dermatologist Dr. Paul Gerson Unna and entrepreneur Oscar Troplowitz, the team laid the foundation of a product that soon became a household essential.

Interestingly, the name Nivea comes from the Latin word nix, nivis, meaning snow, inspired by the cream’s pure white color. While the formula of the classic cream has remained almost unchanged for over 100 years, the packaging has seen many transformations. Yet one thing stayed consistent—the iconic deep blue tin, which has now become a symbol of trust, care, and timeless identity across the globe.

From that single moisturizing cream, Nivea gradually expanded its portfolio—launching sunscreens, deodorants, body lotions, lip balms, men’s grooming products, and even a dedicated line for babies. Today, it operates in 50+ countries, making it a go-to skincare companion for millions of families worldwide.

According to recent reports, Nivea’s brand value stands at over $6.4 billion, underlining its position as one of the most valuable and recognizable skincare names in the industry.

Brand Identity & Target Audience

Nivea has always positioned itself as a family brand—gentle, reliable, and safe for all ages. Its philosophy revolves around “care for skin, care for life”, ensuring products are dermatologically tested and suitable for everyday use. The brand appeals to men, women, and children alike, with specialized sub-brands such as Nivea Men and Nivea Baby catering to specific needs.

Recent Update

Strengthening its presence in India—a rapidly growing skincare market—Nivea appointed Geetika Mehta as the Managing Director of Nivea India in 2023. This move reflects the company’s focus on expanding in high-potential regions where demand for personal care is rising.

Quick Stats about Nivea

| Parent Company | Beiersdorf AG |

| Category | Personal Care |

| Sector | Fast Moving Consumer Goods (FMCG) |

| Year Founded | 1911 |

| Founder of nivea | Dr. Oscar Troplowitz (with contributions from Dr. Isaac Lifschütz & Dr. Paul Gerson Unna) |

| Origin Country | Germany |

| Headquarters | Hamburg, Germany |

| Company Type | Public |

| Brand Value | 6.6 billion U.S. dollars (as of recent estimates) |

| Website | nivea.com |

| Nivea’s Segmentation | People who are into skincare |

| Nivea’s Targeting | Middle-class and upper middle-class consumers worldwide |

| Nivea’s Positioning | Positioned as a “Gentle Care” and “Wellness” brand |

| Global Presence | Available in 50+ countries worldwide |

| Tagline | “Care for skin, care for life” |

| Recent Leadership Update | Geetika Mehta appointed as MD of Nivea India (2023) |

| Sustainability Efforts | Commitment to eco-friendly packaging and reducing CO₂ emissions |

| Product Range | Creams, lotions, deodorants, lip care, men’s grooming, sun care, baby care |

| Customer Base | Trusted by millions of families across generations |

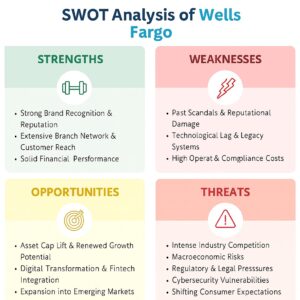

Nivea SWOT Analysis

Let’s break down the SWOT analysis of Nivea into strengths, weaknesses, opportunities, and threats.

Strengths of Nivea

Market Leader in Cold Cream Industry

Nivea has become almost a household synonym for cold cream. For decades, especially in countries like India, Germany, and the UK, people have relied on Nivea cream as their go-to solution for dry and chapped skin during winters.

Example: In India, during peak winters in North India, families often stock up on the classic Nivea blue tin. It is still one of the first creams mothers recommend to children for cracked heels or dry cheeks.

Umbrella Brand with Diverse Products

Over the years, Nivea has moved far beyond its iconic cream and successfully diversified into lotions, lip balms, deodorants, face washes, sun care, and grooming products. Its dedicated sub-brand, Nivea Men, has also captured a significant share of the men’s grooming market, which has been rapidly expanding.

Example: In India, Nivea Men’s face washes and deodorants are heavily promoted, often competing with brands like Garnier Men and Axe, making it a favorite choice among young men.

Global Presence in 50+ Countries

Nivea is distributed worldwide, making it a truly international brand. From developed markets in Europe and North America to emerging economies like India, Brazil, and South Africa, the brand maintains a strong presence.

Example: In Brazil, Nivea Sun products dominate the sunscreen market due to the country’s tropical climate, while in Germany, Nivea Creme is still seen as a cultural staple.

Strong Brand Identity & Packaging

The brand’s blue-and-white packaging is iconic and instantly recognizable across the globe. This consistency has strengthened its recall value, making Nivea stand out on shelves.

Example: Even if you walk into a small pharmacy in rural India or a supermarket in London, the blue Nivea tin is instantly recognizable—proof of its strong visual identity.

Consistent R&D and Innovation

Nivea continues to invest in research and development, ensuring its products stay relevant to changing consumer needs. The brand has pioneered innovations in areas such as sun protection, sensitive-skin solutions, and anti-aging care.

Example: Nivea’s “Sun Protect & Moisture” line was one of the first to combine UV protection with hydration, catering to consumers who wanted sunscreen that didn’t dry out their skin.

Celebrity Endorsements & Marketing

Nivea has successfully leveraged celebrity endorsements to increase its global appeal. From global stars like Rihanna to Bollywood celebrities in India, these partnerships have expanded its reach.

Example: In India, actress Anushka Sharma endorsed Nivea’s skincare range, which resonated with young female consumers looking for fresh, relatable brand ambassadors.

High Brand Equity & Loyal Customer Base

Trust built over more than 100 years has created a highly loyal customer base. Consumers often stick with Nivea despite the availability of many other skincare options.

Example: In the UK, generations of families have passed down the use of Nivea cream, treating it as a tradition rather than just a cosmetic product.

Weaknesses of Nivea

Intense Competition in Skincare

The skincare market is highly competitive, with strong global players like L’Oréal, Vaseline, Olay, and Ponds. Standing out and maintaining market share is a constant challenge.

Example: In India, Vaseline dominates the petroleum jelly and body lotion segment during winters, directly competing with Nivea’s body lotion range.

Overdependence on Cold Cream Identity

Even though Nivea has diversified, consumers still largely identify it as a “cold cream brand.” This perception can limit its ability to position itself as a complete skincare provider.

Example: Many Indian households still see Nivea as “the winter cream,” while for premium anti-aging creams, they prefer brands like Olay or L’Oréal.

Limited Presence Compared to Rivals

While Nivea is a global brand, competitors like L’Oréal dominate with a wider product line, luxury skincare options, and stronger presence in premium categories.

Example: In Europe, Nivea may be popular for mass skincare, but when it comes to luxury creams like Lancôme (a L’Oréal brand), consumers prefer the high-end alternatives.

High Investment for Expansion

Expanding into new markets or launching new product categories requires huge investments in R&D, distribution, and marketing. This sometimes slows down Nivea compared to rivals with deeper pockets.

Example: In the premium skincare segment, L’Oréal spends heavily on advertising luxury products, while Nivea often relies on its mass appeal, limiting its ability to compete head-to-head in niche premium categories.

Opportunities for Nivea

Growth in men’s grooming

Men’s skincare is expanding fast. Nivea Men already leads in basics; the next move is premium, problem-solving SKUs (serums, anti-aging, oil-control, post-workout care).

Example: Launch a “Nivea Men Pro” line—vitamin C brightening serum and SPF50 gel—to compete with L’Oréal Men Expert and The Man Company in India’s metro markets.

Demand for natural & organic skincare

Shoppers are reading labels and choosing clean, eco-friendly formulas with recyclable packs. Nivea can build a certified “Naturals by Nivea” range and highlight sustainability.

Example: Roll out aloe-based face wash with >95% naturally derived ingredients and a refill pouch system, taking on brands like Mamaearth, WOW Skin Science, and Forest Essentials.

Expanding into new territories

Rising incomes in Africa, Southeast Asia, and Latin America make these regions ripe for affordable, high-trust skincare.

Example: Introduce value-size body lotions tailored for humid climates in Vietnam and the Philippines, and shea-rich creams for Nigeria and Kenya via modern trade + WhatsApp commerce.

Higher purchasing power

A growing middle class is willing to pay for upgrades—SPF, anti-pollution, anti-aging, and specialized routines.

Example: Bundle “daily defense kits” (cleanser + SPF + night cream) in India’s Tier-2 cities and Brazil’s urban centers, positioned as small luxuries under a premium sub-brand.

Threats to Nivea

Stiff competition from global & local brands

Players like Pond’s, Vaseline, and L’Oréal invest heavily in R&D and marketing, squeezing shelf space and mindshare.

Example: Vaseline’s “Deep Restore” and Pond’s “Bright Beauty” keep prices sharp and ads constant, forcing Nivea to defend its core body lotion and face care lines.

Local small businesses leveraging digital media

Indie and Ayurvedic/vegan startups win Gen-Z with influencer content, fast drops, and D2C pricing.

Example: Brands such as Minimalist or Plum launch actives-led serums via Instagram + creator reviews, pulling online share that once defaulted to Nivea.

Changing consumer behavior (online shift)

If a brand stays retail-first, it risks losing shoppers who research and buy on marketplaces and apps.

Example: Nykaa, Amazon, and Flipkart host flash sales and subscription reorders; a slower Nivea e-commerce play would cede discovery to rivals’ sponsored listings.

Regulatory challenges

Ingredient, packaging, and claim rules differ by country; non-compliance can delay launches or trigger reformulations.

Example: EU restrictions on certain preservatives and microplastics, plus India’s Cosmetics Rules on labeling, may force pack/claim tweaks and add compliance costs.

Risk of marketing backlash

A single tone-deaf ad or claim can spark viral criticism and hurt trust.

Example: Past industry controversies around skin-tone messaging show how quickly campaigns can be called out; Nivea must keep strict pre-launch social reviews and crisis playbooks.

Example of a Failed Campaign: “White is Purity”

One of the most controversial incidents in Nivea’s history was the 2017 ad campaign with the tagline “White is purity.” The advertisement was widely criticized for being racially insensitive.

- The backlash on social media was immediate, with people accusing Nivea of promoting racism.

- The company quickly withdrew the ad and issued an apology.

Lesson Learned: Brands like Nivea need to exercise cultural sensitivity and inclusivity in all their communications. In today’s interconnected world, even a regional campaign can trigger global backlash.

Nivea’s Top Competitors

Nivea operates in a highly competitive skincare and personal care market. Several well-established brands stand as strong rivals, each with its own strengths and loyal customer base:

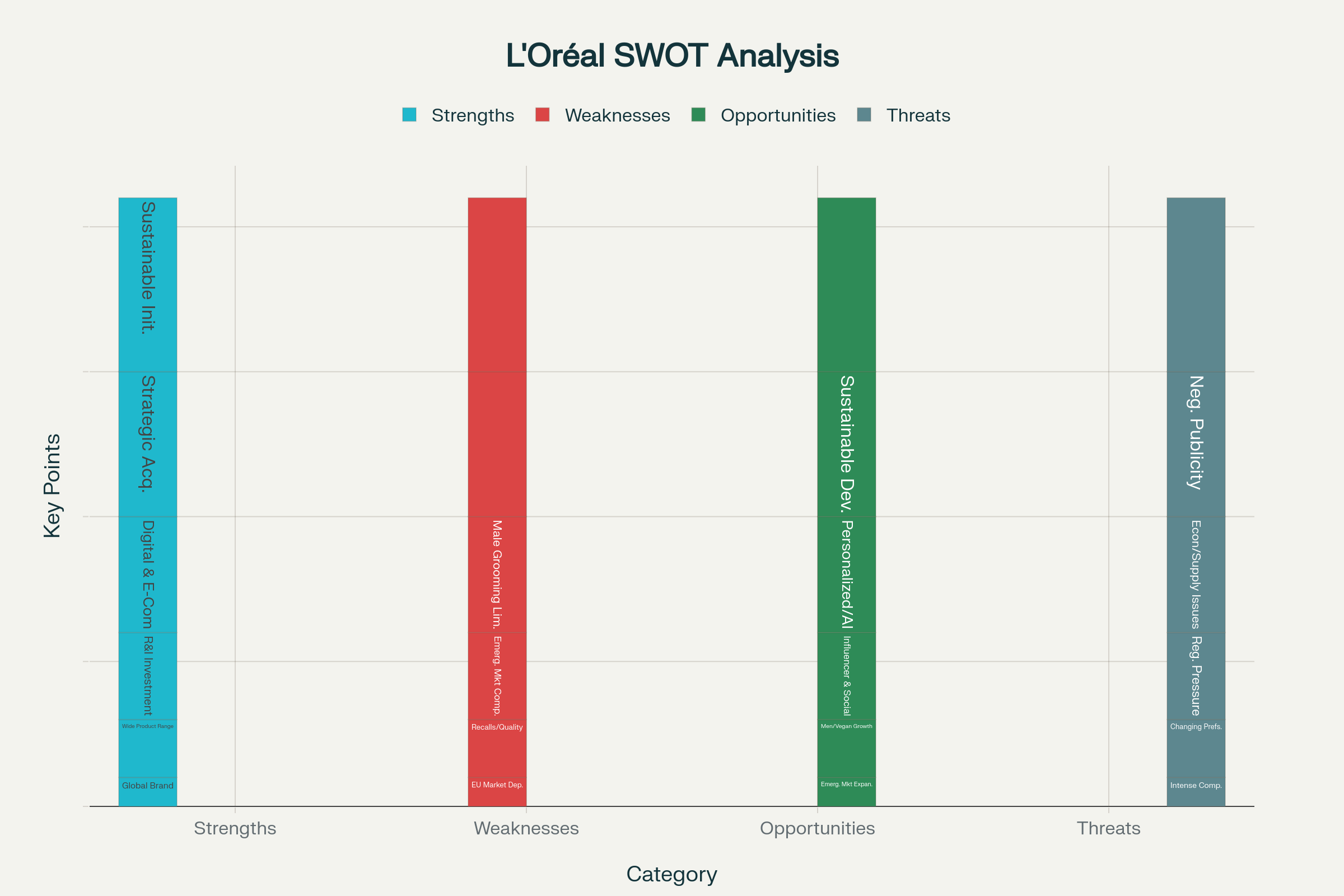

L’Oréal

Recognized as one of the biggest names in beauty and skincare globally, L’Oréal has a diverse product portfolio that ranges from everyday skincare essentials to luxury cosmetics. Its worldwide presence and continuous innovation make it a tough competitor for Nivea.

Amorepacific

Based in South Korea, Amorepacific has made a name for itself with advanced skincare solutions rooted in K-beauty trends. The brand is well-known for blending modern science with natural ingredients, appealing to consumers who prefer innovative and holistic skincare routines.

Olay

A trusted name when it comes to anti-aging and premium skincare, Olay has built its reputation around effective creams, serums, and moisturizers that target fine lines, wrinkles, and overall skin health. Its focus on results-driven products makes it a direct rival to Nivea’s skincare range.

Ponds

With a strong foothold in emerging markets such as India, Ponds offers affordable yet effective skincare products. The brand has gained consumer trust through its wide range of creams, face washes, and beauty solutions tailored for diverse skin types and climatic conditions.

Vaseline

Best known for its petroleum jelly, Vaseline has become a household name for healing, moisturizing, and protective skincare. Over time, the brand has expanded into body lotions, lip care, and overall skin health, giving it a broad consumer base that competes directly with Nivea’s offerings.

Conclusion

The SWOT analysis of Nivea highlights why the brand continues to be a global skincare leader. Its strengths—brand equity, loyal customer base, and global presence—are undeniable. However, weaknesses like heavy reliance on cold cream identity and strong competition cannot be ignored.

Opportunities such as the booming men’s grooming market, demand for organic skincare, and expansion in new territories present strong growth potential. Yet, threats from local startups, shifting consumer behavior, and regulatory hurdles require strategic responses.

For Nivea to sustain and grow, digital marketing, innovation, and inclusivity in communication will be key.

FAQs on Nivea

Nivea company belongs to which country?

Nivea belongs to Germany. It was founded in Hamburg in 1911 by Beiersdorf AG.

Who is the founder of Nivea?

Nivea was founded by Dr. Isaac Lifschütz, Dr. Paul Gerson Unna, and Oscar Troplowitz.

What is Nivea’s net worth?

The brand value of Nivea is estimated at over $6.4 billion globally.

Where can I buy Nivea products online?

You can visit nivea.com or purchase through e-commerce platforms like Amazon, Nykaa, and Flipkart.

swot analysis of nivea What is Nivea most famous for?

Nivea is most famous for its classic cold cream in the blue tin, a product trusted by generations.

What is Nivea’s SWOT analysis?

A SWOT analysis of Nivea highlights its Strengths, Weaknesses, Opportunities, and Threats. It helps to understand how the brand maintains its global skincare reputation, what challenges it faces, and where it can grow in the future.

What are the key strengths of Nivea?

- Strong Brand Heritage: Established in 1911, Nivea is one of the most trusted skincare brands worldwide.

- Global Presence: Sold in more than 200 countries with a diverse product line.

- Wide Product Range: Includes creams, lotions, lip care, men’s grooming, sun care, and body care products.

- Strong Parent Company (Beiersdorf): Backed by a leading multinational with strong R&D capabilities.

- High Brand Trust: Known for affordability, accessibility, and quality.

What are the weaknesses of Nivea?

- Limited Premium Segment: Nivea is seen mostly as a mass-market brand, not positioned strongly in luxury skincare.

- Dependence on Traditional Products: Heavy reliance on Nivea Creme and lotions for revenue.

- Strong Competition: Faces pressure from global and local players offering innovative or premium solutions.

- Slow Digital Adoption: Compared to rivals, Nivea’s online and influencer-driven marketing has been relatively slower.

- Brand Perception Gap: Sometimes perceived as “basic” skincare compared to more advanced, trendy brands.

What opportunities does Nivea have in the market?

- Rising Demand for Natural & Organic Products: Consumers prefer skincare with safe and eco-friendly ingredients.

- Expanding Men’s Grooming Segment: Growing demand for male skincare and grooming provides a chance for Nivea Men to dominate.

- Digital Marketing & E-commerce: Stronger online presence and influencer tie-ups can boost sales.

- Emerging Markets Growth: Expanding in regions like Asia, Africa, and Latin America where demand for affordable skincare is increasing.

- Product Diversification: Introducing premium anti-aging, herbal, or dermatology-based products.

What are the major threats to Nivea?

- Intense Competition: From L’Oréal, Olay, Vaseline, Ponds, Amorepacific, and local brands.

- Changing Consumer Preferences: Customers shifting towards clean beauty and cruelty-free products.

- Price Wars: Competitors often use aggressive pricing in mass markets.

- Counterfeit Products: Fake Nivea products harm brand image and trust.

- Economic Downturns: Reduced consumer spending on personal care during tough economic times.

How does Nivea compare to its competitors in the skincare market?

- L’Oréal & Olay: Strong in premium and anti-aging, while Nivea focuses on mass-market affordability.

- Vaseline: Competes directly in body care and moisturization.

- Ponds: Strong in emerging markets like India, similar to Nivea’s positioning.

- Amorepacific: Leads in K-beauty innovation, while Nivea maintains global trust and heritage.

How does Nivea maintain its brand strength despite competition?

Nivea builds on its long-standing reputation, affordability, and consistent product quality. Its ability to deliver trusted skincare solutions for everyday use keeps it relevant across generations.

What can Nivea do to overcome its weaknesses?

- Expand into premium and natural skincare.

- Invest in digital-first campaigns and influencer marketing.

- Reduce over-reliance on traditional creams by launching innovative products.

- Improve sustainability practices to align with consumer expectations.

Why is SWOT analysis important for Nivea?

SWOT analysis helps Nivea identify its core strengths, areas to improve, opportunities to explore, and external threats to prepare strategies that ensure long-term success in the highly competitive skincare industry.